Feedsectortakesadvantageoflower

grainprices,butendedupsuffering

theconsequencesoftheeconomic

scenariointhefirsthalfof2017

FEEDFORDAIRY CATTLE

Despite the favorable effects of the climate and the lower prices of the cereals that are

components in the feed for lactating cows, milk production suffered a decline in the

milk production hubs in the first half of 2017 andwas responsible for some kind of

competition between the dairy products that depend on the collection of rawmilk for

recomposing the retail stocks. Ariovaldo Zani, executive vice-president at Sindirações,

makes it clear that the concentration of activities in huge enterprises has considerably

improved the productivity rates, mainly because of the use of quality nutrition.

As a result, the production of feed for dairy cattle droppedmore than 3%and

amounted to 2.56million tons. “The rising imports of dairy products, in turn,

should limit the profitmargins derived frommilk in the second half of the year and

encourage consumption at the end of the chain, thus encouraging the resumption in

the production of feed”, says Zani. In agriculture, the production of feed for fish and

shrimp amounted to around 547 thousand tons, representing a 5-percent decrease,

whilst the demand for dog and cat food demonstrated resilience and soared 0.5%,

coming to a total of 1.3million tons.

D

emand for industrialized feed

reached 33.1 million tons, but

dropped 1.5% in the first half of

2017, in comparison to the same

period in 2016. These numbers

come from the National Union of the Animal

Feed Industry (Sindirações). Ariovaldo Zani,

executive vice-president of the association,

understandsthatthelowerpricesofcornand

soybean meal were not enough to encour-

age cattle confinements, prepared feed for

the dairy cattle, and for the confinement of

youngchickenandpiglets.However,eggpro-

ducers took advantage of the lower prices of

these inputs throughout the first sixmonths.

“The recovery of the shipment rhythm

and the still slow resumption of the pur-

chasing power, resulting from the small-

er inflation rate and lower interest rates,

already seemtohave reflections on the sup-

ply chain, whose perceptible reaction, since

July, could intensify in the secondhalf of the

year, although unemployment rates contin-

ue resilient and the business environment

is still rather unstable”, he ponders. In the

analysis of the first half of 2017, the market

demanded16.5milliontonsoffeedformeat

chickens, down 1.7%, in response to young

chicken confinements, which dropped 6%.

The production of feed for laying hens,

in turn, totaled 2.9 million tons, up almost

10%. The official maintains that the growth

comes as a response to the robust confine-

ment of young laying hens and to the pro-

duction of eggs, which, for their nutritive

Eager to

grow

Demand for industrialized feedamounted to 33.1million tons

Until December, however, the expecta-

tion is for a recovery in the pig farming op-

erations. The same holds true for the feed

for beef cattle, which decreased by 8% in

the first half of the year. “The reaction dur-

ing the second half of the year, although

not very promising, is credited to some in-

dications of higher values per arroba, but

recovery greatly depends on the resump-

tion of the domestic consumption levels

and on the unfolding of the North-Ameri-

can embargo, which could set a model for

the interests of other importers.

n

properties and affordable price, replace a

huge portion of the animal protein tradi-

tionally consumed by the families. Demand

for pigsdropped3.3%in the first half of 2017

and amounted to 7.7 million tons, a reflec-

tion of the 3-percent drop in pork exports

and3.5% in thenumber of pigs slaughtered.

