T

he Brazilian target to exceed

the 100 million ton soybean

barrier, vigorously pursued

over the past few years, was

successfully achieved in the

2016/17 growing season, greatly exceed-

ing expectations. After two seasons with a

crop of 95 to 96 million tons, this time the

volume surpassed 114 million tons, an ab-

solute record, also ascertained in planted

area and productivity. This has happened

in all regions throughout the Country, with

the only exception of a slight decrease

in planted area in the South. In physical

terms, it was a golden year for Brazil as far

as the biggest farm crop goes, reinvigorat-

ing its successful global trajectory, where

the Country is the leading exporter and the

second largest producer.

While the 2015/16 growing season ex-

perienced a crop shortfall due to climate

related problems (especially in the North),

the season in question has benefited from

good weather conditions almost through-

out all the regions in the Country, according

to surveys conducted by the National Food

Supply Agency (Conab). Besides the ris-

ing trend in cultivation, which went up 2%,

productivity recovered significantly, and

was up around 17%, with production soar-

ing 19.5%. The planted area has been ris-

Up in the

clouds

Center-West regionaccounted for 44%of the entire soy crop

Braziliansoybeancrophitrecordhigh

inthe2016/17growingseason, inarea,

productivityandsize, inallregions

ares a year). Several changes in the produc-

tion systems limitedan increase in this item.

“Even so, soybean productivity rates soared

almost throughout all the regions, which at-

tests that researchworks, technology devel-

opment and transference proved greatly ef-

ficient”, says researcher Alvadi Balbinot.

An analysis conducted by Embrapa at-

tests that soy crops in Brazil are grown in

different environmental conditions, includ-

ing cold regions with altitudes higher than

1,200 meters, warm regions with low al-

titudes and latitudes, besides a variety of

soils, thus resulting into different produc-

tion potentials. The Center-West region, ac-

cording to the final number released by

Conab regarding the 2016/17 growing sea-

son, was responsible for 43.96% of the to-

tal produced in the Country, followedby the

South region, with 35.58%, while the North-

east accounts for 8.45%, the Southeast, for

7.15% and the North, for 4.85%. The farm-

ers in the North and Northeast, in turn, are

devotingmore andmore land to the crop.

n

ing constantly since the 2007/08 season, to-

taling 33.9 million hectares in the 2016/17

crop year, while performance per area and,

inconsequence, the sizeof thecropsuffered

oscillations during the period, but reached

the top during the season in question.

