The planted area of the 2016 Brazilian to-

mato crop is estimated at 54,714 hectares,

with a possible crop size of 3,544,593 tons,

down approximately 600 thousand tons

from the previous year. According to sourc-

es from the Brazilian Institute of Geography

and Statistics (IBGE), average productivity is

projected at 61 tons per hectare throughout

the Country. However, as it frequently hap-

pens, these data could vary greatly, either up

or down, depending on the region where

the crop is produced. This oscillation is quite

frequent with table tomatoes, simply because

the technological level of the farmers and the

weather conditions differ considerably.

According to vegetable researcher Rena-

ta Pozelli Sabio, a member of the Hortifru-

ti team at the Center for Applied Studies on

Advanced Economics (Cepea), of the Luiz de

Queiroz College of Agriculture (Esalq), a divi-

sion of the University of São Paulo (USP), the

entity, jointly with the agents of the sector, in-

dicates that about 19 thousand hectares are

devoted to the production of industry to-

matoes in the Country, whilst the remain-

ing area corresponds to tomatoes consumed

fresh. “Goiás is the leading hub, when the

subject is tomatoes for the industry, corre-

sponding to upwards of 60% of the total cul-

tivated in Brazil”, he clarifies. The remaining

portion of the production for this purpose is

produced in São Paulo and Minas Gerais.

As to table tomatoes, production is

widespread, comprising several producing

regions. The States with the biggest areas

devoted to this vegetable are as follows:

São Paulo, Minas Gerais, Goiás and Ba-

hia. Some important hubs, in each of these

states, are Goianápolis (GO), the Itapeva re-

gions, Mogi Guaçu and Sumaré (SP), Ara-

guari (MG), Chapada Diamantina and Irecê

(BA). There are also other strategic regions

that dictate the behavior of the prices of

this vegetable in the national market, such

as Serra da Ibiapaba, in Ceará; Caçador, in

Santa Catarina; North of Paraná, and Cax-

ias do Sul, in Rio Grande do Sul.

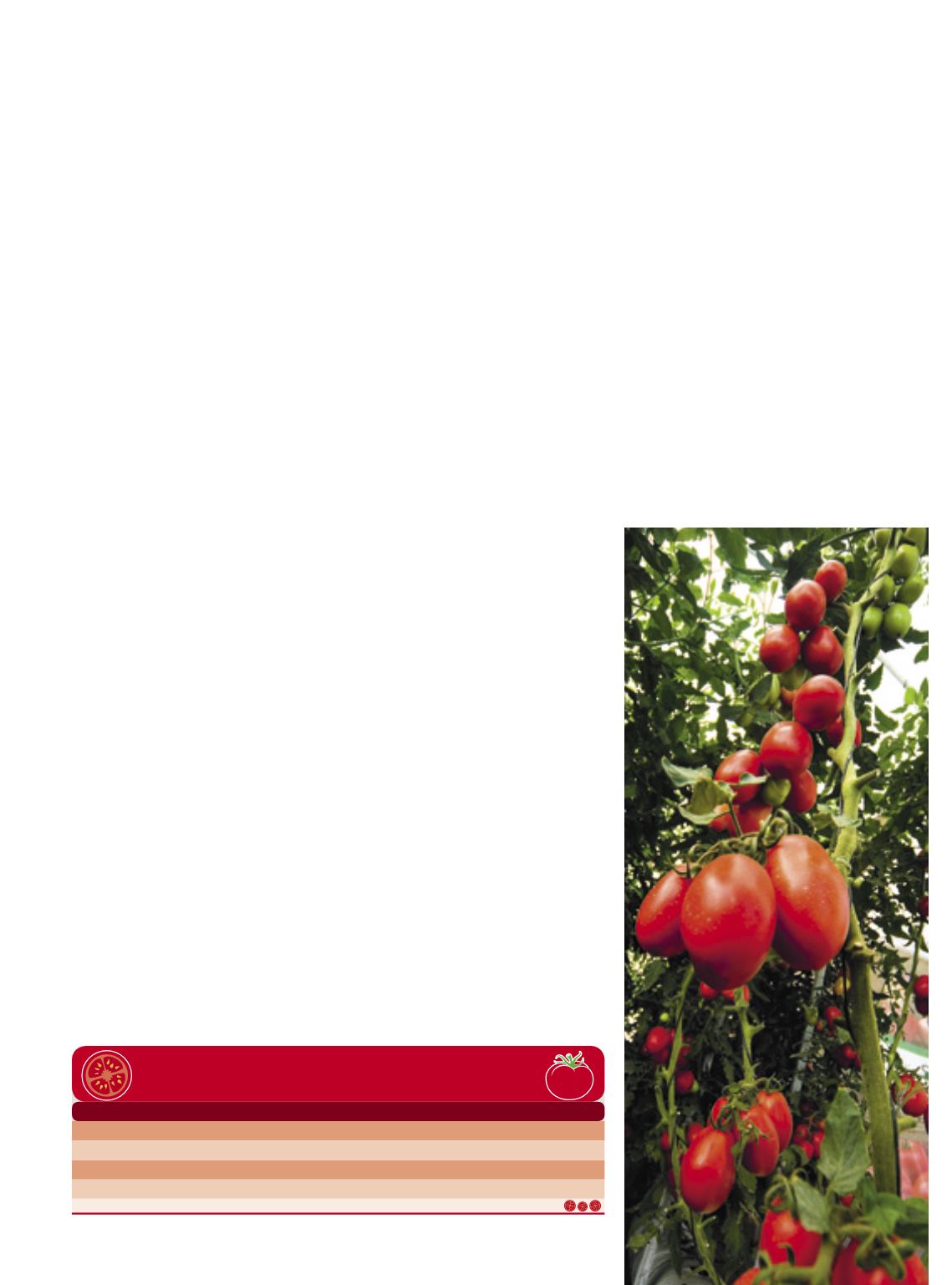

Currently, the leading variety of toma-

toes traded in Brazil for fresh consump-

tion is known as Long Life Salad, now pre-

vailing in the market. Nonetheless, Renata

ponders that Hortifruti/Cepea collabora-

tors point out that over the past years there

have been significant increases in the share

of other types of tomatoes, like a variety

known as Italian, and also Grape mini toma-

toes. “The credit of this growth goes to the

rising purchasing power of the Brazilian

people, who, thanks to a thriving econo-

my, have been going after discerning prod-

ucts, with higher added value”, she says.

Due to the recent economic downturn

experienced all over Brazil, it is believed that

these products will grow less expressively or

face stagnation in the short run. However,

the researcher anticipates good expectations

in terms of demand, in the long run. “Fortu-

nately, as tomatoes are now a staple in the

Brazilian cuisine, their consumption does

not seem to vary greatly, although prices

frequently fluctuate”, she comments. “How-

ever, when prices skyrocket, as was the case

in January 2016, we have seen consumers

in retreat, or switching to more affordable

alternatives, no longer consuming toma-

toes or reducing their purchases’.

Pleasing

to the eye

Production for the industry is almost entirely concentrated in three states,

while tomatoes for fresh consumption are produced all over Brazil

Inor Ag. Assmann

62

Fonte:

Sidra/IBGE. – * Estimativa de abril.

Delicious

saboroso

Os números mais recentes da produção de tomates

Safra

2015

2016*

Área plantada (hectares)

62.096

54.714

Produção (toneladas)

4.145.553

3.544.593

Rendimento (quilos por hectare)

66.810

64.814

As principais

MAINVEGETABLES