45

Just like people who use the right

dose for preparing their much celebrated

drink (caipirinha) from lemon and Brazil-

ian cachaça, the sector of this citrus in the

Country is eager to come up with appro-

priate measures to ensure the best prod-

uct and future, especially as far as phytosan-

itary questions go. In general, in the recent

phase, after production growth (total of 1.2

million tons in 2012), supply shrank. In

2015, still with no official numbers, what

caused concern was a change in the rainy

season and, in the sequence, in the season

of the fruit itself and of its prices, which rose

to atypical highs in certain periods, reach-

ing almost R$ 70 per box in August 2016.

Observing this behavior, Afonso Caste-

lucci, president of the Brazilian Lemon Pro-

ducers and Exporters (Abpel), based in

Itajobi, leading lemon producing region

in Brazil, in São Paulo, ascertains a good

domestic market for the citrus fruit, and

dictates its price. The domestic market

absorbs almost 92% of the entire produc-

tion. However, among Brazil’s fresh fruit

exports, lemons rank as third most export-

ed fruit, in volume. The fruit gained mo-

mentum for its availability all over the year

and, in particular, for its appealing appear-

ance (color and skin), used in salads and in

drink preparations, the official recalls”.

Volumes shipped abroad soared over

Lemon segment is

going through an

atypical moment and is

attempting to ensure

soliddevelopment of

the supply chain

In the right

dose

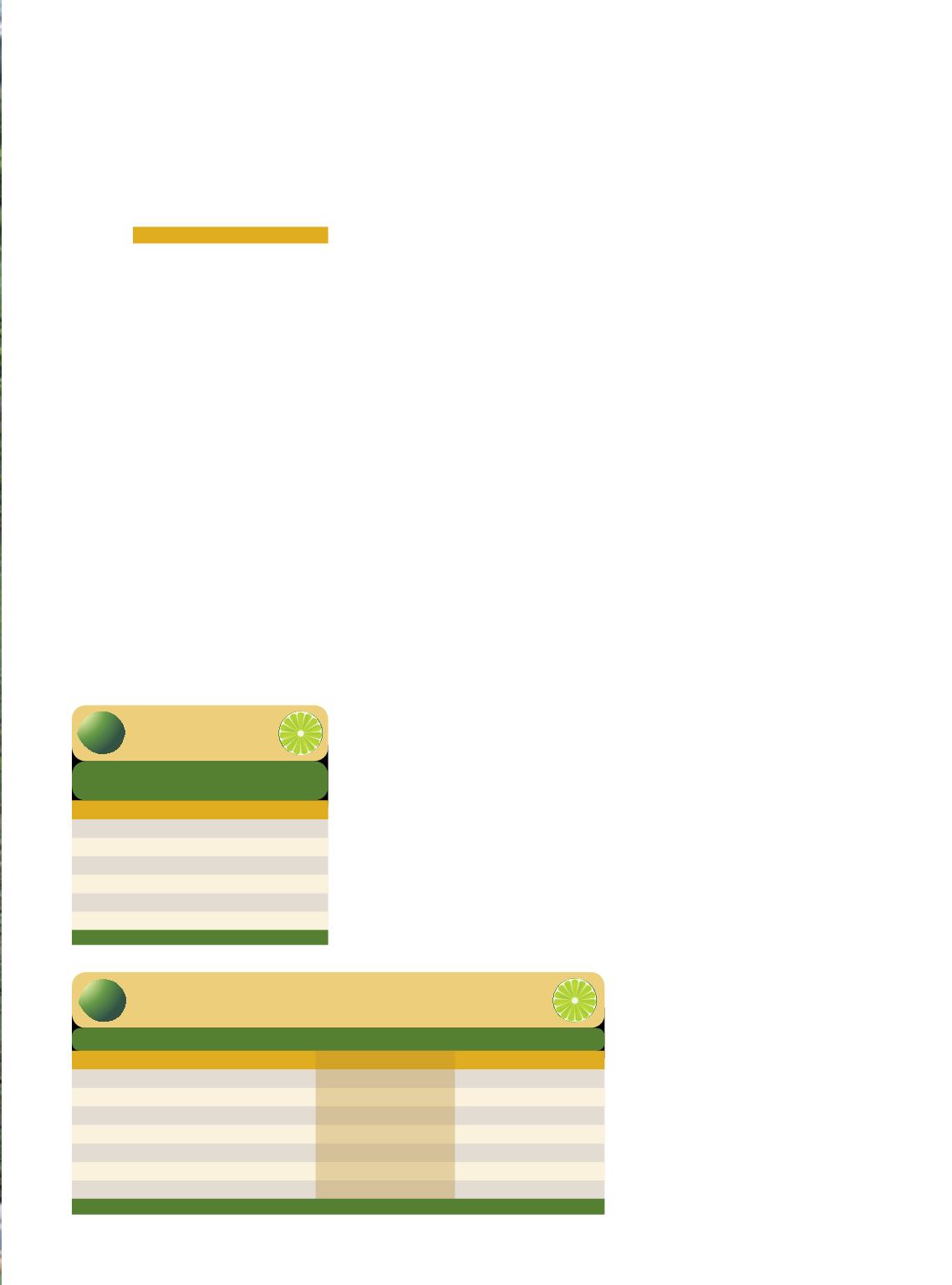

DESTINOS

DESTINATIONS

Principais mercados da fruta

brasileira no exterior – 2015

Fonte:

Agrostat/Mapa.

