Withthebumpercropin2017,foreignsales

byBrazil,leadingglobalexporter,reach

thehighestvolumes,whileshipments

throughtheNorthareontherise

HEADINGFORTHE EAST

Brazilian soy is exported to around 40 countries, but great concentration occurs in

China (75% in 2016). To this Asian giant, and to other countries in this region, the

trend is for these countries to continue absorbing the biggest amount over the next

years, due to their great growth potential and vastmarket for primary products,

observes SérgioMendes, fromAnec. The projections for soaring demand and bigger

soybean crops over the coming years are alsomentioned by Thomé Freire Guth,

market analyst with Conab, besides the fact that there is China representing a huge

market pursued by twomajor exporters, Brazil and theUnited States. That iswhy,

with regard to the Country’s conditions and leadership, what deserves attention is the

fact that “more investments in crop transportation logistics are deemed necessary”.

G

lobal leader in soybean ex-

ports, Brazil Frequently hits

records highs in foreign sales,

a performance that is affect-

ed only in case of a crop fail-

ure, like in 2016. Upon disclosing this

observation, Sérgio Castanho, gener-

al director of the National Association

of Cereal Exporters (Anec), stresses that

“this situation stems from the efficien-

cy of the Brazilian exporters, who know

all too well how to detect and serve the

market satisfactorily, as well as the mate-

rialization of the objective of increased ex-

ports through the North, which contribute

towards the fluency of the operations”.

The numbers of the foreign soybean

negotiations of the Country in 2017, up

until August, when the bulk of the crop

had been negotiated, had already out-

stripped the volume of 2015, which, up

to that time, had been the year with the

highest amount ever shipped abroad.

While during that crop year total ship-

ments amounted to 54 million tons, while

that month’s estimates for the current

year were pointing to around 64 million

tons. And could even exceed this amount,

speculated Leonardo Amazonas, ana-

lyst at the National Food Supply Agency

(Conab), should North-American exports

“decline sharply” from September to De-

cember, “like in 2015, when, just like now,

international prices were low and paved

the way for Brazilian exports”.

With regard to the revenue from soy-

bean exports during the current year, the

Center for Applied Studies on Advanced

Without

limits

Brazilian soybean exports are esti ated

to amount to 64million tons

emphasizes. Anyway, despite these two

opposing factors, low price and not-so-

favorable dollar, “a fact that rarely takes

place simultaneously”, the Country still

manages to hit record highs in volume

exported, “thanks to its efficiency” the

Anec official complements.

