T

he checks and balances in the

pork year tilted toward a posi-

tive balance in late 2017 and the

expectations for 2018 remained

favorable. Although affected

by the persistent effects from the econom-

ic crisis and a small reduction in the volume

shipped abroad, a minor increase was reg-

istered in production and consumption, as

well as in the revenue fromexports and from

domestic sales. For the new year, the projec-

tions suggested growth in several indicators,

based on the 2 to 3 percent bigger supply of

pig meat in the country that ranks as fourth

biggestglobalproducerandexporterofpork.

To this end, the Brazilian Association of Pig

Breeders (ABCS), in turn, ascertained that do-

mestic prices continued stable, while over

the year, in 10 months, they show some in-

creasefrom2016.Asforproductioncosts,the

price of a sack of corn, the main component

in livestock feed, dropped considerably over

the period, “creating a rather interesting con-

textforthepigfarmersandleadingtoarecov-

eryofpartofthelossesaccumulatedoverthe

past year”. With regard to shipments abroad,

with a small drop in volume, chief executive

officer Nilo de Sá observed that “the result is

still much higher than the historical average

of the Country” and that “the performance

was again relevant to guarantee pork prices

in thedomestic scenario”.

The volume of 700 thousand tons export-

ed in 2017, according to the forecast, “was a

victory for the sector”, says Francisco Turra,

presidentattheABPA.Herecalledthatthere-

sultsoftheyearsurpassedtheinitialexpecta-

tions, stemming from the impacts generated

by the equivocal decisions by the so-called

Operation Weak Flesh. He mentioned in-

creasesintheRussianmarket(themainone),

andinthemarketsinArgentinaandUruguay,

l

DOMESTIC MARKETING

Francisco Turra, from ABPA, with regard to 2017, he praised that

“theBraziliandomesticmarket conqueredbackpart of the consump-

tion levels lost over the two past years, due to the economic down-

turn”. He also expressed his understanding that “the consolidation of

the economy resumption should keep demand on the rise, despite a

possibly troubled political scenario”. Likewise, Nilo de Sá, fromABCS,

expressedwith regard to thismarket, “which consumes from80 to 85

percent of the national production, perspectives for a recovery of the

economy, although the high unemployment rate affects income and

consumption”. And even “in light of a certain degree of uncertainty

generated by the presidential elections in 2018”, he said that “there

is a positive perspective for the economy in the coming years, which

is supposed to contribute in a very positivemanner towards domestic

demand for pork and towards farmgate prices”.

Positive

balance

Amid the talks on the pros and cons of the activity

during 2017, final resultswere considered

favorable for pork, while expectations are renewed

withrespectiveincreasesof8%,32%e9%up

to themonthof November and, in themean-

time, the high Chinese stocks were responsi-

ble for a 50 percent drop in the purchases of

the Asian giant, third biggest market for Bra-

zil, coming after Russia and Hong Kong, and

biggest global importer.

The official of the animal protein entity

recalled that the relative exchange rate sta-

bility over long periods in 2017 favored ex-

ports, while the balanced costs ensured a

better international competitive capacity to

the sector. From January to November, the

exported volume dropped 5.6 percent (to

643.5 thousand tons) and revenue soared

nearly10percent, toUS$1.5billion. With re-

gard to 2018, he believed in good perspec-

tives, with chances for 4 to 5 percent high-

er shipments abroad, achieving levels very

close to the record volumes of 732 thou-

sand tons shipped abroad in 2016. Within

this context, he hoped for Russia to resume

its import volumes, as the embargo against

Brazilian pork was finally solved, besides

the influence coming from theWorld Cup in

that Country, not tomention the positive ef-

fects coming from new markets like South

Korea, Peru and South Africa.