Record average productivity ascertained

by Conab in the Country reached 3,364 ki-

lograms per hectare. Up to that time, a per-

formance in excess of 3 thousand kilograms

had only been achieved in the 2010/11 sea-

son, with 3,115 kg/ha. Upon evaluating the

behavior of the crop in ten decades (from

the 1996/97 to the 2015/16 season), not yet

including the recent bumper crop, Embra-

pa Soybean already maintains that bigger

Brazilian production over the period (3.5

million tons, or 13.4% a year) resulted from

the bigger planted area (one million hect-

Inor Ag. Assmann

20

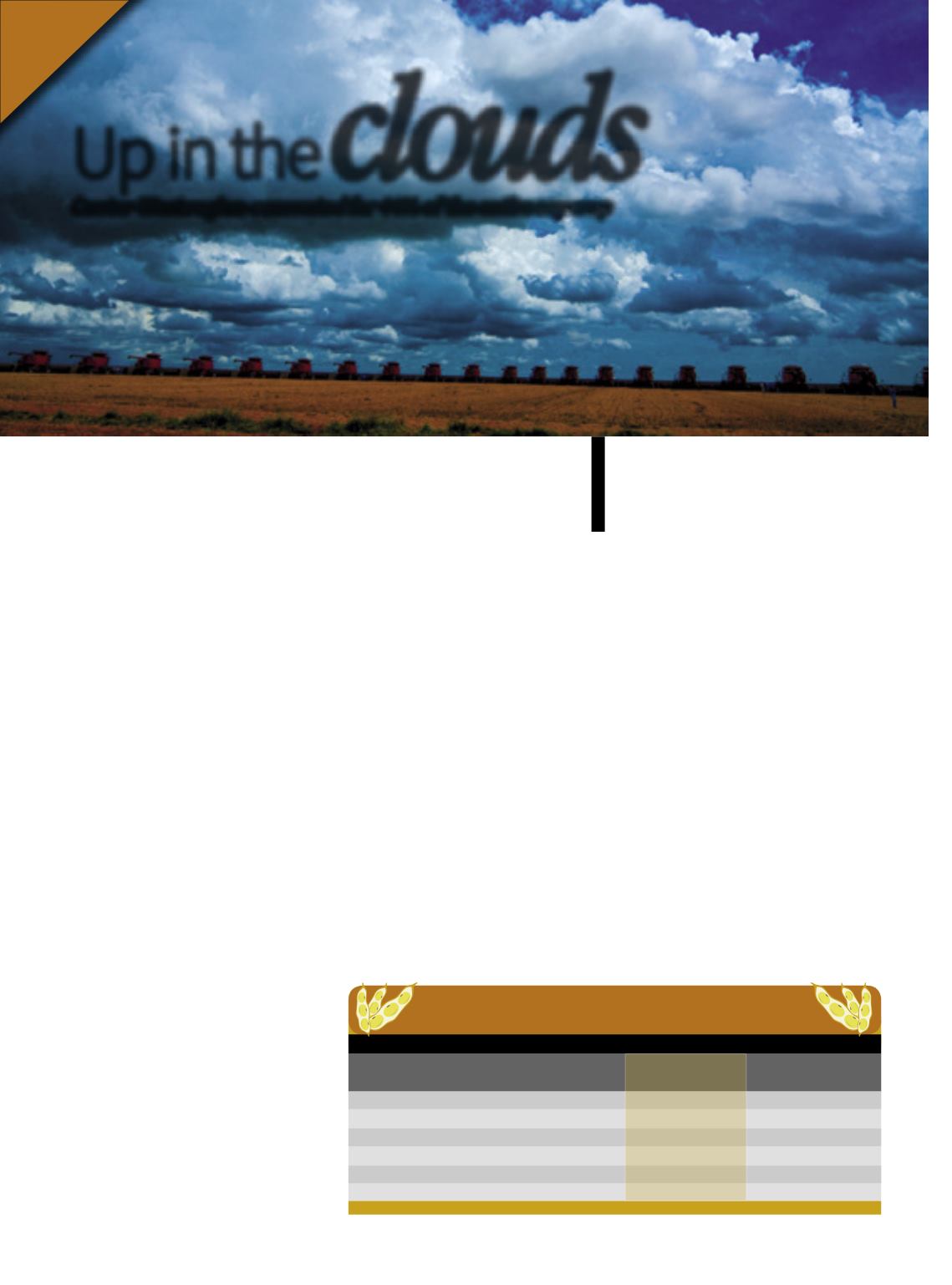

Fonte:

Conab, setembro de 2017.

O GRÃO POR REGIÃO

the kernel per region

Números das safras de soja 2015/16 e 2016/17 no Brasil

Regiões

Área

Produtividade

Produção

(mil ha)

(kg/ha)

(mil t)

Centro-Oeste

14.925,1 15.193,6

2.931 3.301 43.752,6 50.149,9

Sul

11.545,4 11.459,6

3.047 3.542 35.181,1 40.592,8

Nordeste

2.878,2 3.095,8

1.774 3.115

5.107,1 9.644,7

Sudeste

2.326,9 2.351,4

3.255 3.467

7.574,9 8.151,5

Norte

1.576,3 1.809,0

2.423 3.061

3.818,9 5.536,4

País

33.251,9 33.909,4

2.870 3.364 95.434,6 114.075,3