Right after Russia

andHong Kong,

major markets, China

is gainingmomentum

in 2016 among the

importers of pork

fromBrazil

Eastern

attraction

Ainda cresceram as aquisições de pa-

íses da América Latina: Chile (216%), Ar-

gentina (119%) e Uruguai (32%). “Exce-

to Venezuela e Angola, quase não houve

retrações entre os importadores da carne

suína do Brasil e, de forma geral, o saldo

de vendas foi bastante positivo, em espe-

cial nos mercados chinês e sul-america-

no”, afirmou o dirigente da ABPA. Sobre

a China, o maior produtor e consumidor

mundial, a Confederação da Agricultura e

Pecuária do Brasil (CNA) ainda observou

que “a produção interna de carne suína so-

freu drástica redução por questões relati-

vas à legislação ambiental, aumentando a

dependência externa para se abastecer, o

que deverá favorecer o incremento grada-

tivo das exportações brasileiras”.

East is themain destination of Brazilianpig

meat, fourth largest exporter, which in 2016

experienced an increase in sales, hitting the

record and, in addition, attracting more mar-

kets in the Eastern countries. Up until Octo-

ber, the numbers had already outstripped the

numbers of the entire previous year, up 38.1%

from the first 10months and, at the end of the

period, could even exceed 700 thousand tons,

according to the projections by the Brazilian

Association of Animal Protein (ABPA). There-

fore, the volume shipped abroad (83% in the

modality of cuts)was supposed to reach about

one fourth of the total production, while in

2015 this share corresponded to 15.2%.

In 2015, exports had reacted, to 555 thou-

sand tons, although remaining below the pre-

viously estimated 600 thousand tons, which

had already been surpassed in 2005, 2007 and

2009, remaining close to the volumes export-

ed back in 2012. The result expected in 2016,

according to Francisco Turra, executive presi-

dent of the ABPA, was based on the behavior

of the market in the second half of the year,

when average shipments per month soared to

65 thousand tons, while in the first half of the

year, it was 58 thousand tons.

Revenue was also higher in 2016. In 2015

there had been a decrease in this item from the

previous period (about 20% in dollars), the val-

ue ascertained from January to October in the

next year (US$ 1.208 billion), was up 13.4%

and, in Brazilian currency (R$ 4.182 billion),

it was 19.5% up from the previous number.

In view of the difficulty to pass on to the con-

sumers the high production costs in domestic

sales, the solution consisted in expanding sales

abroad, resulting into a certainbalance, says Rui

Vargas, technical vice-president at the ABPA.

A novelty in the foreign operations, says

Vargas, was the vigorous step taken by China

opting for becoming a relevant buyer, and in

2016 this country ranked as third biggest im-

porter, coming right after Russia and Hong

Kong, leading markets, compared to the pre-

vious year when this country occupied the

11th position. Up until October, the Asian gi-

ant had acquired 75.4 thousand tons of Brazil-

ian pigmeat, up 2,400% from the volume pur-

chased in the first 10 months, and purchases

by Russia did not alter much (up 3%), while

the purchases by the second biggest buyer,

Hong Kong, soared 45%, while another rele-

vant Eastern market, Singapore, was recover-

ing space and purchased 20%more.

Other countries that showed progress in

their acquisitions were from Latin America:

Chile (216%), Argentina (119%) and Uruguay

(32%).With the exceptionof Venezuela andAn-

gola, there were almost no decreases among

the importers of Brazilian pork and, in general,

the balance of trade was positive, especially in

theChinese and South-Americanmarkets”, said

the ABPA official. About China, the biggest glob-

al producer and consumer, the Brazilian Con-

federation of Agriculture and Livestock (CNA)

also observed that “the domestic production of

pork suffered a drastic reduction for matters re-

lated to the environmental legislation, putting

pressure on foreign dependence as far as sup-

ply goes, a fact that should gradually favor the

rising trend for Brazilian exports.

