l

READY TOMEET DEMAND

Productivity of the new Brazilian crop was initially estimated to be

down6.2percent fromthe recordof theprevious year, 3,364 kilograms

per hectare, although, in general, climate conditions were favorable,

inducingthepublicorgantoraiseitsprojectionfromDecember2017to

January 2018. Therefore, production could again surpass the consid-

erable amount of 110 million tons, in line with the prognoses of some

consultancies and perspectives previously expressed by the Brazilian

Confederationof Agriculture and Livestock (CNA). “The volume should

be similar to last year,with thenewareas in theMatopiba region (Mara-

nhão, Tocantins, Piauí andBahia), cultivationof soyonpasturelands in

the Center-West and corn in the South, with the farmers holding on to

their investments”, Conab officials say.

For the future, theexpectation is for soy consumption tocontinueon

a rising trend in theworld, withBrazil in thepositionas big supplier. Chi-

na, which in 2017 purchased 53.8 million tons of soy from Brazil (79%

of the total soy exports by the Country), should have an additional de-

mand of about 35million tons of soybean within the next 10 years, and

theBrazilian farmers couldsupplyabout 80percent of this volume, from

anevaluationconductedby Lief ChiangandVictor Ikeda, for Rabobank.

According to the study, demandby Chinawill growas a result of ur-

banizationmoves and the consolidationof livestock farming, especial-

ly pigs. In a comparison with the United States and Argentina, Brazil is

in better conditions to meet this demand. To this end, and for the do-

mestic needs, like bigger absorption by biodiesel, the study maintains

that theCountry shouldexpand itsplantedareaand thiswill specifical-

ly by grown the cereal on former pasturelands.

sive shocks, they did not expect relevant

changes in prices in the short and medi-

um run. They observed that the interest

in the kernel, just like the interest in meal

and oil, continues steady. In themeantime,

the preference of the farmers for soy, to the

detriment of other cereal crops, keeps the

supply of the oilseed stable.

Overtheyears,nevertheless,theymain-

tain that the profitability of the farmers is

on the decline and themargin of the crush-

ers does not improve. Anyway, as Conabof-

ficials reiterate, in a survey on the 2017/18

Brazilian crop, stimuli coming from the

agility, stability and liquidity in soybean

sales induce the farmers to expand their

planted areas, year after year. In early 2018,

it was estimated that the planted area

would go up 3.2 percent, with expansions

taking place in all Brazilian regions and in

almost all the 18 states where the cereal is

grown, more in theNorth/Northeast (4.2%)

and in states like Maranhão, in the North-

east (12%); Pará, in theNorth, and SãoPau-

lo, in the Southeast, with 7%; Santa Catari-

na, in the South, andMatoGrossodoSul, in

the Center-West, nearly 5 percent.

