As far as exports go, the highlight is

pineapple juice, while foreign sales of

fresh fruits, including dried fruit, have

dropped over the past years. In 2016, it

still registered positive advances in vol-

ume (91.3%) and in value (56.2%). Aver-

age prices decreased by 18.3%. The vol-

ume of the fruit traded in 2016 (3,014 t) is

much smaller than in 2007 (36,764 t), for

example, recalls Souza. He observes that

Brazilian pineapples no longer fit into the

type that is most traded at global level.

The international market, the re-

searcher says, is dominated by the va-

riety MD-2 (sweeter in taste, with a high

content of vitamin C and with a longer

shelf life, compared to Smooth Cayenne,

which was previously preferred). As pro-

duction in Brazil consists mostly of the

varieties Pérola (88%) and Smooth Cay-

enne (12%), explains Souza, exports of

fresh fruit became rather limited and, in

general, geared towards nearby markets.

In 2016, main purchasing countries in-

cluded Argentina, with 78.8%; and Uru-

guay, with 16.3%.

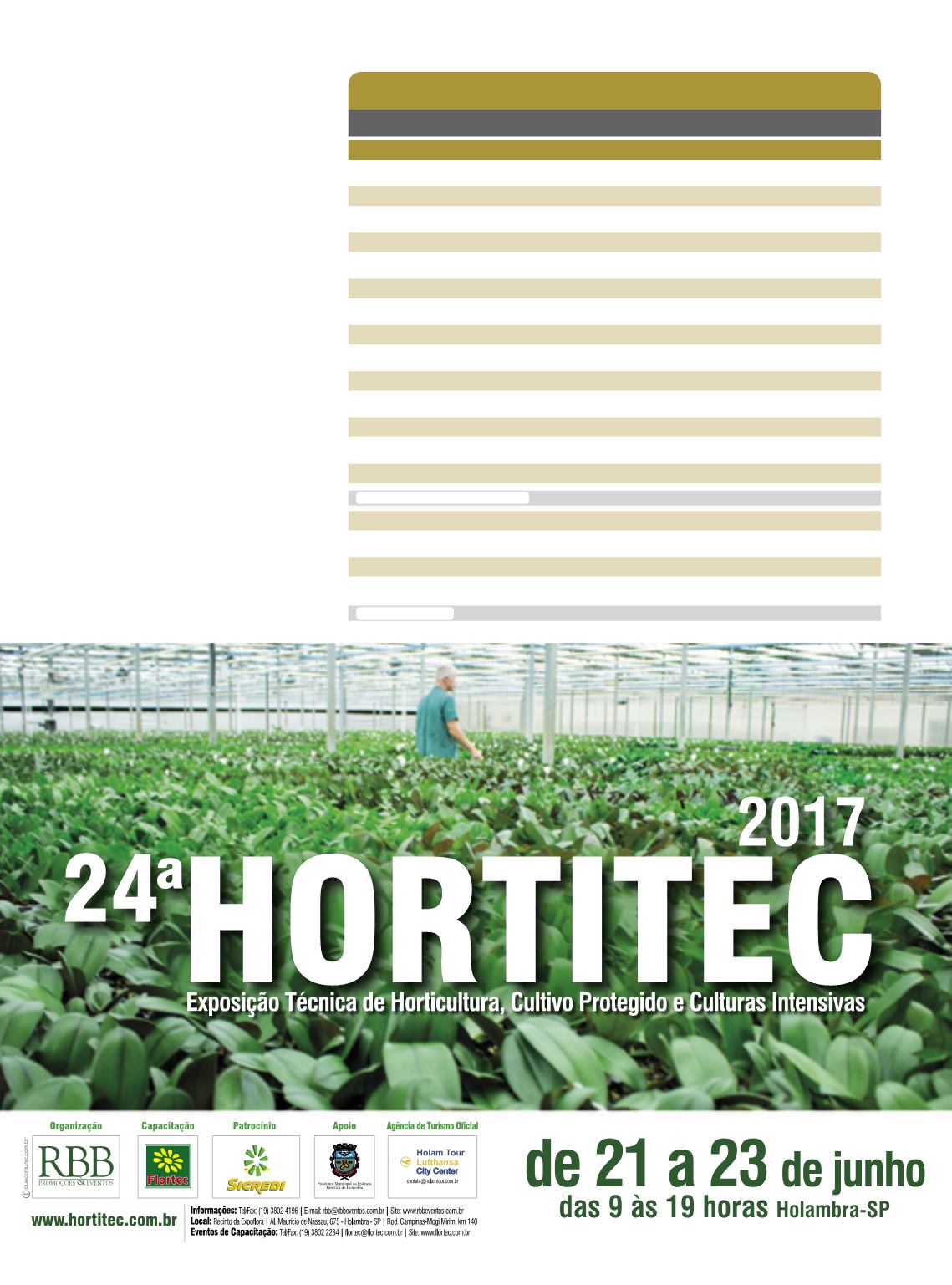

Últimos indicadores da fruta brasileira

ABACAXI EMPEDAÇOS

Pineapples in detail

Anos

2015

2016

Produção (mil frutos)

1.801.415

1.756.359

Área plantada (ha)

69.565

102.476

Área colhida (ha)

69.165

68.618

Produtividade (fr/ha)

26.045

25.596

Pará (mil frut)

372.686

399.282

Área plantada (ha)

11.958

24.083

Paraíba (mil frut)

290.772

283.362

Área plantada (ha)

9.697

13.973

Minas Gerais (mil frut)

263.133

251.429

Área plantada (ha)

8.575

13.169

Bahia (mil frut)

144.827

129.600

Área plantada (ha)

5.800

7.700

São Paulo (mil frut)

96.719

96.129

Área plantada (ha)

3.657

5.520

Fonte:IBGE/LSPA–Dezembro2016

Exportação fruta (US$)

1.023.310

1.598.083

Exportação fruta (kg)

1.576.024

3.014.198

Exportação suco (US$)

17.431.544

25.864.161

Exportação suco (kg)

7.489.088

10.049.920

Fonte:Secex/MDIC.