27

T

he weakened prices in the inter-

national scenario, by virtue of

rising supply, is one of the rea-

sons that accounts for the 3.3

percent drop in in the size of

the 2017/18 global crop, disclosed by the

US Department of Agriculture (USDA) in

June, with chances to amount to no more

than 1.032 billion tons. It would represent

a decrease of 35.3 million tons. Global con-

sumption, however, will continue soaring

at the rate of 2.7%, to 1.062 billion tons (28

million tons more). With demand outstrip-

ping supply, the global stocks, at the end of

the 2017/18 commercial year could shrink

by 13.5 percent, representing 194.3 million

tons. The volume is equivalent to 66 days of

global consumption.

TheUSDA report released in June antic-

ipates that within this scenario world corn

trade will drop to 152.9 million tons, or 3.6

percent. Some nations will consume a por-

tion of the stocks to balance their domes-

tic needs.

After the record crop in the current sea-

son,whoseexactvolumewillonlybeknown

in July, after an evaluation of the losses and

productivity levels resulting from excessive

precipitation in some corn growing regions,

USDA officials estimate that the size of the

crop in the United States will drop 7.1 per-

cent, to 357.3 million tons. There will be in-

terference in this behavior coming from the

instability of the positions of the Trump gov-

ernment regarding agriculture finance and

declining planting intentions.

In Brazil, the 2017/18 growing season

Productioninline

with demand

Global 2017/18 crop tends to be

smallerinsize,butconsumptioncontinuestosoar

andcouldlendsupporttointernationalprices

should shrink by 2.1 percent, to 95 mil-

lion tons (from the current projected 97

million tons), according to USDA bulletin,

despite the bigger planted area. The re-

duction has to do with the declining per-

formance per area. Price (with scarce use

of technology) and climate will affect the

corn fields.

In the meantime, consumption of three

of the four leading consumers should grow

at record levels in the coming season. The

exception is the European Union (EU28),

as the region will outstrip demand over

the 2016/17 period, but will still remain be-

low its biggest consumption in history, 77.9

million tons in the 2014/15 crop year (to-

taling 315.6 million tons) and China (with

238 million tons), together, they represent

upwards of 50 percent of international de-

mand for corn in the entire planet. Brazil,

fourth biggest global consumer, will use its

recordcropof 61.5million tons for its differ-

ent needs.

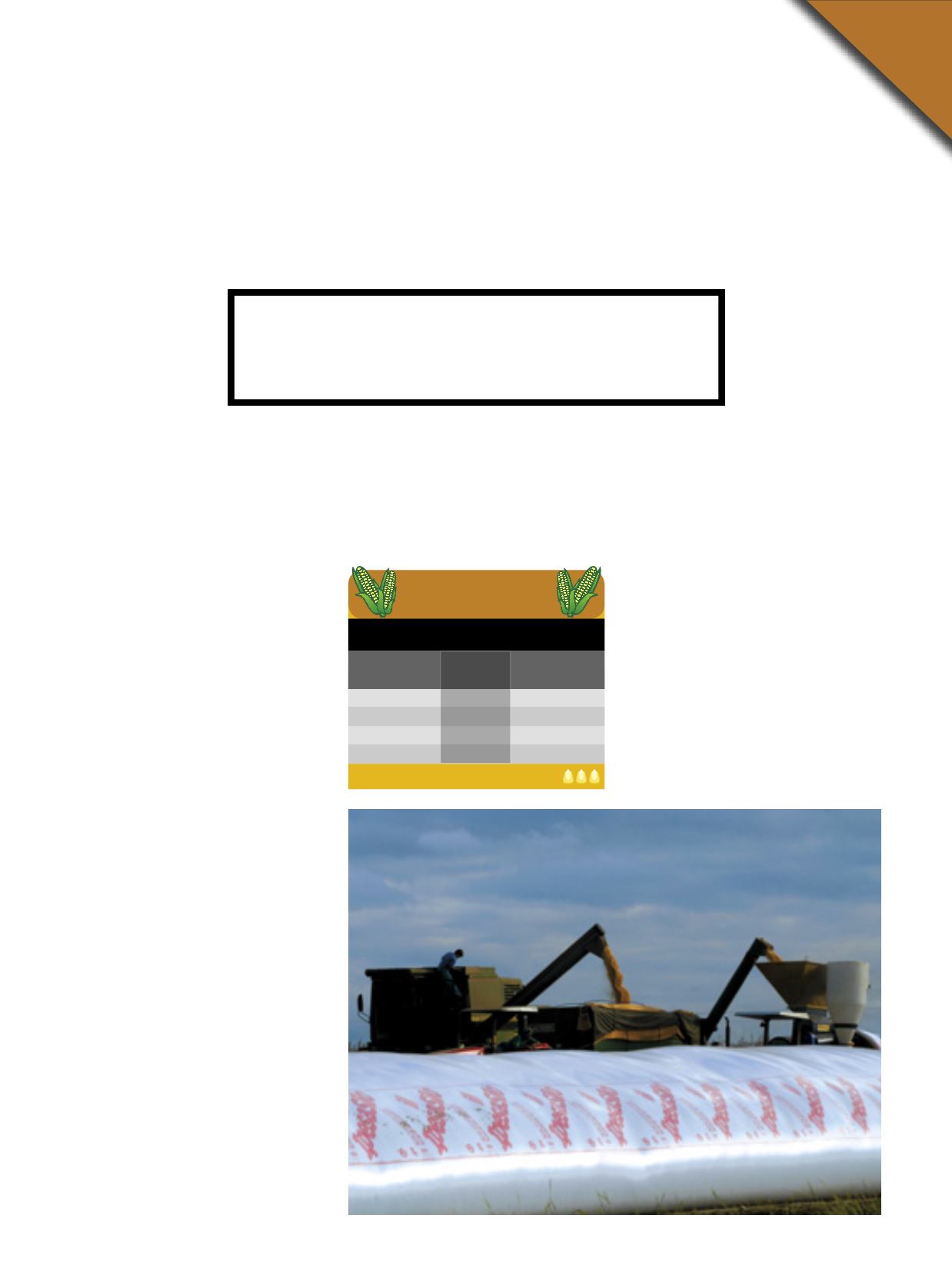

n

Inor Ag. Assmann

no mapa

on the map

O Brasil no ranking mundial do

milho – Ciclo 2016/17

* Considerando União Europeia (UE28).

Fonte:

USDA, junho de 2017.

Atividade Posição Volume

(milhões de t)

Produção

3º

97,0

Consumo*

4º

60,5

Exportações

2º

34,0

Estoque

3º

9,8