55

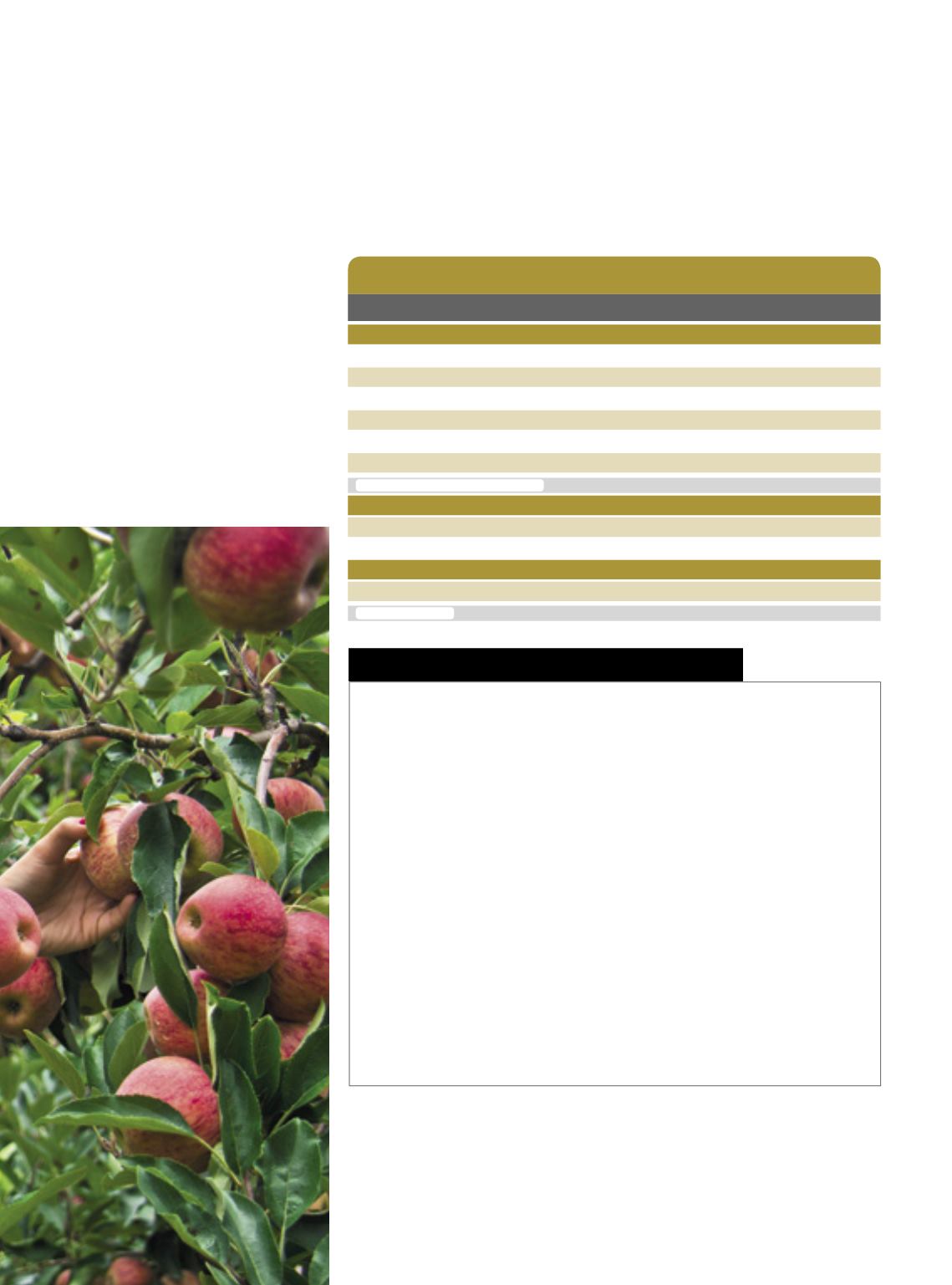

Quadros das últimas colheitas damaçã brasileira

OCORTEDA FRUTA

Fruit slices

Safras

2015

2016

Produção (t)

1.264.651

1.064.708

Área colhida (t)

35.842

34.399

Participação Região Sul (%)

98,8

98,8

Santa Catarina (%)

48,5

49,4

RioGrande do Sul (%)

47,3

45,6

Paraná (%)

3,2

4,2

Fonte:IBGE/LSPA–Dezembrode2016

Exportação

2015

2016

Maçã (t)

60.113

30.657

Suco demaçã (t)

23.544

11.496

Importação

Maçã (t)

77.413

155.523

Fonte:Secex/MDIC.

