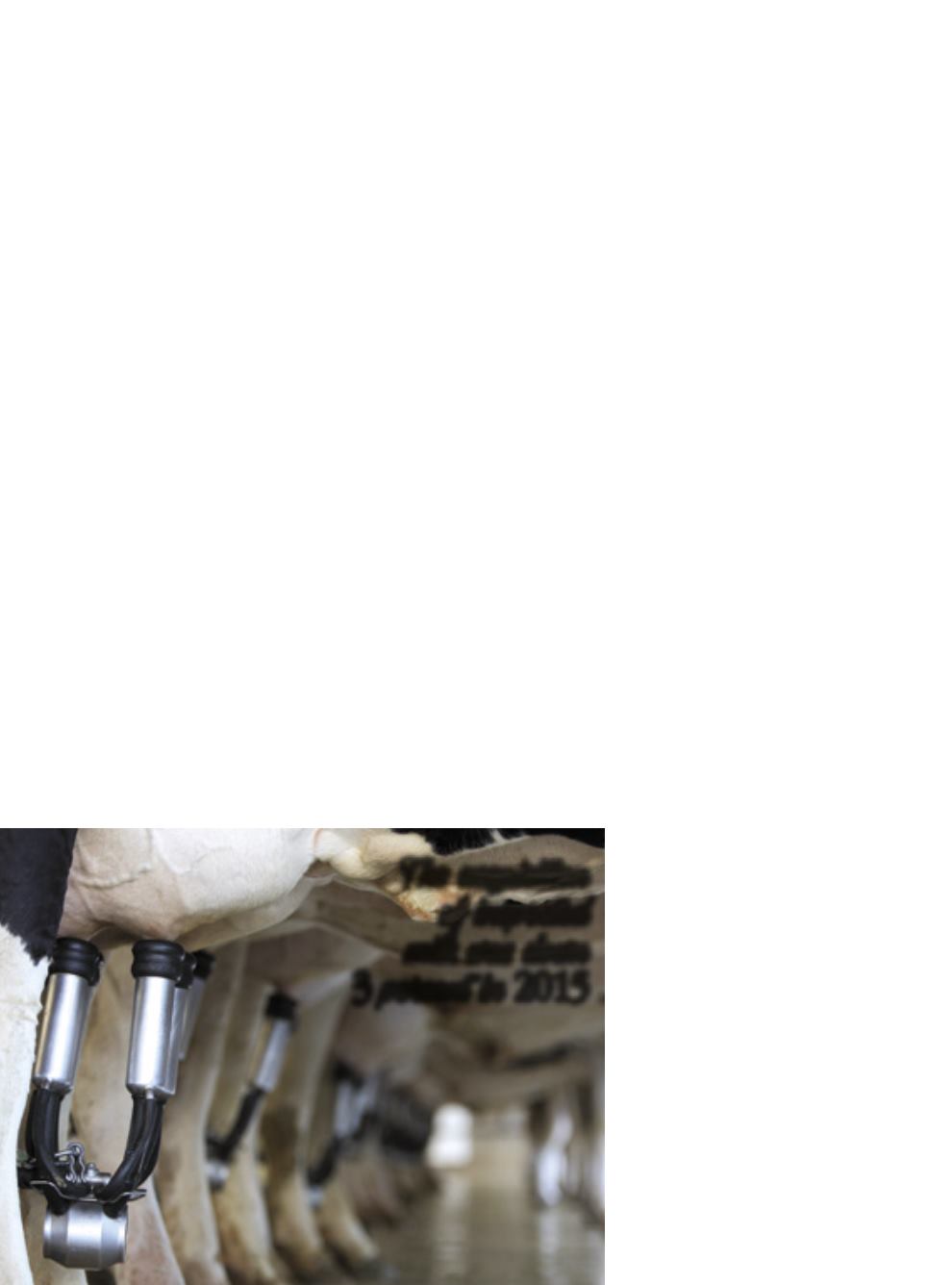

Milk production in Brazil, which had been

rising at an average rate of more than 3 per-

cent per year, from 2011 to 2014, may have

dropped about 1 percent in 2015, according

to figures released by the National Food Sup-

ply Agency (Conab). Or even up to 2.8%, if it

is equivalent to the drop in the acquisition of

inspected milk during that year, according to

a quarterly survey conducted by the Brazilian

Institute of Geography and Statistics (IBGE). It

is the first time that the amount of milk pro-

duced suffered a drop since the surveys start-

ed, in 1997, according to sources fromEmbra-

pa Dairy Cattle.

“Low prices, production costs on the

rise and shrinking domestic demand, result-

ing from the economic crisis, pushed pro-

duction down in all regions throughout the

Country”, says Maria Helena Fagundes, from

Conab, based on data released by the IBGE.

The leading milk producing regions (South-

east and South) experienced the smallest de-

clines. Samuel Oliveira, Embrapa researcher,

also mentions the crisis/consumption rela-

tion and the expressive increase in costs, fac-

tors that account for the smaller production of

milk in 2015. Until that year, the numbers had

been constantly rising, from 29 million liters a

day, in 1997, to 68million liters a day, in 2014.

For 2016, a projection by Conab, released

in April, was still pointing to a possible in-

crease (1%). However, analyst Maria Helena

had it that the level of production would de-

pend on the domestic scenario, where sever-

al factors could alter the estimates. She also

understood that the reduction in production

should, somehow, offer some support to pric-

es and avoid further reductions in produc-

tion. Nevertheless, in her opinion, the expect-

ed downtrend in the Gross Domestic Product

(GDP), with the loss of jobs and income, high

inflation and smaller consumption of dairy

products, would inevitably lead to a decrease

in production.

As a matter of fact, numbers released in

June by the IBGE, regarding a survey of the

acquisition of inspected milk in the first quar-

ter in 2016, pointed to a new decrease in the

amount of milk produced: down 6.8% from

the previous quarter and 4.5% from the same

period in 2015. In most states, there was a de-

crease in the production of milk. On the oth-

er hand, most big dairy farms did not reduce

their milk producing capacity, according to a

survey known as Top100 Milkpoint 2016. Al-

though registering smallest rates over the past

five years, they soared 2.2% in 2015, with an

average of 15,486 liters a day, and the major-

ity of the dairy farms (92%) are determined

to continue expanding their production vol-

umes.

A hole in the bucket

The upward trend in the production of milk in Brazil is facing

an interruption, with unfavorable prices and production costs,

alongwith shrinking demand because of the crisis

On the top, smaller decline

Just like what occurred with the biggest

farms, the main dairy factors that operate

in Brazil kept growing in 2015, but equally

at a slower path. According to information

released by Brazil Milk Association, based

on surveys conducted by entities of the

sector, the 15 biggest dairy manufacturers

increased by 1.2% their milk purchases this

year, totaling 9.86 billion liters, whilst in

2014 the increase had totaled 8.9% over the

previous year. Thus, their idle time rose

from 33.8% to 37.9%.

The list of the 15 biggest companies

is led by Nestlé, with 1.77 billion liters.

It is followed by the French company

Lactalis do Brasil, by CCPR/Itambé and by

Laticínio BelaVista, while the fifth position

is occupied by the group of Castrolanda,

Frísia and Capal cooperatives. The

highlight in this group was Vigor, which

jumped from the 11th to the 8th position.

In general, relying on an analysis by Scot

Consultancy, the 2015 scenario was a

reflection of the economic results, under

pressure from higher production costs and

smaller margins and investments by the

producers.

T he acquisition

of inspected

milk was down

3

percent in

2015

Sílvio Ávila

8