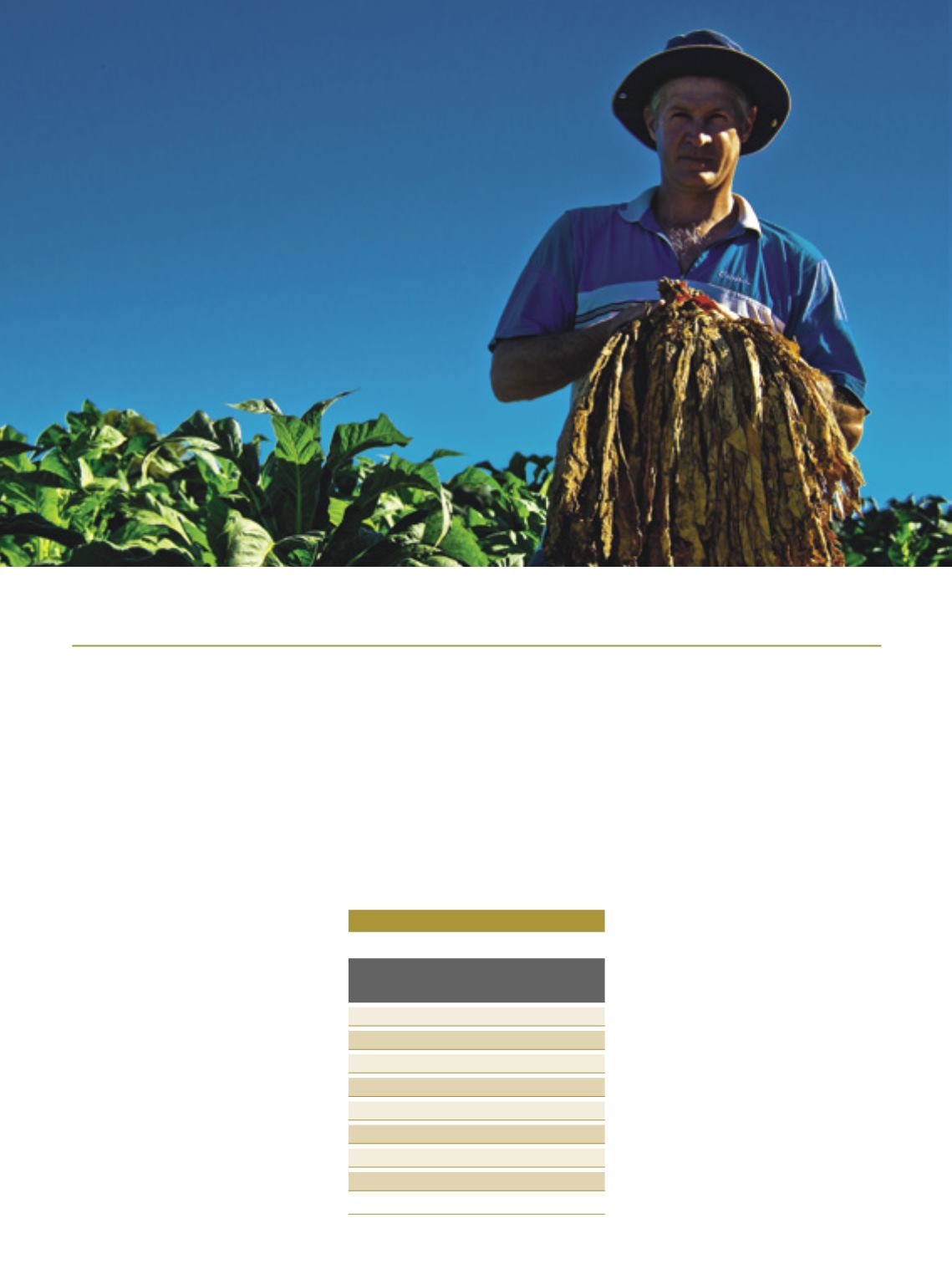

A

recent study attests that more

than 80% of the tobacco farm-

ers in South Brazil, region that

is responsible for 97.5% of the

national crop, belong to eco-

nomic classes A and B, way above Bra-

zil’s reality. Median monthly household

per capita income is R$ 1,926.73, while the

general average in the Country remains at

R$ 1,113.00, as ascertained by the Center

for Studies and Research on Administra-

tion (Cepa) of the Federal University of Rio

Grande do Sul (Ufrgs), in 2016. That year,

144 thousand tobacco growing families of

the region earned R$ 5.23 billion, a bigger

volume compared to the previous year, a

fact that encouraged the farmers to expand

their planted areas by 10% for the 2016/17.

“It came as a nice surprise to learn

about the high income earned by the to-

bacco farmers, compared to producers of

other crops, and their expressive person-

al property, starting from the availabili-

ty of electric energy, washing machines

(96%), clothes dryers (65%) and air con-

ditioners (21%)”, commented Luiz Anto-

nio Slongo, professor at Ufrgs and coordi-

nator of the study. What also grabbed his

attention was the high degree of satisfac-

tion shown by the farmers (90%) regard-

ing their agricultural activity and interest

(85%) in holding on to their crop.

The value of the 2015/16 crop went up

by almost 40% in comparison to the pre-

vious year, including the three types of to-

bacco grown in the South for the manufac-

ture of cigarettes (Virginia, in its majority,

87%; and air cured Burley, 12%; and Co-

mum), according to numbers furnished by

the Tobacco Growers’ Association of Brazil

(Afubra). Climate-related problems during

the season ill affected the productivity rates

(which, in general, is high at every growing

season, along with quality), a fact that had

an influence on income andon the decision

for the next season, says Benício Albano

Werner, president of the association.

