VETOREXTERNO

A previsão para o ciclo 2016/17 é de “um ano de safra

boa e recuperação da produção nacional, comclima neutro

ou sob efeito de

La Niña

fraca”, frisa o documento “Outlook

Fiesp 2016”. Registra que o “crescimentode área deve conti-

nuar a ocorrer, porémemescalamenor doque emanos an-

teriores,comalgumamigraçãodeáreaparamilhodeprimei-

ra safraestimuladapelospreços remuneradoresde2016”.

Para o futuro, o principal vetor da produção da soja será

omercado externo. “Mas a demanda doméstica seguirá im-

portante, em farelo para alimentação animal, diante da boa

performance da pecuária, aomesmo tempo emque o con-

sumodeóleocombustível e comestível deverá ser relevante

e inclusive fortalecido com incremento do uso de biodiesel

pela ampliação das metas estabelecidas pelo governo para

misturanodiesel (10%até2019)”, observaaentidade.

O Ministério da Agricultura, Pecuária e Abastecimento

(Mapa), de sua parte, também faz projeções de maior incre-

mento em 10 anos nas exportações da oleaginosa brasileira:

41%contra22,6%noconsumo, enquantoaproduçãoevolui-

ria35,1%(abaixodoregistradonaúltimadécada,66%).Aárea

cultivadanoPaís,nasprevisõesdoministério,crescerámenos

(30,2%, ou 2,7%ano, ante 5,8%anuais na década passada) e

amaiorexpansãodeveráocorrersobreterrasdepastagens.

HEATEDALTERCATION

With regard to 2016, Imea sources refer to “higher average nominal soy-

beanprices in thehistoryofMatoGrosso, stimulatedby scarcedomestic sup-

ply, high demand, and by the ChicagoMercantile Exchange and the appreci-

ation of the dollar in mid-year. The Center for Applied Studies on Advanced

Economics (Cepea), in São Paulo, also ascertained record prices in the Brazil-

ianmarket (the indicator inParaná in2016wasR$77.43/sc).

The top soybean producing State complements and celebrates the 8-per-

cent bigger shipments through the ports in the North, in 2016, which should

continue throughout 2017, with reflections on the global competitiveness of

the soybean produced in Mato Grosso. However, these exports, both in the

StateandintheCountry,sufferedareductionthisyear,mainlyduetothesmall-

er amount of the crop. As for the next period, with a projected increase in pro-

duction,exportsofBrazilcouldhitrecordforeignsales(closeto58milliontons).

This,fromprojectionsreleasedbyseveralorgansinlate2016,wassupposed

to occur despite the bigger global supply (in light of the already consolidated

record crop of the biggest producer, the United States, with 118.7million tons,

and good perspectives for the crop in Brazil), simply because demand contin-

ues heated. China, major buyer (this country accounts for 74% of all Brazilian

soybeanshipmentsabroad)isstilldemandingbigvolumes.Nevertheless,glob-

alstocksarerisingandcouldhaveanegativeimpactupontheprices.

ThesmalleramountsofsoybeanavailableinBrazilin2016,alongwiththe

economic crisis, have equally adversely reflected on the production and do-

mestic consumption of soy based products (meal and oil), as well as on the

profitability of the industry, which is also resenting the accumulation of tax

credits. But the Brazilian Vegetable Oil Industries Association (Abiove) is har-

boringmore positive expectations for 2017, regarding bigger rawmaterial of-

fer,theadditionofmorebiodieseltofossildiesel(B8)and,eveninthemainte-

nanceof good international prices.

EXTERNALVECTOR

The forecast for the 2016/17 season “a year of a good

crop and recovery of national production, with a neutral

climate or under the effect of a weak La Niña”, says the

São Paulo State Industry Federation (Fiesp), in the docu-

ment “Outlook Fiesp 2016”. It registers that “area increases

should continue, but on a smaller scale compared to previ-

ous years, with some areamigration to summer crop corn,

stimulated by the remunerative prices in 2016”.

For the future, the main soybean production vector will

be the foreignmarket. “The importance of domestic demand

will continue, inmeal for animal feed, in light of the goodper-

formance of all livestock operations, whilst the consumption

of edible and fuel oil should continue relevant, and strength-

enedbytheever-increasinguseofbiodieselforexpandingthe

targets set by the federal government for the fossil diesel and

biodieselblends(10%upuntil2019)”,observeentityofficials.