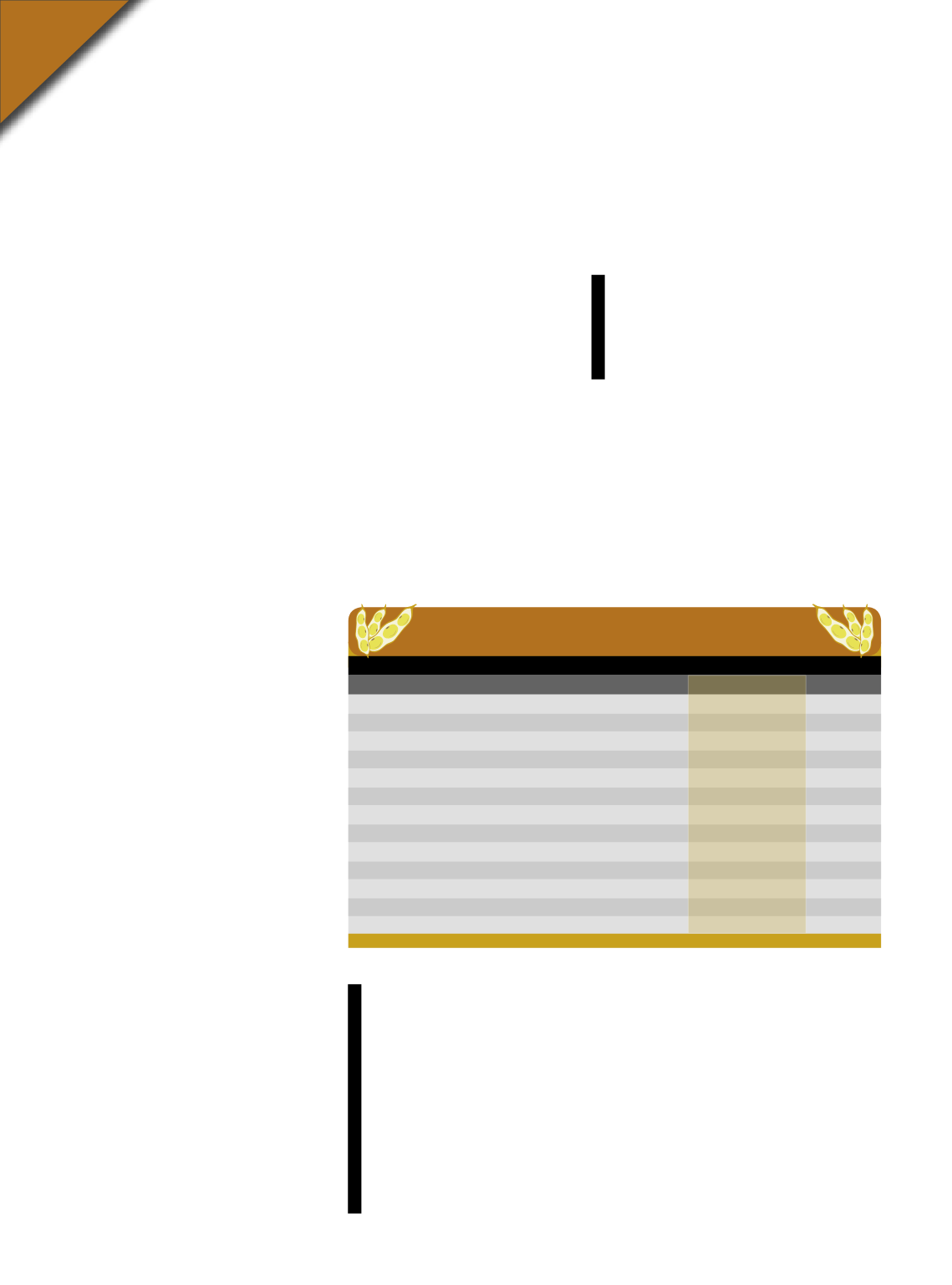

The big amount of kernel shipments,

higher than the average of the past years,

puts to test the efficiency of the Brazilian

ports, which have been performing well,

according to an evaluation of the first half

in 2017 by Anec officials. They highlighted

the expansion of the port of Santos and,

particularly, an above average growth of

the ports located in the North of the Coun-

try, which has greatly contributed towards

achieving the 2017 export targets”. The

units of Barcarena, in Pará, and Itaqui, in

São Luís, State of Maranhão, display more

significant rates, but Aratu/Cotegipe, in

Salvador, State of Bahia, has shown rel-

evant reaction, with the recovery of pro-

duction across the State.

n

Economics (Cepea), of the University of

São Paulo, analyzed the dimension of the

setback. “With the rising value of the Bra-

zilian currency in the first half of 2017,

compared to the same period in 2016,

there was a reduction in dollar terms and

domestic soybean prices in Real suffered

a negative variation of 13.7%”, the organ

46

PONTOS DE SAÍDA DA SOJA

shipment ports

As plataformas brasileiras de escoamento do grão - (Emmil quilos)

Portos

2017 (Jan/Ag)

2016 (Jan/Ag)

Var. (%)

Santos (SP)

16.361.463

14.394.611

13,66

Rio Grande (RS)

8.870.496

8.180.306

8,44

Paranaguá (PR)

8.774.960

7.411.859

18,39

Itaqui/São Luís (MA)

5.389.616

3.600.783

49,68

São Francisco do Sul (SC)

4.226.317

3.635.752

16,24

Barcarena (PA)

4.153.895

2.245.546

84,98

Vitória (ES)

2.885.422

2.672.125

7,98

Aratu/Cotegipe (BA)

2.169.808

1.058.943

104,90

Itacoatiara (AM)

1.954.762

1.814.317

7,74

Imbituba (SC)

823.976

917.729

-10,22

Ilhéus (BA)

92.699

61.820

49,95

Barra dos Coqueiros (SE)

---

20.581

---

Total

57.610.461

47.608.768

21,01

Fonte:

Anec.