balançodosuínobrasileiro•

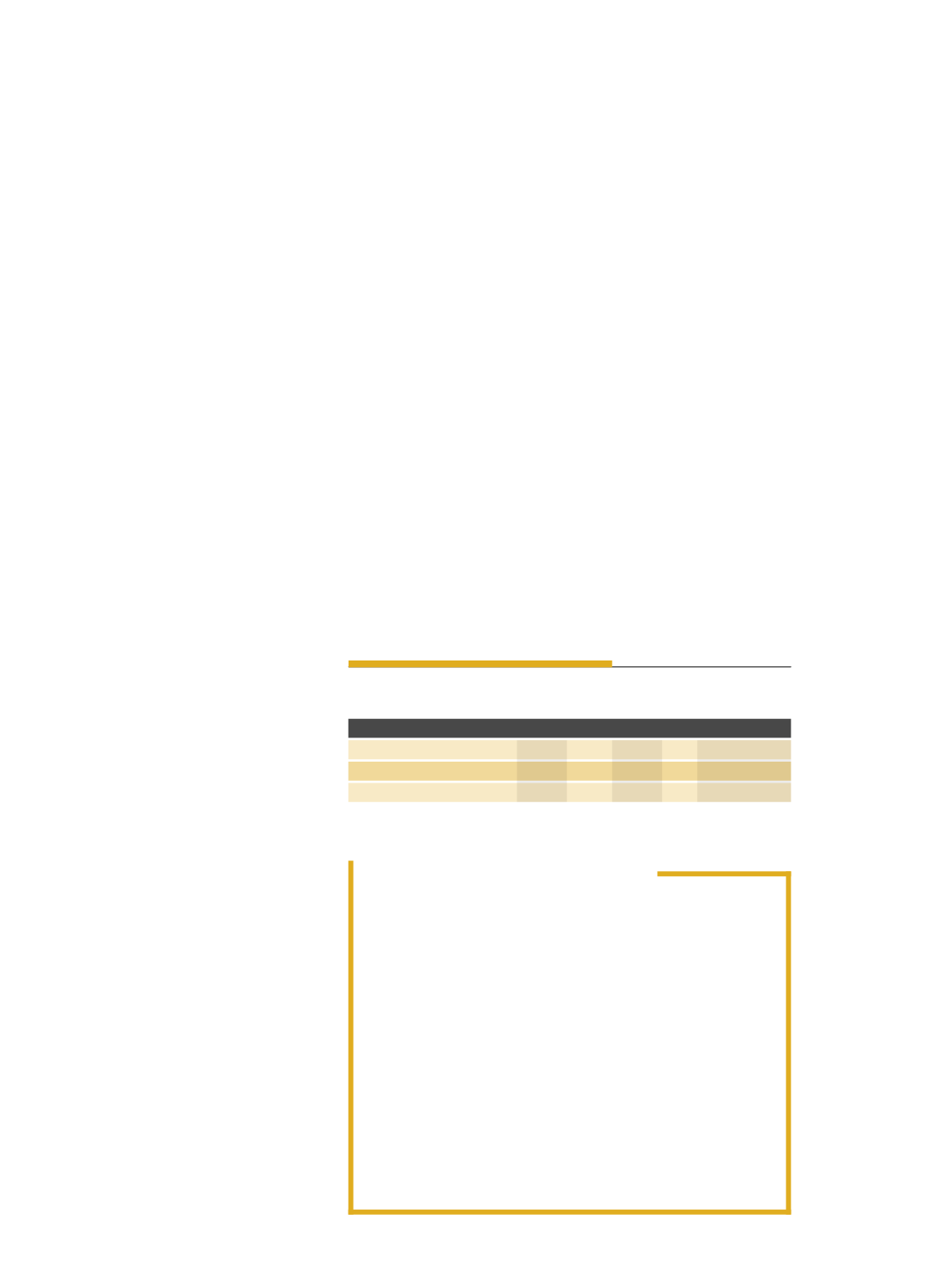

SCENARIOOFBRAZILIANPIGS

Números e projeções para a carne suínanofinal de 2017

Anos

2016

2017

Variação (%)

Produção (mil t)

3.731

3.759

+ 0,7

Exportação (mil t)

732

693

- 5,4

Consumo (un./hab)

14,4

14,7

+ 1,7

Fonte:ABPA,dezembrode2017.

83