Inor Ag. Assmann

12

A

s long as weather conditions

were favorable, planting inten-

tions continued soaring, and

the second Brazilian corn crop

of the 2016/17 season acquired

“huge” proportions, farm -gate corn prices

began todecline,making it impossible to sell

the crop in some corn producing regions, es-

pecially in the hubs in Mato Grosso, leading

producer. Pictures of harvested corn lying in

the open because of deficient transportation

or warehousing structures, and prices way

below production costs and below the min-

imum prices stipulated by the government

were facts thatmadenews inJune.

This giant harvest exerted an abnormal

pressure upon the prices practiced in Bra-

zil, even before it was available, and forced

the federal government to intervene offering

commercializationmechanismsatminimum

prices, at least offering the market a refer-

ence. The sector views this measure as posi-

tive. After the first half of the year on adeclin-

ing trend, the supply chain is eager to know,

especially the farmers, what the prices will

look like and which factors will induce them

tocover theproductioncosts.

There are lots of hurdles to be surmount-

ed: they include the local economic scenar-

io and all major buyers of the grain and of the

Brazilian proteins, going through the nation-

al political scenario, which has influenced the

exchange rate, for example, to the balance

between offer and demand, and the size of

the stocks at home and abroad. With the ex-

change rate ranging from R$ 3.25 to R$ 3.30

toUS$1,itishopedthattheresumptionofex-

portsthatstartedinMayisforreal,withthede-

clining national supplies translating into high-

er cornprices. In spiteof this, the year inBrazil

willcometoaclosewithahugeendingstock.

As things are, without a new fact that

boosts consumption and shipments abroad

considerably, the expectation is for pric-

es in Brazil to recover gradually and partial-

ly, without reaching the record prices inmid-

2016. This will lead to smaller planted areas

in the 2017/18 growing season. Even if soy-

beanprices reachhigher recovery levels than

projected in early 2017, the farmers who lost

moneyinthecurrentcropwillthinktwicebe-

fore keeping the soybean-corn succession

system, andwill seekalternative crops.

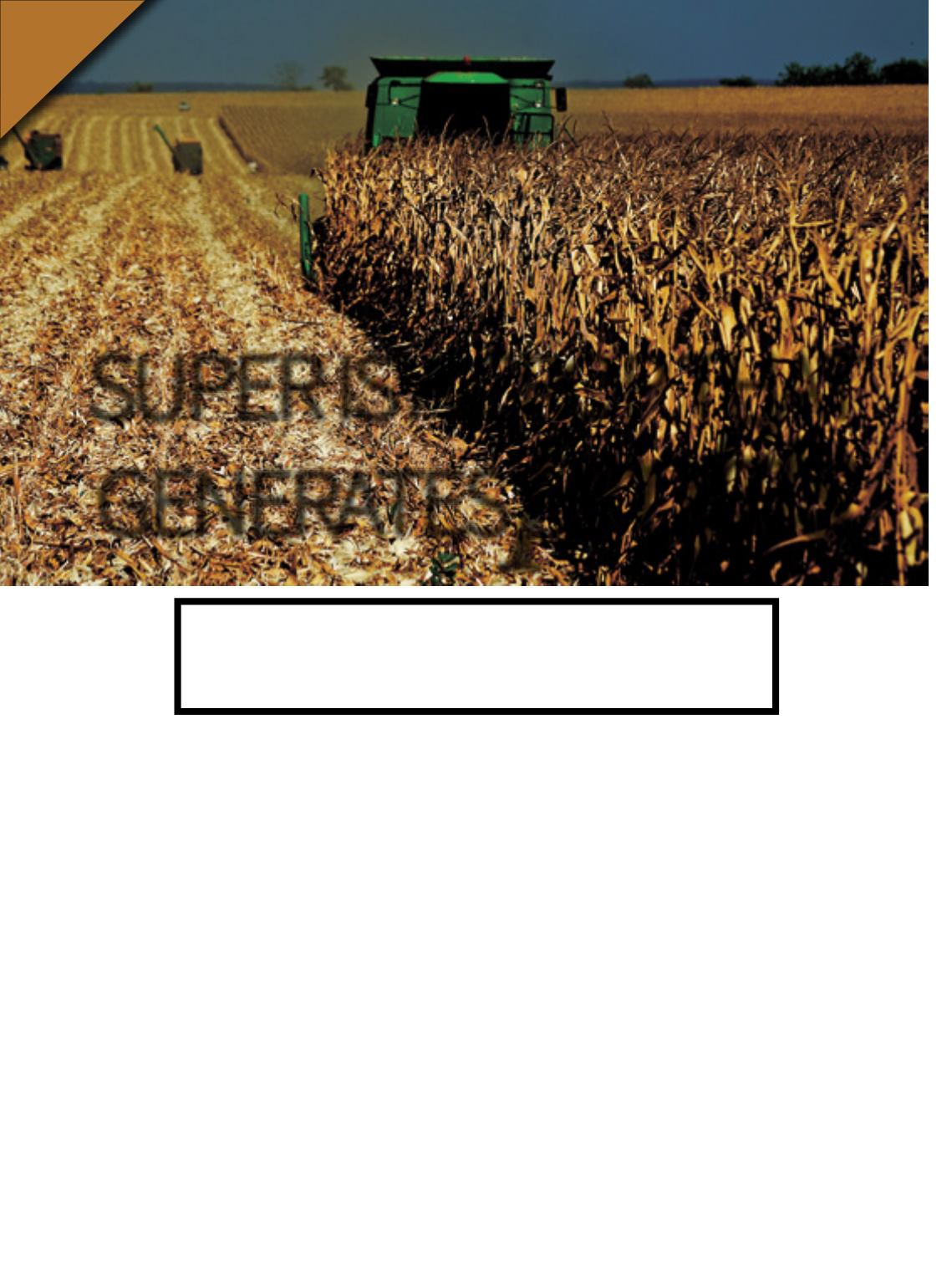

The 2017 crop ratifies what all farmers al-

ready know: super crops are the ones that

generate profits. Foodon the table andmon-

ey in the pocket that covers the production

costs, areassurances for thenext crop, the in-

vestments and the sustenance of the family:

these are crops for the farmers to commem-

orate. In the current season, only a few farm-

ers have reasons to celebrate the achieved

target.

n

Super isacropthat

generates

profits

Volume of BrazilianandNorth-American

crops,theexchangerate,stockprofileandconsumptionare

challengingfactorswhenitcomestosellingthe2017crop

Hugewinter crop exerts pressure upon themarket, and exports is the onlyway out