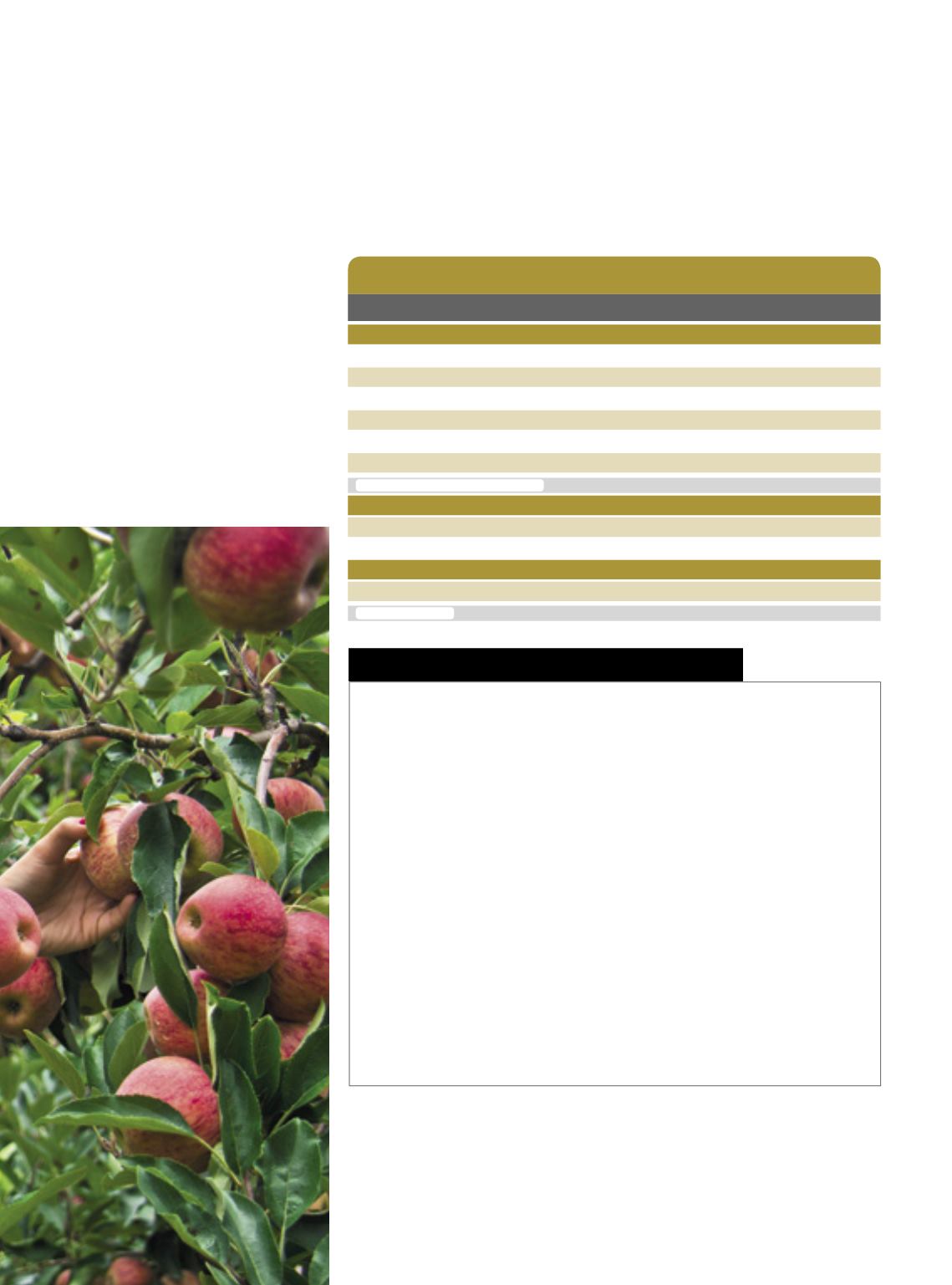

The excitement about the new crop

became clear at the official inaugura-

tion of the apple harvest ceremony held

in Santa Catarina, leading apple pro-

ducing State. On that occasion, in the

town of Fraiburgo, viewed as the cradle

of modern apple farming in the Coun-

try and second biggest producer in the

State, the speakers dwelled on the “ex-

ceptional quality” of the fruits and the

higher production volume, up about

20% in Brazil and in the State. State

governor Raimundo Colombo attend-

ed the event, promised to lend support

to the sector and emphasized that the

good result of the apple sector is an ex-

tra force behind the efforts of the Coun-

try to surmount the economic crisis.

The other relevant producer, Rio

Grande do Sul, in late 2016 was cel-

ebrating a crop of “excellent quality

and big enough to supply the market”,

whilst the farmers in South Paraná,

with a smaller crop but on a rising

trend, were commemorating the prof-

its brought by the fruit. The apple is one

of themost consumed fruit in the Coun-

try (at the São Paulowholesale produce

market, it ranked as second most trad-

ed fruit in 2016). The bigger crop in 2017

should lead to a resumption of exports

to Europe, Asia and Middle-East. The

supply chain, according to the 2016

Brazilian Apple Yearbook, is responsi-

ble for R$ 6 billion in sales and gener-

ates 195 thousand jobs.

n

n

n

Enthusiasm

Climate adversely affected the

amount of apples produced in

the previous season

cellent physical and sanitary quality, with

a crisp bite, succulent, aromatic and deli-

cious, as a result of the balance between

sweetness and acidity.

On the other hand, the representative

of the sector was expecting a crop size

similar to two years ago, making it possi-

ble to fully meet Brazilian demand in all

market niches related to size and qual-

ity, with surpluses to be exported”. The

2015/16 season was smaller than the pre-

vious one, with losses caused by an un-

timely freeze, particularly in the regions

of Fraiburgo (SC) and Vacaria (RS), ob-

served the Center for Applied Studies on

Advanced Economics (Cepea) of the of the

University of São Paulo (USP), and con-

firmed by the Brazilian Institute of Geog-

raphy and Statistics (IBGE).

With tighter supply, analyzes Isabe-

la Costa, from Cepea, prices soared, “but

volume limitations and production costs

hindered the rate of profit from rising”.

She has it that “the economic and politi-

cal crisis also impacted upon the market,

besides driving up imports”. Shipments

abroad dropped considerably, according

to her, and the blame goes to the smaller

crop, foreign competitiveness and the at-

traction exerted by the domestic market,

with higher prices”. For the 2016/17 grow-

ing season, she anticipated a production

and field investment recovery, though, in

general, the planted area would suffer no

changes, except for a slight reduction. In

the meantime, the region of São Joaquim

(SC) is expected to rise, she said.