A

s far as the scenario of the crop

andmarkets in early 2017 are at

stake, the rice supply chain will

have a quite adjusted year in

terms of supply and demand,

and equally with regard to prices through-

out the year. The 2016/17 growing season,

to be harvested from late January through

February and March in South Brazil, should

amount to a volume similar to the domestic

need of the cereal, of 11.5million tons of un-

hulled rice. At the same time, the domestic

scenariopointstolowpricesinthefirsthalfof

the year, due to abundant supply, which will

favor exports and, at the same time, boost

national competitiveness, but should ad-

verselyaffect farmers’ profits.

Grain market analyst Sérgio Roberto

Gomes dos Santos Júnior, from the Na-

tional Food Supply Agency (Conab), em-

phasizes the recovery of almost one mil-

Braziliancroptendstobeexactlythesize

projectedforconsumption,thedifferencewill

lieinthetradeofbalanceandprivatestocks

Ripe

bunches

RICE

and imported about 1.2 million tons. The

trend is for Brazil to celebrate surpluses in

2017”, he anticipates.

According to Tiago Sarmento Barata,

commercial director at theRioGrandedoSul

Rice Institute (Irga), 2017 tends to be a year

of rather lower prices. “The market adjusts

itself. As domestic prices drop, shipments

abroad go up, they absorb the supplies and

prices soar again”, he comments. “If they rise

considerably, imports begin to soar and the

market again adjusts its prices to a point of

equilibrium”. Even so, he insists that produc-

tion costs soared and the margin of the rice

farmers should remain low during the sea-

son. “Production costs need to be carefully

calculated, alongwith a good selling strategy

if profits are tobeobtained”, hewarns.

In Barata’s view, the crop in Rio Grande

do Sul will be a normal one, with about 8.2

million tons, representing 70% of the total

production in the Country. “In other regions

there are failures, and our supply and de-

mandpicturewill continue rather tight, with

no public stocks andwith private stocks just

enough tomeet demand”, he recalls.

Chief economist Antônio da Luz, from

the Rio Grande do Sul Federation of Agri-

culture (Farsul), emphasizes that in 2017

there is no excuse for the federal govern-

ment not to ensure rice sales under favor-

able conditions for the farmers. “We are

witnessing heavy indebtedness and scarce

access to rural credit lines. Due to this, it is

important for the federal government to

grant resources for production costs, whilst

selling surpluses and generating mecha-

nisms capable of reducing the pressure

upon farmgates prices”, he stresses.