Países

Toneladas

Países Baixos

60.161

Reino Unido

14.743

Emirados Árabes

11.694

Alemanha

2.175

Bélgica

1.604

Espanha

1.387

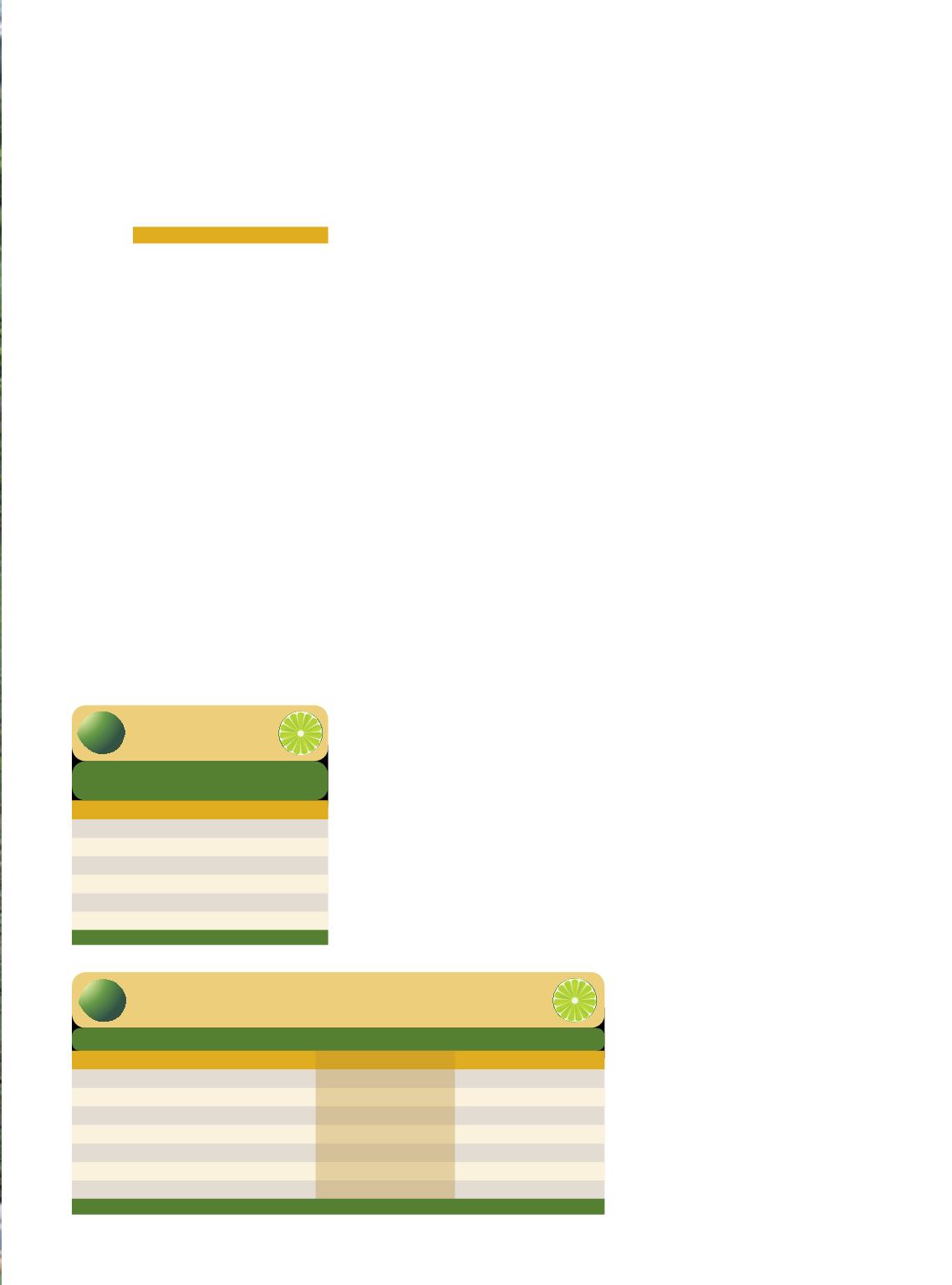

O TAMANHO DO LIMÃO

LEMON SIZE

Evolução recente do limão brasileiro

Fontes:

IBGE e Agrostat/Mapa.

Anos

Área (ha)

Produção (t)

Exportação (t)

2009

41.029

899.821

66.374

2010

42.779

1.020.741

63.061

2011

47.267

1.126.736

66.458

2012

47.349

1.208.275

72.810

2013

45.690

1.169.370

78.603

2014

43.394

1.101.762

92.301

2015

–

–

96.632

the past year, amounting to 96.6 thou-

sand tons (up 4.7 percent from the previ-

ous year), in 2015. Revenue then derived

from foreign sales reached US$ 78.6 mil-

lion, down 18.2% from the previous peri-

od. In the first seven months in 2016, com-

pared to the same period last year, prices

made a recovery, but the amounts shipped

abroad pointed to stability, with as small de-

crease (from 69 to 68.6 thousand tons), un-

der the influence of some problems like the

citrus canker in some shipments to the Eu-

ropean Union (EU), major importer.

With regard to this problem, the sector

has strengthened control and prevention

measures, and established a management

system for the process. The phytosanitary

question, by the way, is going through

legislation changes, in which the lem-

on area is pursuing a risk mitigation sys-

tem, jointly established by the private

and public sector, replacing the suppres-

sion model in force. As a result, argues

the leader of the association of producers

and exporters, the rural property will nev-

er be interdicted and will continue operat-

ing, provided certain cares are taken.

To this end, he recalls the need for time

to adapt, besides tools for implementation

and control purposes, but maintains that

no more time should be wasted on stud-

ies and evaluations. “It is a typical ICU unit

case, which requires decisive measures”,

says Castelucci. He also points out efforts

of the sector focused on placing value on

standards, adopting special labels and im-

proving the processes, so as to surmount

the problems and confirm good practices

and promising perspectives. With regard

to the future of the activity and, in partic-

ular, of lemon exports, he foresees expan-

sions some time from now, towards the

same direction “ever more professional,

selective and qualitative”.