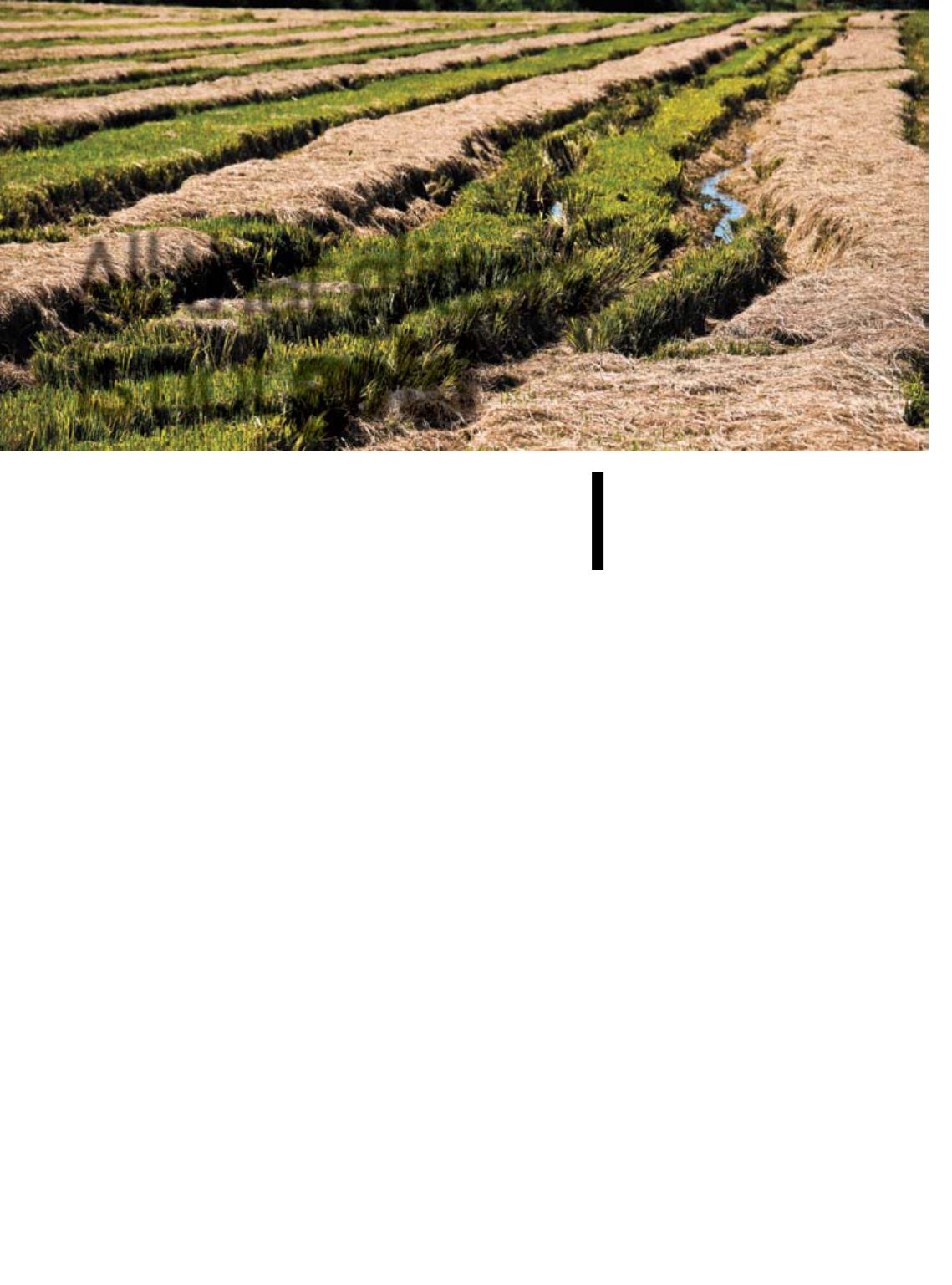

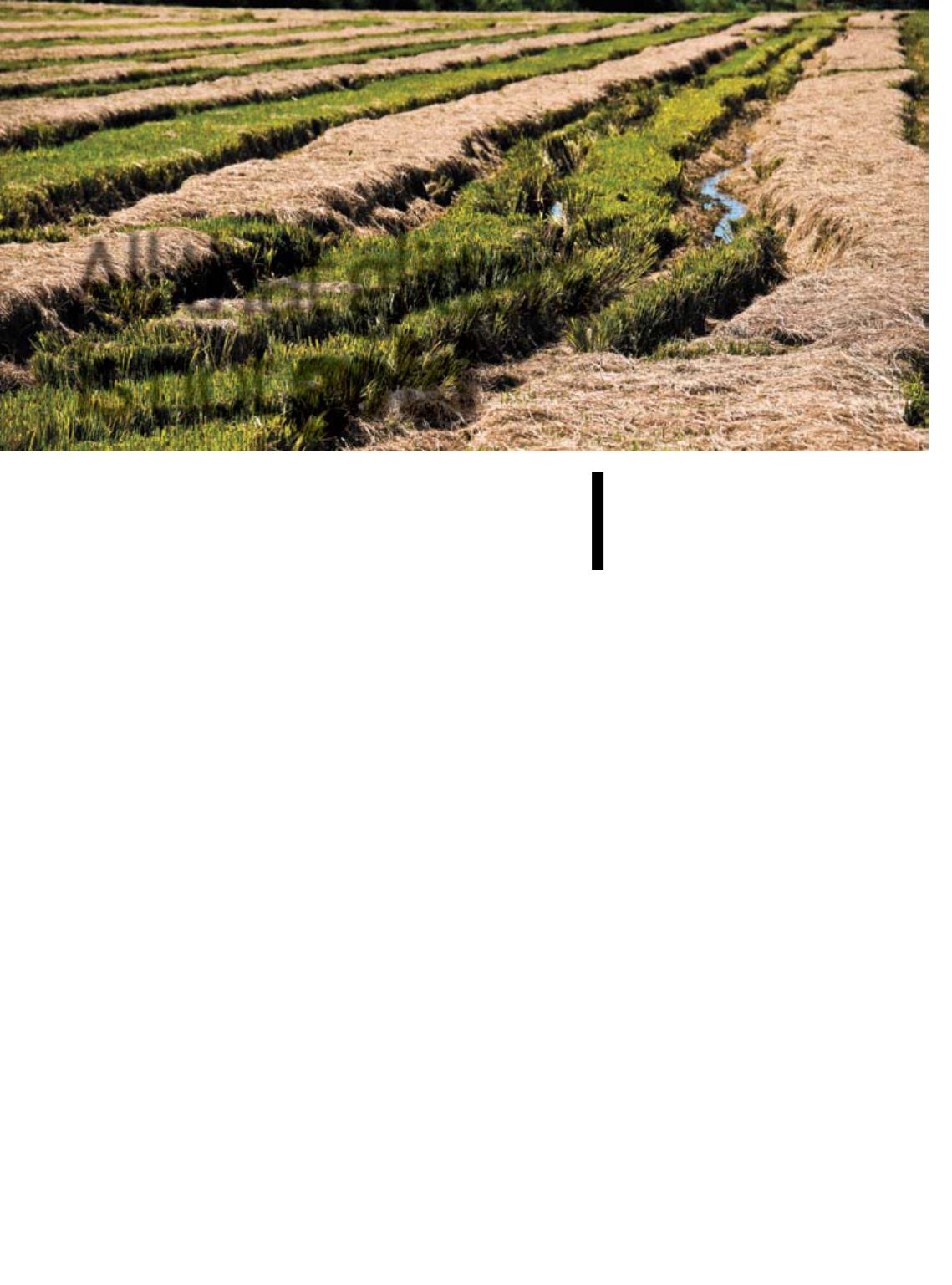

R

eflecting the sunrays, the ripe

bunches of rice harvested in Bra-

zil, in the first half of 2017, glitter

like gold meadowlands in times

of plenty. Although being the re-

sult of a year of intensework and represent-

ing thehope for better days, as a compensa-

tion for the work carried out, not all the rice

farmers will be able to transform their in-

vestments into profits. Weather conditions

were favorable during the season.