58

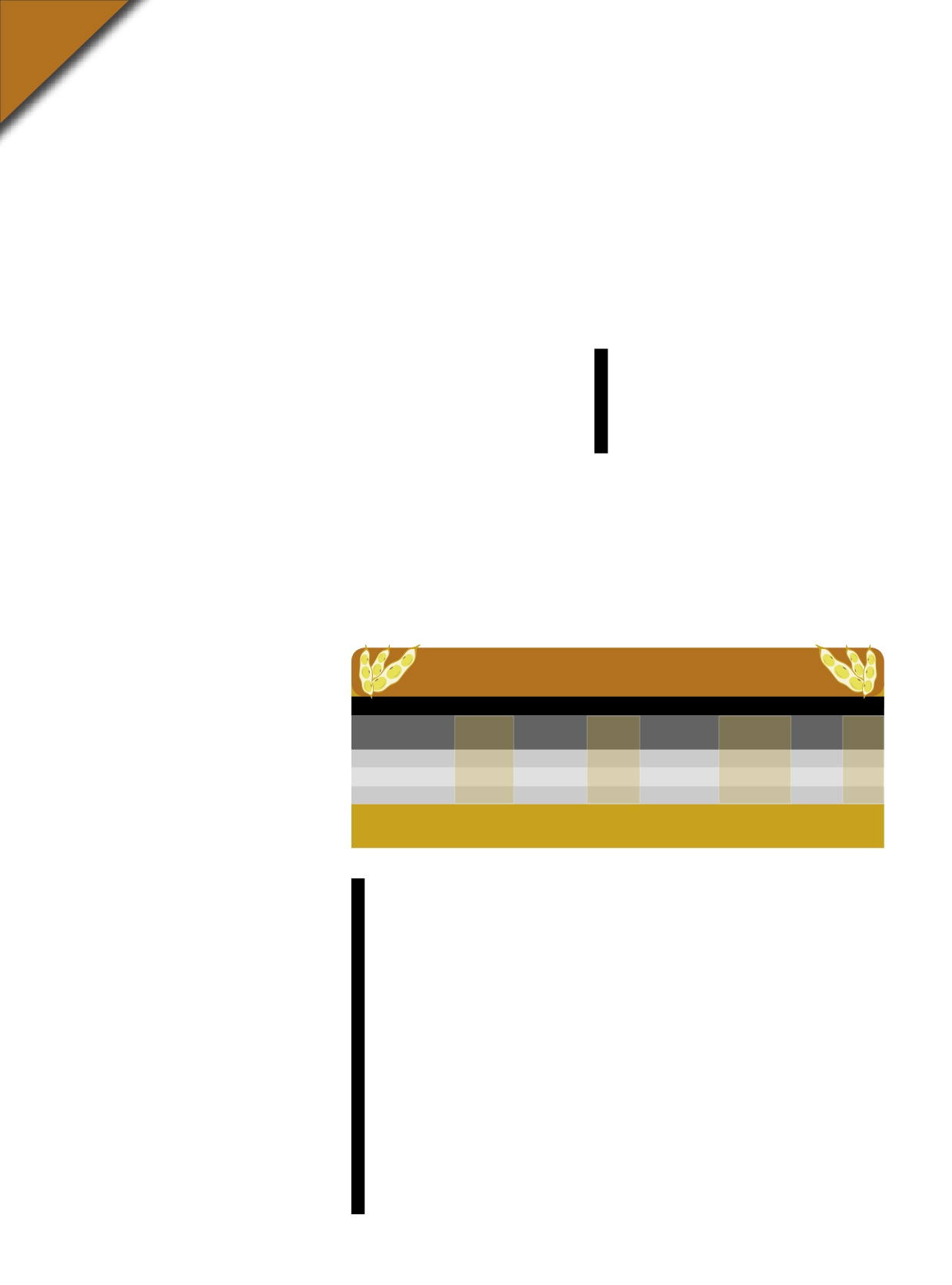

Variação no custo do farelo se soja:

Junho de 2016: R$ 1.526,00 por tonelada; Julho de 2017: R$ 990,00 por tonelada.

Fonte:

JOX, elaborado pelo Sindirações.

ESFOMEADOS

hungry

Demanda por farelo de soja no Brasil - (emmilhões de toneladas)

Janeiro/junho

Frangos

Poedeiras Suínos Gado corte Gado leite Outros Total

de corte

2017

16,5

2,9

7,7

1,09

2,56

2,43 33,1

2016

16,8

2,6

7,9

1,18

2,65

2,44 33,6

%

-1,7

9,6

-3,3

-8,2

-3,4

-0,5 -1,5