The Ministry of Agriculture, Livestock and Food Supply

(Mapa), on its part, also projected increases in 10 years of

Brazilian soybean exports: 41%against 22.6% in consump-

tion, whilst productionwas supposed to soar 35.1%(below

the levels of the past decade, 66%). The planted area in the

Country, according to theministry, will experience a small-

erincrease(30.2%,or2.7%ayear,against5.8%ayearinthe

past decade) and the biggest expansion will occur on de-

graded pasturelands.

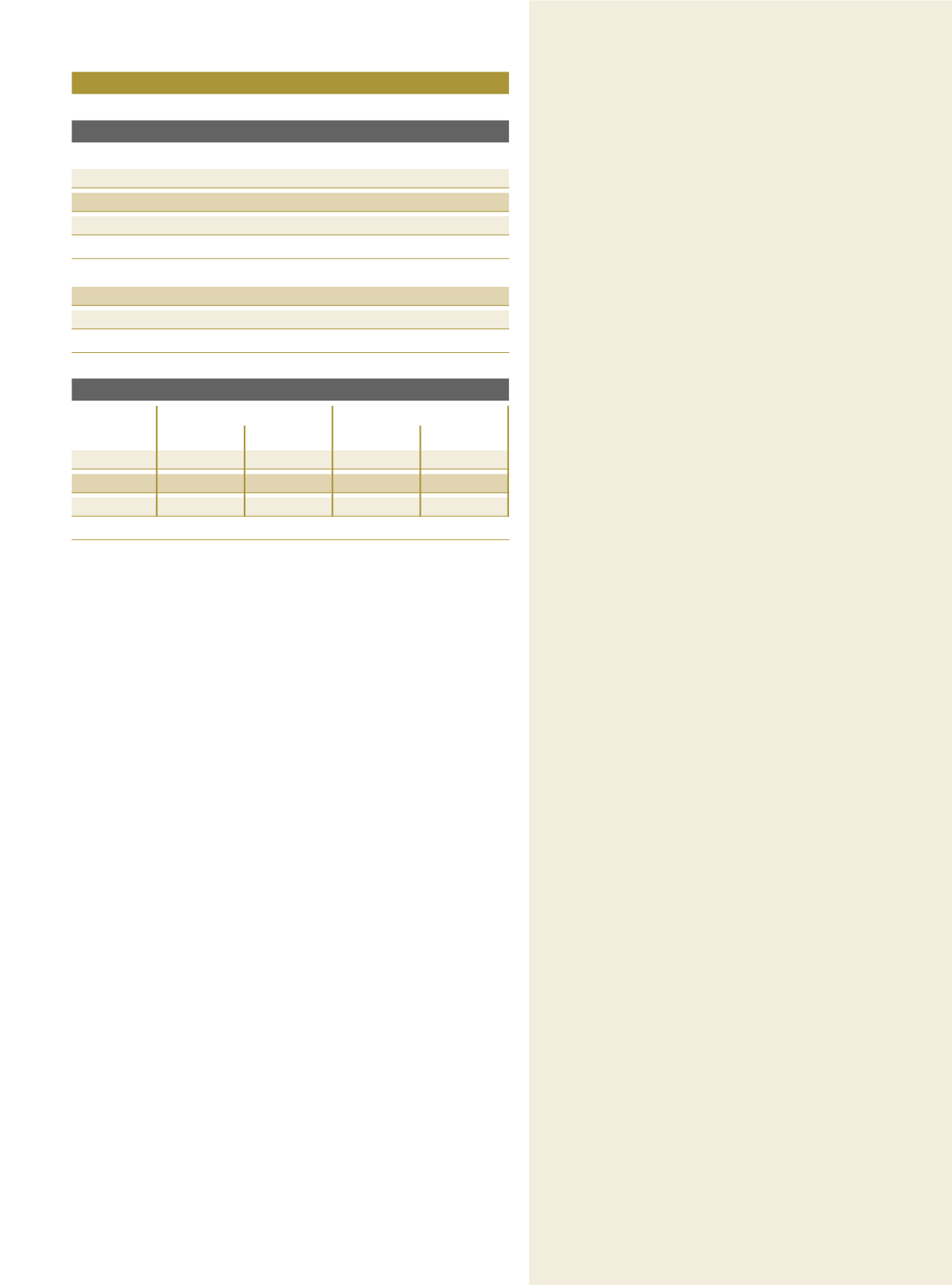

MOVIMENTOSDASOJA

Soybeanonthemove

Produçãobrasileira

Safras

2015/16

2016/17

Área(milha)

33.251,9

33.903,4

Produtividade(kg/ha)

2.870

3.022

Produção(milt)

95.434,6

102.446,6

Fonte:Conab/Estimativa.Dezembro:2016.