Brazil started its commercial year in2017,

with466 thousand tonsof riceending stocks,

thankstoimports,ofwhichonly25thousand

tons were in public stocks. The crop in Brazil

is estimated at 12 million tons of rice in the

husk, recovering 1.4 million tons of losses in

2016, when floods in the South reduced the

crop to 10.6 million tons. Total forecast sup-

ply amounts to 13.53 million tons, made up

of the stock, production and imports of 1.1

million tons, 90%fromMercosur countries.

Even so, the relation between offer and

demand will continue tight, seeing that con-

sumption and exports, estimated at 1.1 mil-

lion tons, reach a total of 12.6 million tons. At

the end of the year, surpluses in the Country

should remain only at 932 thousand tons, ac-

cording to projections by the National Food

Supply Agency (Conab), equivalent to 7.4%of

national demand. In themeantime, the glob-

alstockamountsto31%oftheglobalneeds.

Farmers’ income, in the first half of the

year, will suffer pressure from excessive of-

fer. The first cargoes of the crop knocked R$

6 off the price of a sack of rice in the husk in

Rio Grande do Sul (to R$ 44), from Febru-

ary to March 15. Some companies in Santa

Catarina set their purchasing prices of the

crop at R$ 40 for 50-kg sacks. And the im-

ports from Paraguay, Argentina and Uru-

guay reach theBrazilianmarkets at R$39, or

less, because of the Exchange rate, interna-

tional prices and lower production costs in

Mercosur countries. These numbers are rel-

evant because South Brazil and imports are

taken as reference for the domestic prices.

“The scenario is not favorable to exports,

but is attractive to imports, Brazilian pric-

es are high in comparison to international

prices, but low as far as production costs go.

Thepanorama is supposed to improve in the

second half of the year, but many rice farm-

ers cannot wait”, says Tiago Sarmento Bara-

INTHERICEFIELDS,THENEWCROPMAkESUPFOR

THELOSSESINTHE2015/16GROWINGSEASONANDIS

AGUARANTEEOFSUPPLy,BUTABUNDANCEDOESNOT

TRANSLATEINTOHIGHERINCOMEFORTHESECTOR

ta, commercial director at the Rio Grande do

Sul Rice Institute (Irga). In his view, the num-

bers of the croparenormal, but the econom-

ic and sectoral scenario in the first half of the

year exert pressureover themarket.

Daire Coutinho, president of the Rice

Sectoral Chamber, a division of the Minis-

try of Agriculture, Livestock and Food Sup-

ply (Mapa), considers that hope should not

be shaken at themoment. “We are engaged

in conquering newmarkets and investing in

structures to make exports soar. Shipments

to the foreign markets lead to tight supply

and price recovery”, he adds. “Our course

consists in exporting if it comes to keeping

the balance of domestic supply.”

On his part, Henrique Osório Dornelles,

president of the Federation of Rice Growers’

Associations in Rio Grande do Sul (Federar-

roz), says that cash-strapped farmers repre-

sent the majority, and they are just making

ends meet or losing money because of the

scenario at the beginning of the year. “Our

priority attention, as an entity, is focused on

meeting the demand of the majority, which

consists in solving the question of prices,

credit lines, production costs and open new

marketstobalanceofferanddemandandre-

cover prices”, he specifies. In the end, about

theBrazilian rice fields,what glitters themost

is not the gold color of the rice bunches. It is

the eyes of the rice farmers, reflecting hope,

seasonedwithsomedisillusions.

All that glitters

isnot

gold

Harvest recovers the production volume, but not all farmers will earn profits

Inor Ag. Assmann

12