tons. “The currency depreciation between

2014 and 2015 transformed Brazilian corn

into a cheap and competitive commodi-

ty abroad, but kept prices profitable in the

national currency”, he explains. The failure

of the winter crop in 2016 caused offer to

shrink and strengthened domestic prices.

Throughout 2016 and early 2017 the

value of the Brazilian currency increased

and this affected the competitive edge. Cli-

ents began to seek other suppliers over

the six final months in 2016, and Brazil

shipped little corn abroad. This scenario

held true until June 2017, when low do-

mestic prices lent support to the resump-

tion of sales abroad. However, with the

projection of a huge summer crop and in-

ternational buyers reluctant to acquire

corn, prices started to decline.

The high prices in 2016 encouraged

the farmers to devote bigger areas to the

second crop, resulting into a record crop.

“The bigger harvested volume immedi-

ately caused the reference values to fall,

keeping pace with the shrinking demand

from abroad and from shrinking demand

at home, further affecting the prices un-

til the second half of 2017”, says Miranda.

It is a situation that, in view of the dimen-

sion of offer and stocks, along with the in-

ternational scenario, should last through-

out 2018.

n

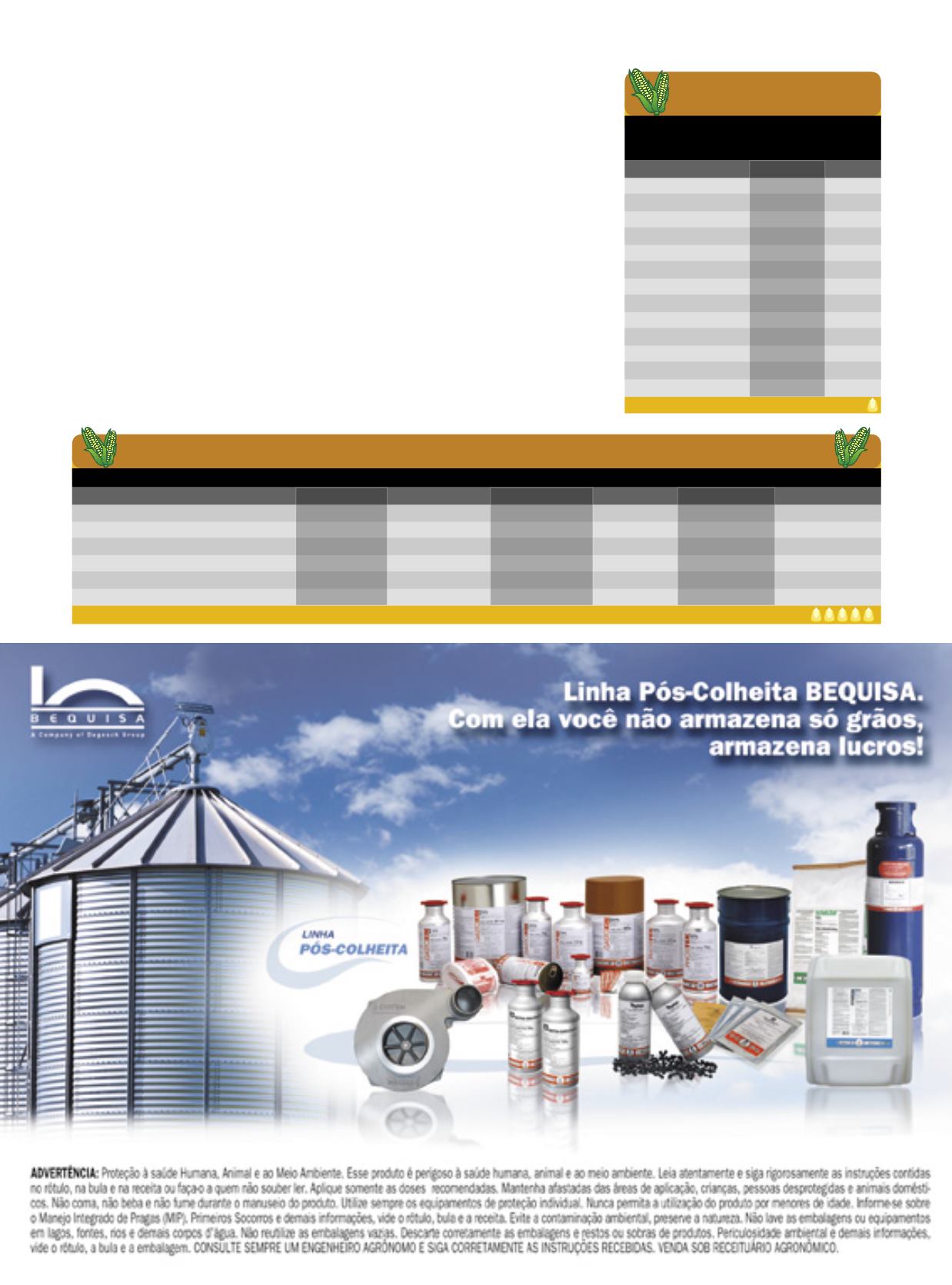

CURVASACENTUADAS

steep bends

Evolução dos preços médios do

milho no Brasil - Indicador Esalq/

BM&FBovespa - (60 kg – à vista)

Fonte:Cepea/Esalq/USP.

|

*Em12de julhode2017.