Anos

2016*

2017**

Farelo(milhõest)

29,70

31,10

Óleo(milhõest)

7,80

8,10

Fonte:Abiove/Dezembro2016 *Estimativa**Projeção

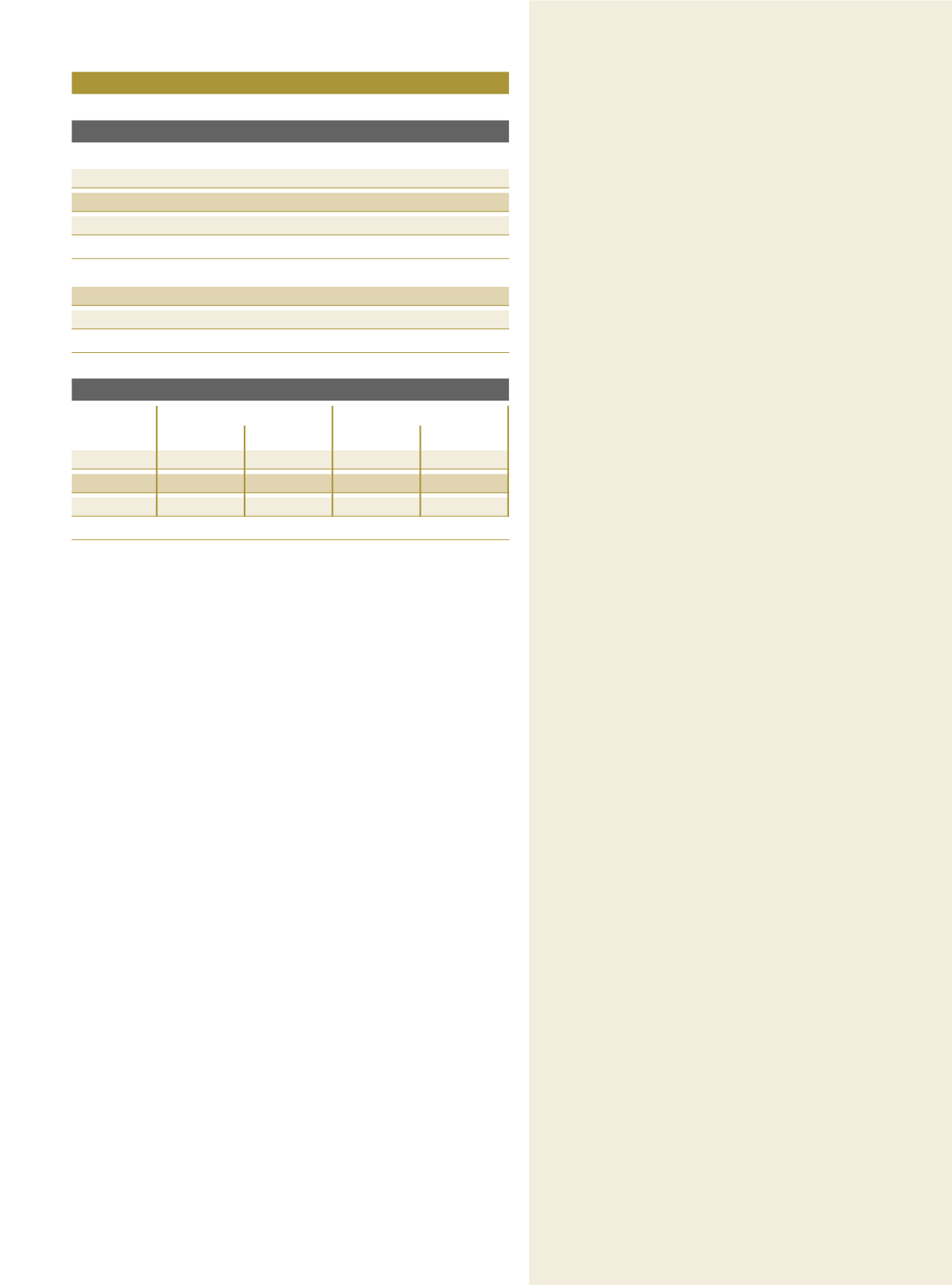

Exportaçãobrasileira

Anos

2015

2016

MilKg

MilUS$

MilKg

MilUS$

Grão

54.324.238 20.983.575 51.581.875 19.331.323

Farelo

14.826.662 5.821.074 14.443.792 5.192.781

Óleo

1.553.835 1.055.342 1.149.961

801.362

Fonte:Secex.

93