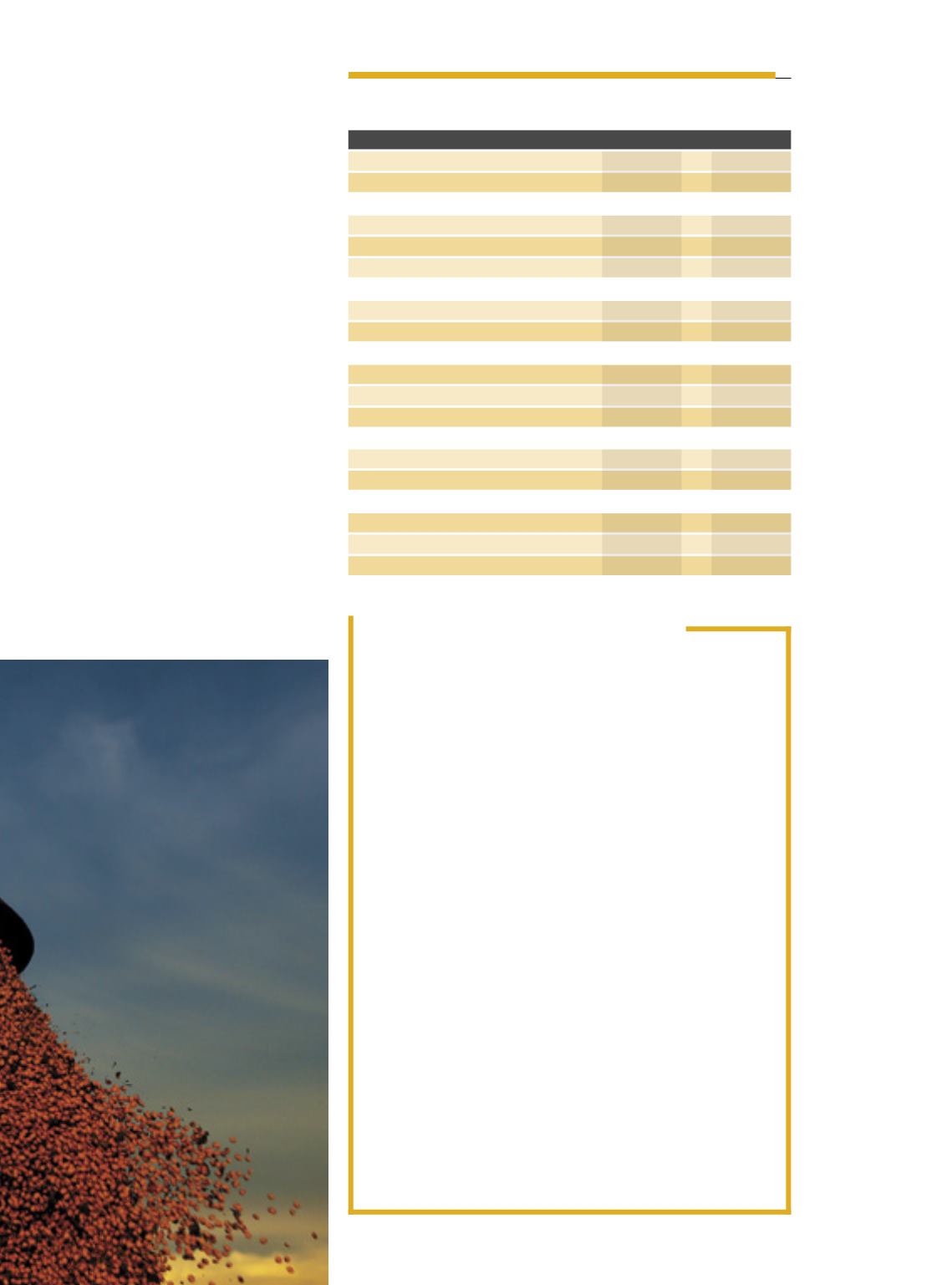

EXPORTAÇÃOBRASILEIRADOCOMPLEXOSOJAEMGRÃO

•

BRAZILIANSOYBEANEXPORTCOMPLEX

Ano

2016

2017

Valor (US$mil)

19.331.325

25.718.422

Peso (T)

51.581.875

68.154.809

Principais importadores (Emt)

China

38.563.909

53.796.980

Ásia (excetoChina)

4.336.048

5.275.129

União Europeia

5.279.870

5.191.076

FARELO

Valor (US$mil)

5.192.781

4.973.331

Peso (T)

14.443.792

14.177.057

Principais importadores (Emt)

União Europeia

7.975.607

7.501.666

Ásia (excetoChina)

5.262.967

5.748.957

OrienteMédio

1.011.724

576.617

ÓLEO

Valor (US$mil)

898.271

1.031.162

Peso (T)

1.254.928

1.342.519

Principais importadores (Emt)

Ásia (excetoChina)

643.604

674.898

China

249.569

335.240

África

190.093

152.704

Fonte:Abiove.

79