About 85% of the crop, on average, is

shipped abroad (major buyers are Belgium,

ChinaandtheUnitedStates)andBrazil,sec-

ond-biggest global producer, leads exports,

accounting for about 30% of all tobacco

negotiated in the world. In 2015, with big-

ger volumes available, the volume shipped

abroad by the Country (99.4% from the

South) went up by 8.6%, but in 2016, with a

smaller crop, the expectation is for a reduc-

tion in exports. “With competitive prices,

Brazil is supposed to continue leading the

exports of the sector, in view of the quali-

ty and integrity of the tobacco, besides the

advances inproduction sustainability”, says

Cropbringsinaheftyincomeandsatisfaction,stimulatingthefarmersto

increasetheplantedareaforthe2016/17growingseason, inSouthBrazil

Happyand

satisfied

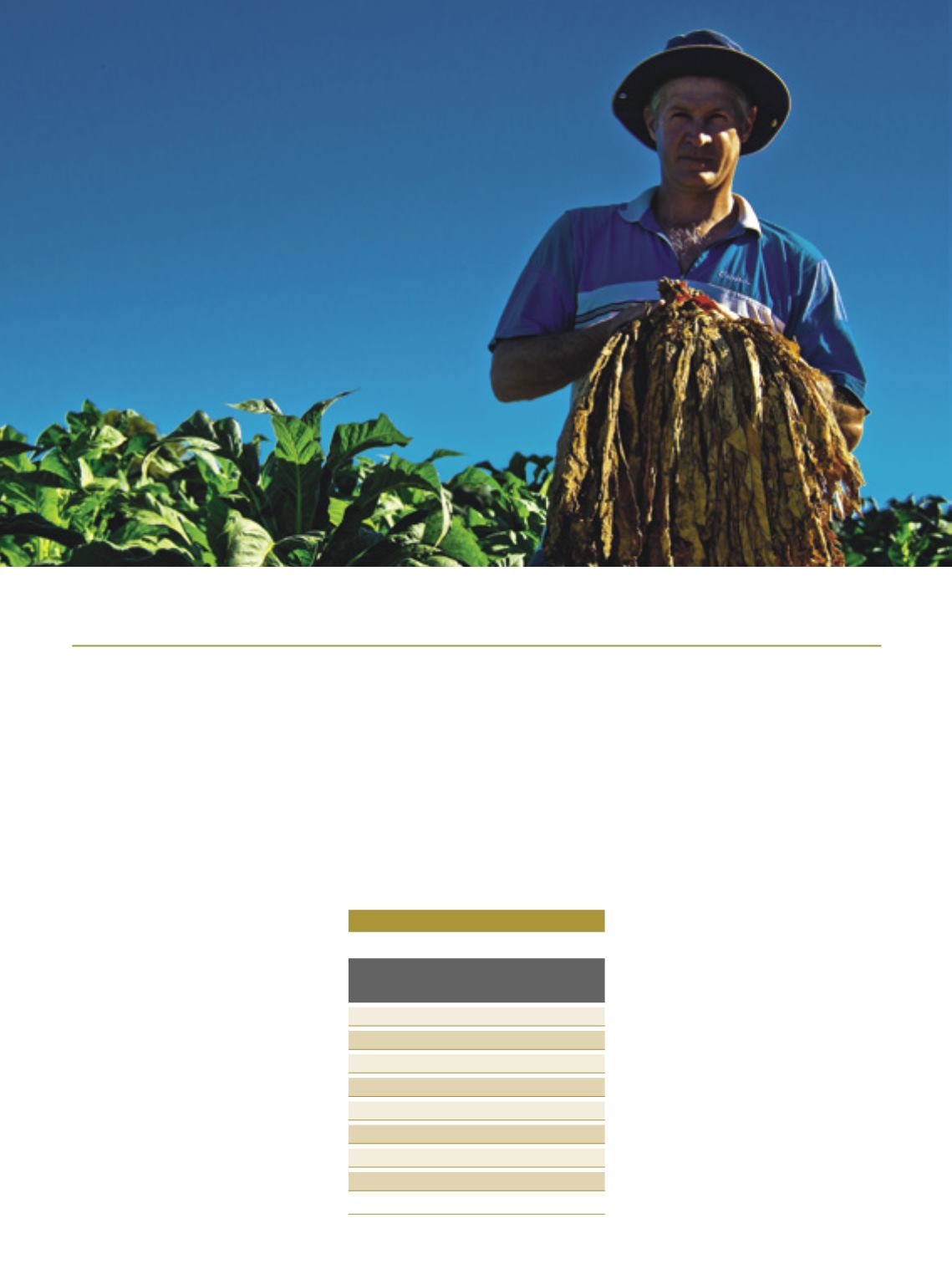

VALORESDOTABACO

Tobaccovalues

NúmerosdaculturanoBrasil

Safra2015/16

Área

283.670hectares

Produção

538.683toneladas

Exportação(2015)

517miltoneladas

Receitaexportação(2015)

US$2,19bilhões

Rendaprodução(Sul)

R$5,2bilhões

Rendasetor(2015)

R$27,8bilhões

Tributos(2015)

R$13,2bilhões

Empregosdiretoseindiretos

2,1milhões

Fonte:Afubra/SindiTabaco.

tobacco

Inor Ag. Assmann

100