D

espite the shortfall of almost 1.5

million tons in the 2015/16 crop

year, prices fetched by a 50-kilo-

gram rice sack show quite a dif-

ferent behavior in the quarters

of the commercial year that started in March

2016 and finished in February 2017. At the

peakofharvest,pricesdroppedfromR$47to

R$ 39, on average, in almost all regions inRio

Grande do Sul. In Santa Catarina, they fell to

R$ 37 per sack and, in Mato Grosso, 60-kilo-

gramsacks fetched less thanR$42.

The pressure of offer in the first four

months of the semester, brought about by

cash-strappedricefarmers,andafloodofim-

ports fromMercosurwere responsible for the

fall. Brazil began to export more, taking ad-

vantage of the momentary competitiveness

of the domestic prices, and the demands

from South and Central America, Caribbean

and Africa were a good help. Under such cir-

cumstances (and the accumulation of good

stocks by the industry), supply remained on

a par with domestic demand. Domestic pric-

es gradually rose, and ended up reaching R$

50.50 at the beginning of the second half of

the year (August and September) in the Rio

Grande do Sul production hubs. In Santa

Catarina prices peaked at R$ 49 and in Mato

Grosso, at R$65.

For a production cost ranging from

R$ 45 to R$ 46 a sack, on average, in Rio

Grande do Sul, the price was remunerat-

ing. The fact is, most farmers sold their rice

right after harvest, and many of them sold

it belowproduction costs. The situationag-

gravated the credit crisis, which had been

badly affected by the losses caused by the

El Niño phenomenon.

“Rice farming in South Brazil is going

throughdistinctrealities.In2016,manyfarm-

ershadnocashflowproblems,especiallythe

ones that use high technology, usually land

owners who have adhered to crop rotation

practices, soybean in association with live-

stock operations, and their profits, in some

cases, amounted to R$ 3 thousand per hect-

are”, says Henrique Dornelles, president of

the Federation of Rice Growers Associations

in Rio Grande do Sul (Federarroz). “There

were farmers who lost their entire crop, and

hadnoinsurancecover,inconsequence,they

GREATPRICEOSCILLATIONINTHE2015/16

GROWINGSEASONISSTILLREFLECTINGONTHE

MARkETOFRICEINTHEHUSkANDADVERSELy

AFFECTSTHERICEFARMERSINSOUTHBRAZIL

hadnoaccess tocredit lines andarenowfac-

ing serious difficulties. The majority suffered

losses, either total or partial, andendedup in

the red in the2015/16growing season.”

ExTENSION

The low prices in the

Brazilian market from March to May 2016,

compared to the production costs, are still

impacting upon the rice sector. “Without

any official credit, and with losses, lots of

farmers depended on bank loans, at mar-

ket interest rates, and on suppliers and buy-

ers, under tight rules and repayment plans”,

argues consultant Carlos Cogo. “It means

that, despite some delays in the harvest of

the 2016/17 crop, stemming from occasion-

al climate-related events, again there will be

a supply concentration, coming from cash-

strapped farmers, and thosewhomadeprof-

its in 2016 should make profits again in the

2017/18 crop year”. The reflections were felt

inFebruary,withprices fallingmore than5%,

andin15daysinMarch,whentheyplummet-

edmore than 11.5%, according to the Esalq/

Senar-RSprice indicator.

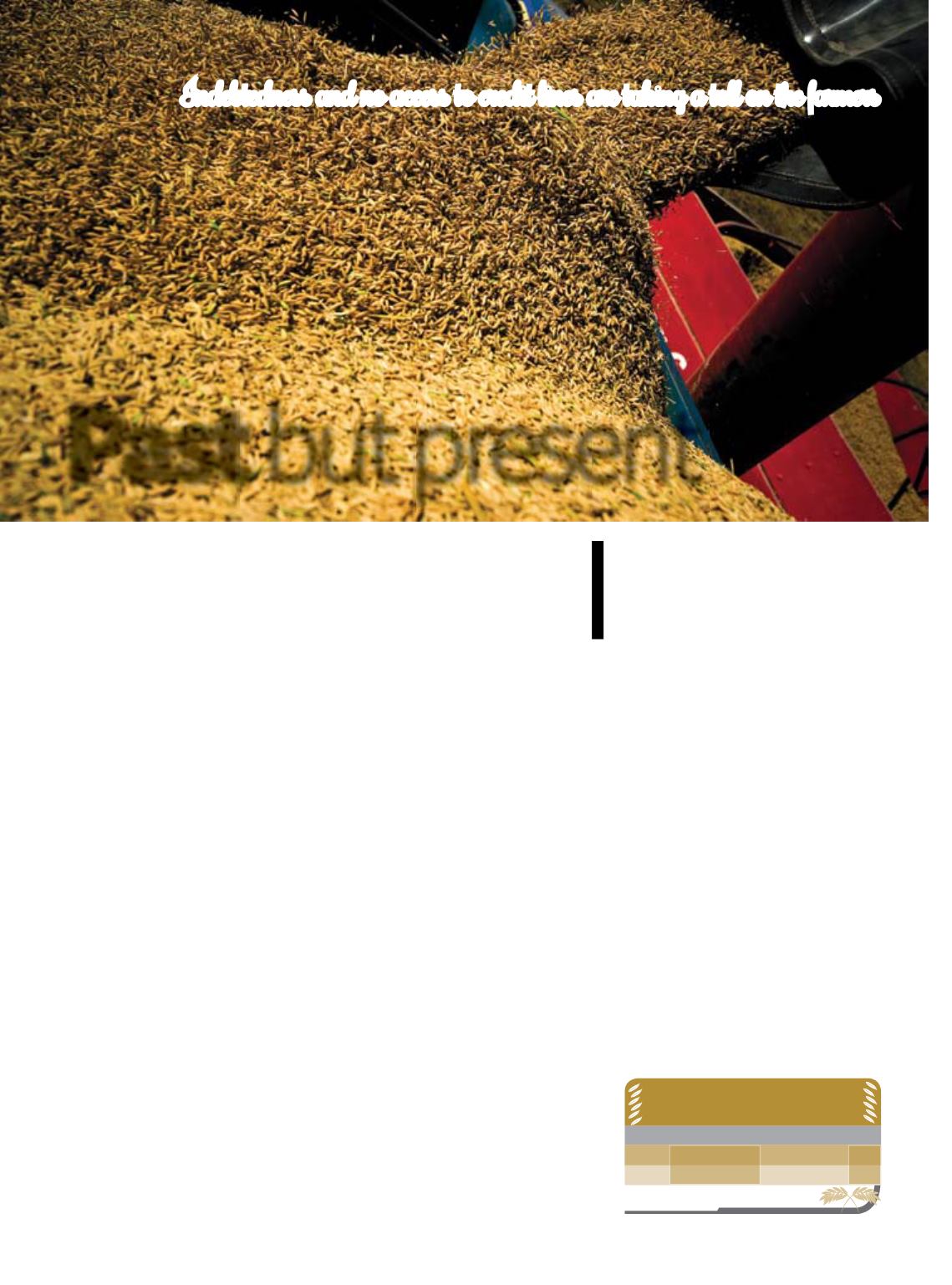

Past

butpresent

Indebtedness and no access to credit lines are taking a toll on the farmers

42

Fonte:

Mapa

Valor Bruto de Produção (Arroz)

NO BRUTO

GROSS VALUE

Ano

2016

2017

%

VBP

10.197.687.882 11.998.047.900 17,7