domíniobrasileiro

Brazilian domain

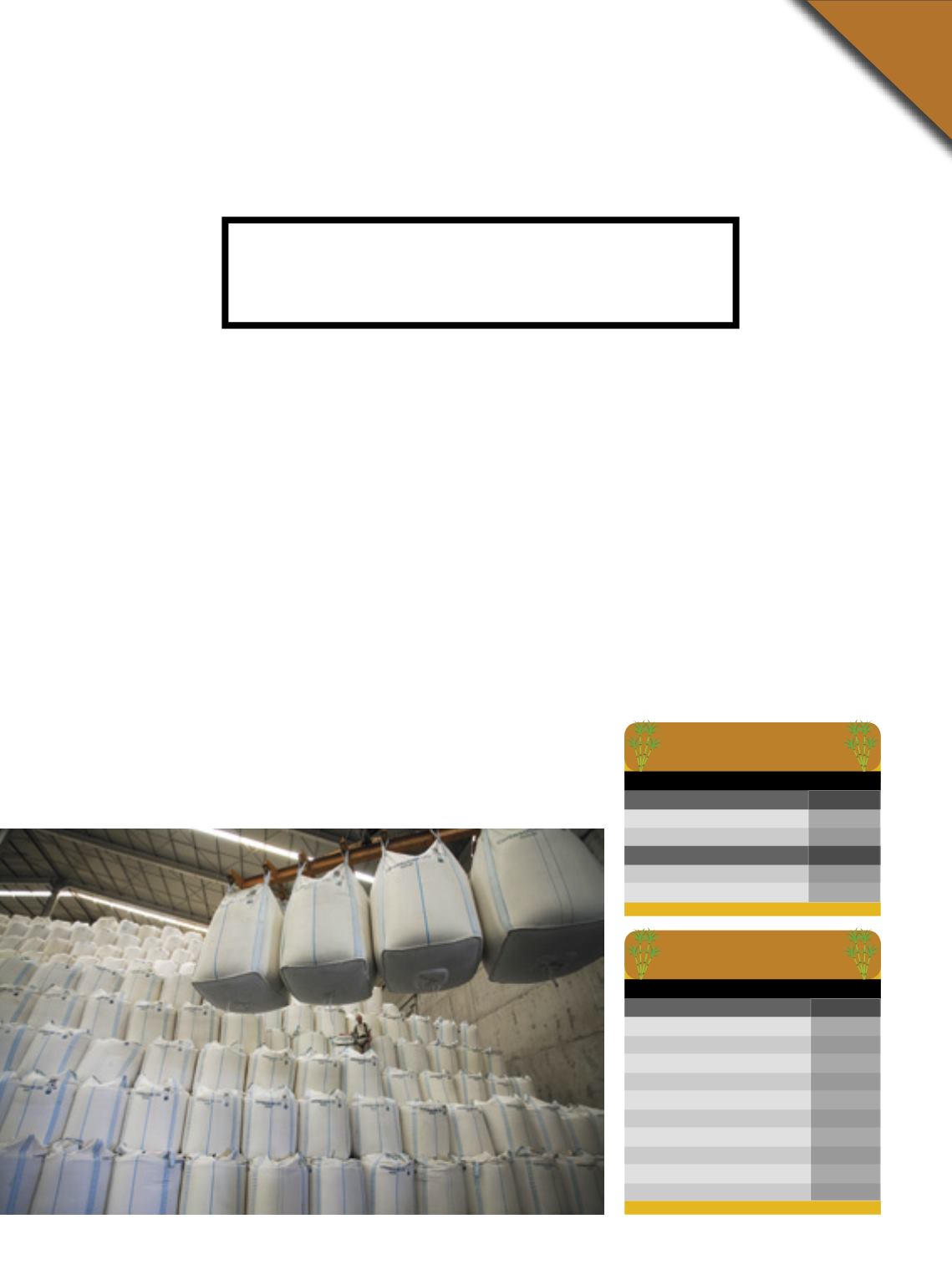

Exportações de açúcar do Brasil

Fonte:

Secex/Unica.

Ano

2015

2016

Volume (t)

24.012.213 28.932.360

Receita (US$mil)

7.641.353 10.435.387

Janeiro-Junho 2016

2017

Volume (t)

12.504.215 12.786.636

Receita (US$mil)

3.927.885 5.513.768

os clientes

The clients

Principais destinos (em toneladas)

Fonte:

Agrostat/Mapa – Editora Gazeta.

Países

2015

2016

Índia

1.518.573 2.443.653

China

2.506.779 2.403.146

Argélia

1.625.522 2.054.034

Bangladesh

2.465.857 1.934.355

Emirados Árabes 1.450.026 1.666.893

Nigéria

1.338.431 1.618.282

Indonésia

330.388 1.510.778

Malásia

981.197 1.469.609

Arábia Saudita 1.135.486 1.236.379

Marrocos

793.707 1.040.097

Speedy

shipments

T

he bigger national sugar produc-

tion volumes and a scenario of

tight supply at global level have

led Brazil, leading exporter, to in-

creaseconsiderably its shipments

abroadin2016(upmorethan20percentfrom

2015). The volume of sugar shipped abroad

reached28.9milliontonsandbroughtinreve-

nueof US$10.4billion. Inquantity, ahistorical

recordhighwashit,outstrippingthevolumeof

28million tons in 2010,which, up to that time,

hadbeenthebiggestintheseriessurveyedby

the Center for Applied Studies on Advanced

Economics (Cepea), of the Luiz de Queiroz

College of Agriculture (Esalq), linked to the

Universityof SãoPaulo (USP).

The sugar cane mills in São Paulo, State

that leads production and exports, have

even reduced their share in sugar sales in

the spot market, giving priority to exports,

saidCepeaofficials, inananalysis of the sec-

tor’s scenario in 2016. Nonetheless, in terms

of revenue from the foreign operations, in

2010and2013biggervolumeswereachieved

(US$ 12.8 billion and US$ 11.8 billion), ac-

cording to statistical figures surveyed by the

Ministry of Agriculture, Livestock and Food

Supply (Mapa) and by the Brazilian Sugar-

cane Industry Association (Unica).

The main destination for the Brazilian

sales in 2016 was India, country that is the

biggest consumer and second biggest glob-

al sugar producer, but had to grapple with

production problems. Its acquisitions out-

stripped the purchases by China, Bangla-

desh and Algeria, which had been the lead-

ing buyers of sugar fromBrazil in 2015. India

continued as biggest importer of the Brazil-

ian product (9.8 percent of the total) in the

first half of 2017, butwas anticipating the re-

sumption of its production in the next crop

year,whichshoulddiminish India’spurchas-

es, while China is increasing its tariffs, ulti-

mately affecting its import operations.

Favorable picture of the sector

hasledtheleadingsugarexportertoboostits

foreignsalesin2016,hittingahistoricalrecordhigh

From January through June 2017, Bra-

zilian sugar exports were on a par with

amounts shipped in the same period the

previous year, although revenue from the

sales has soared considerably, by some 40

percent, reaching the amount of US$ 5.5 bil-

lion, according to numbers released by the

Secretariat of Foreign Trade (Secex), dis-

closed by Unica. The National Food Sup-

ply Agency (Conab), in turn, judging by the

scenario of the crop, observed that “the

volume exported in June 2017 continued

on the same upward trend of the previous

month, influenced by the high value of the

dollar against the Brazilian currency, with a

monthly increase of 26.3 percent and annu-

al increase of 15 percent thismonth”.

n

Sílvio Ávila

35