Data

R$

US$

07/2015

25,99

8,07

12/2015

35,33

9,13

03/2016

47,79

12,94

05/2016

51,48

14,55

07/2016

44,42

13,56

12/2016

38,29

11,43

01/2017

35,92

11,25

02/2017

36,21

11,67

03/2017

33,77

10,80

04/2017

28,32

9,02

05/2017

27,76

8,66

06/2017

26,75

8,12

07/2017*

27,05

8,44

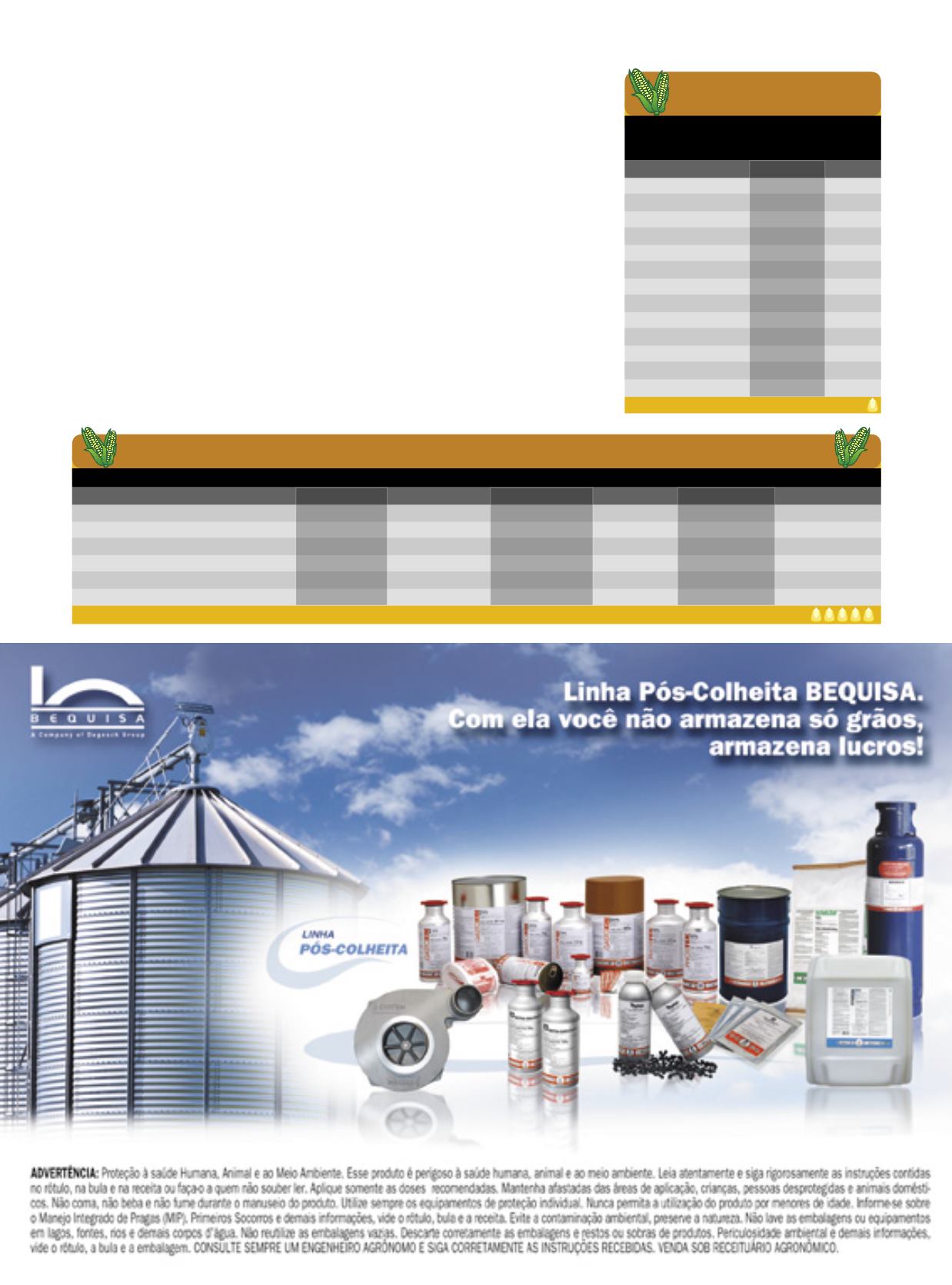

Na ponta do lápis

on the tip of the pencil

Balanço brasileiro de oferta e demanda de milho

Fonte:

Conab, julho de 2017.

Safra

Estoque inicial

Produção Importação Suprimento Consumo Exportação Estoque final

2011/12

4.459,6

72.979,5

774,0

78.213,1

51.903,0

22.313,7

3.996,4

2012/13

3.996,4

81.505,7

911,4

86.413,5

53.287,9

26.174,1

6.951,5

2013/14

6.951,5

80.051,7

790,7

87.793,9

54.541,6

20.924,8

12.327,5

2014/15

12.327,5

84.672,4

316,1

97.316,0

56.742,4

30.172,3

10.401,3

2015/16

10.401,3

66.530,6

3.338,1

80.270,0

53.387,8

18.883,2

7.999,0

2016/17

7.999,0

96.026,2

500,0

104.525,2

56.100,0

28.000,0

20.425,2