59

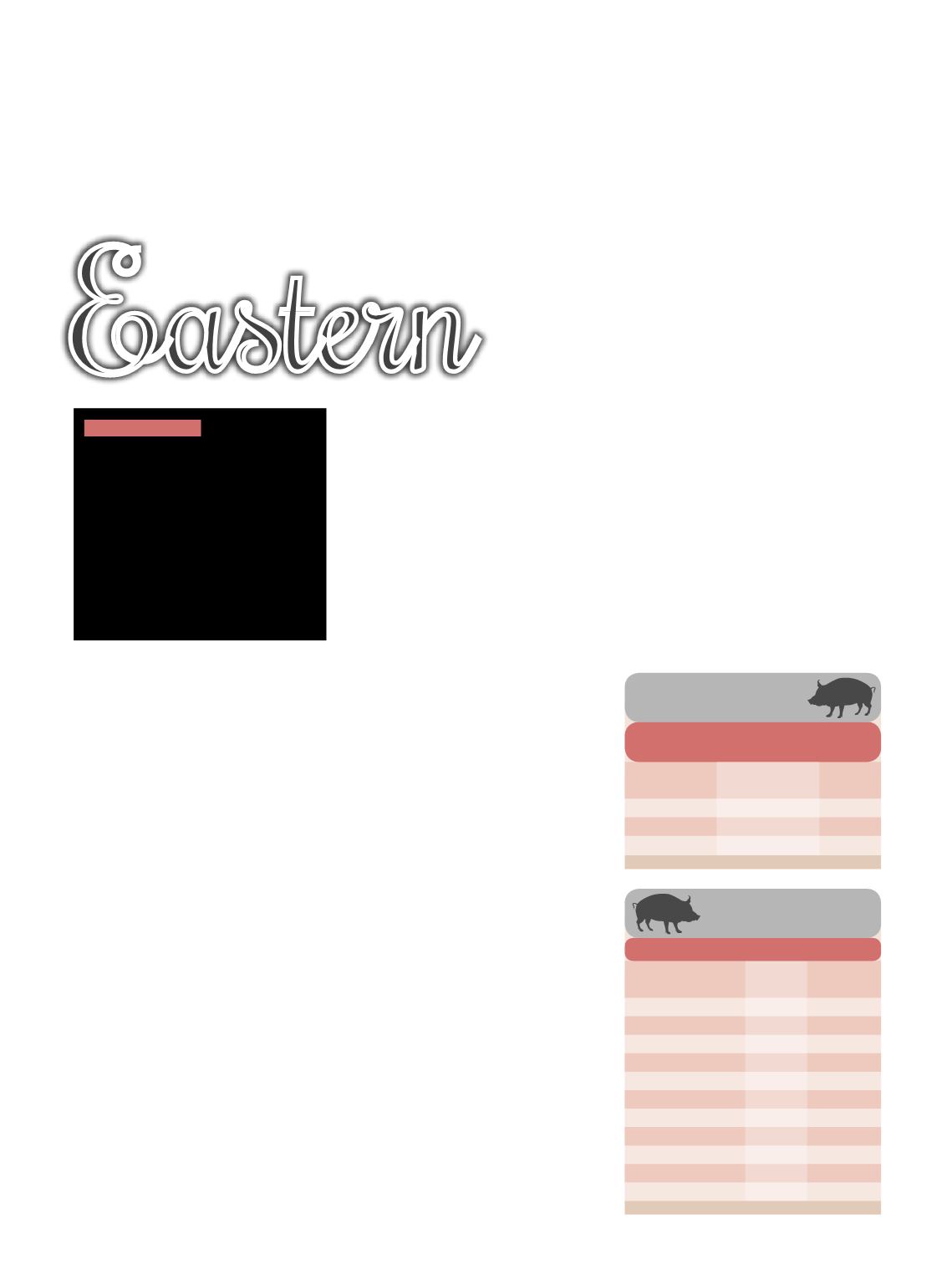

Principais destinos/2015

Fonte:

ABPA/Secex

Países

Volume Variação

(T) s/2014 (%)

Rússia

243.651

30,6

Hong Kong

123.733

11,6

Angola

35.570

-32,0

Singapura

28.080

-13,0

Uruguai

22.750

9,2

Argentina

10.913

37,1

Venezuela

9.949

142,7

Chile

8.299

-0,8

Georgia

7.432

-13,7

Emirados Árabes

6.050

13,9

China

5.225

520,2

CLIENTELAS

Clients

Exportações de carne

suína brasileira

Ano

Valor Volume

(US$ milhões) (Mil t)

2013

1.359

517

2014

1.606

505

2015

1.279

555

Fonte:

ABPA/Secex

PARA O MUNDO

To the world