PRATOFEITO

Readytoeat

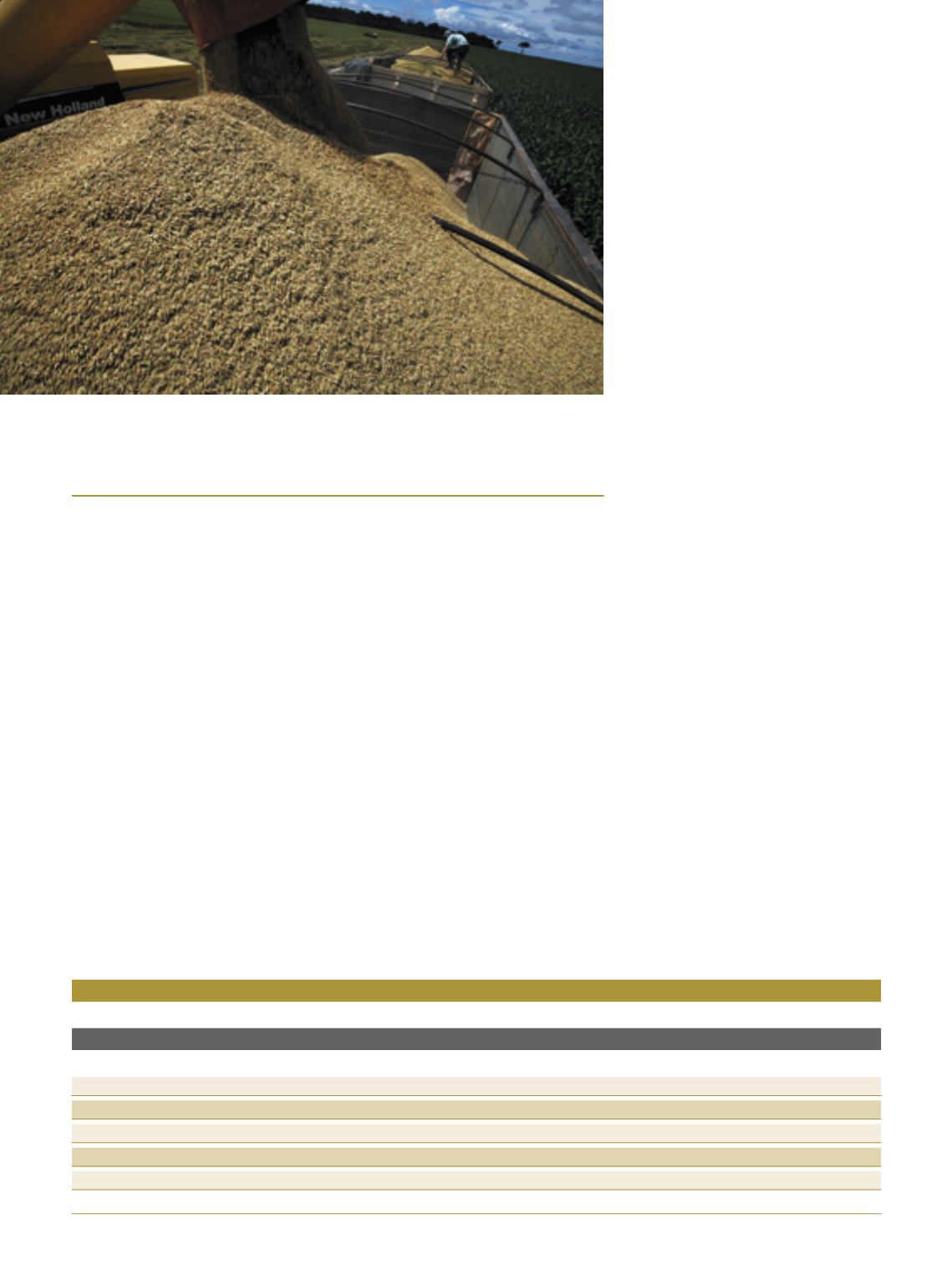

QuadrodeofertaedemandadearroznoBrasil,emmiltoneladas

Safra

Estoqueinicial

Produção Importação Suprimento

Consumo

Exportação Estoquefinal

2012/13

2.125,3

11.819,7

965,5

14.910,5

12.617,7

1.210,7

1.082,1

2013/14

1.082,1

12.121,6

807,2

14.010,9

11.954,3

1.188,4

868,2

2014/15

868,2

12.448,6

503,3

13.820,1

11.495,1

1.362,1

962,9

2015/16

962,9

10.602,9

1.300,0

12.865,8

11.450,0

1.100,0

315,8

2016/17

315,8

11.506,6

1.000,0

12.822,4

11.500,0

1.100,0

222,4

Fonte:Conab,dezembrode2016.

Expectation is for lower prices than in 2016

lion tons in the 2016/17 growing season,

compared to the 2015/16 season. “In all,

10.6 million tons were harvested, because

the phenomenon El Niño took a heavy

toll on the crop. The bigger supply in the

new season will dictate average prices in

the range of R$ 43 to R$ 44, contrary to the

second half of 2016 when prices remained

stable at R$ 48, and in some instances

prices peaked at R$ 50”, he explains.

He also maintains that because of the

failure of the crop Brazil needed to im-

port more rice from Mercosur countries,

with only small quantities available for

exports. Therefore, the civil year comes

to a close with a deficit of approximate-

ly 200 thousand tons in the balance of

trade. “We exported almost a million tons

Sílvio Ávila

24