59

Sílvio Ávila

Likewise, the perspectives expressed by Brapex president

Rodrigo Martins for the national market in 2017 refer to low

prices due to abundant supply, within the theory of the crop

cycles. “Several producers got excited by the high prices in ear-

ly 2016, increased their planted areas and are now facing the

reality of having to sell their fruit below production costs”, he

ascertained in early January 2017. As for exports, still repre-

senting 2%of the entire production volume, he anticipates the

trend for bigger shipments abroad, involving more fruit and

better quality, besides the still favorable exchange rate.

Europe is the biggest destination for Brazilian papayas,

where the leading buyers in 2016 were the Netherlands, Por-

tugal, Spain, the United Kingdom and Germany, followed by

the United States. With the latter country, Brazil has recent-

ly signed an agreement that should make exports less com-

plicated. Changes in the working plan anticipate speedier

harvesting processes, fruit treatment and packaging, includ-

ing more flexible time periods for handling the fruit, which,

according to Martins, could gradually increase sales to the

American market.

n

n

n

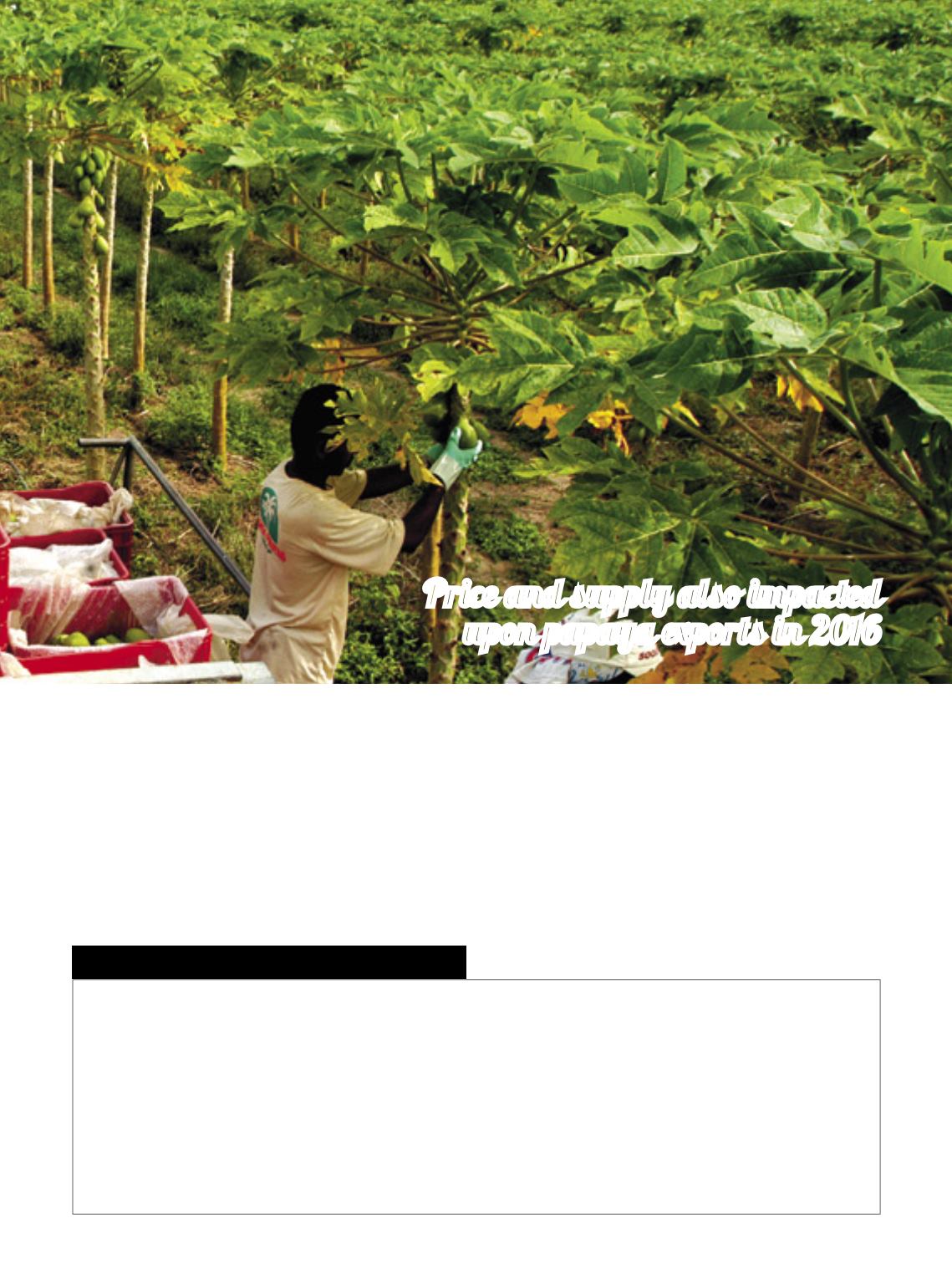

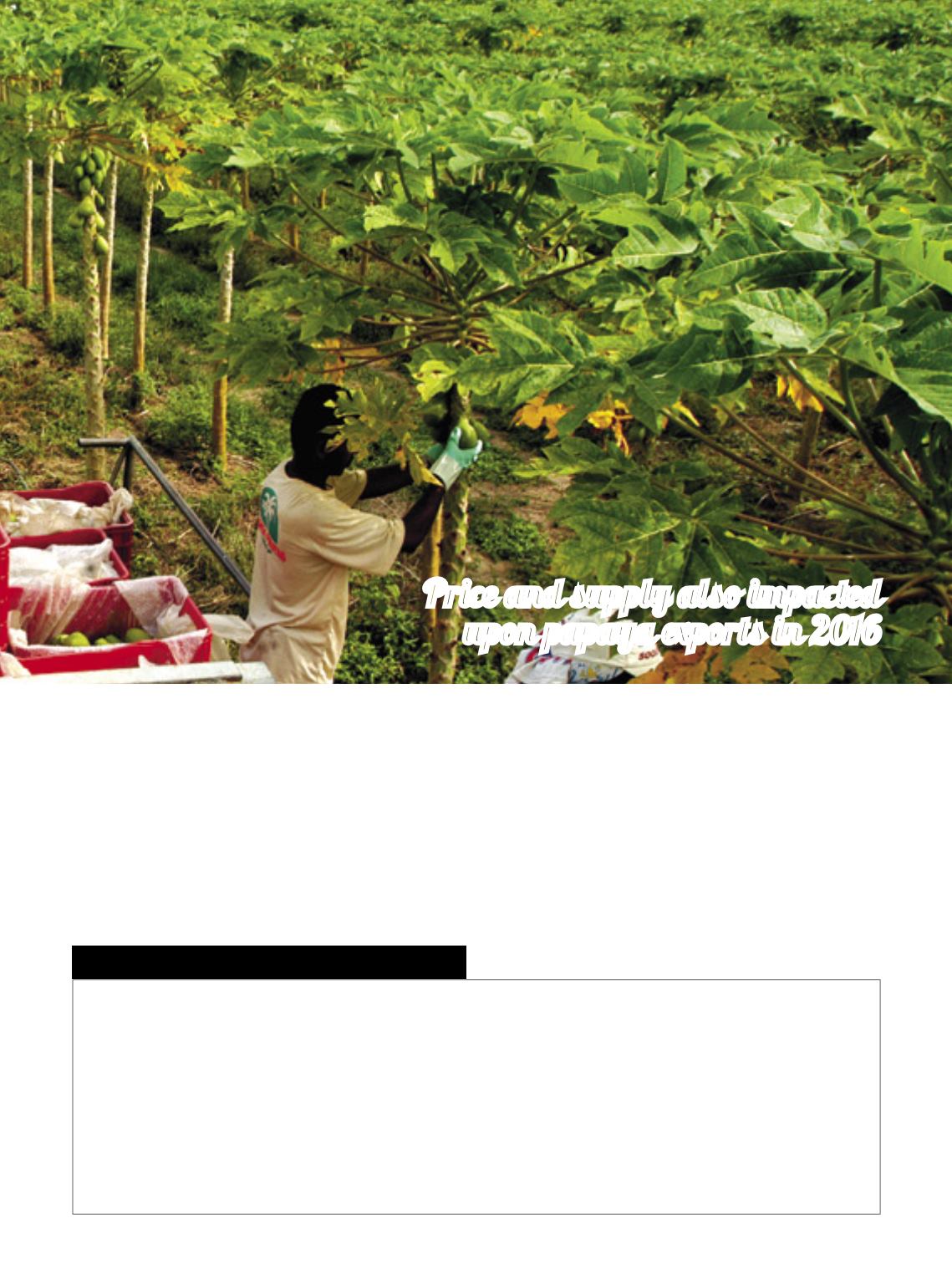

Dream and reality

Price and supply also impacted

upon papaya exports in 2016

surveys of themain producing regions, with

reflections upon production, prices and ex-

ports. Domestic prices soared to the point

that they reached the highest values in the

series available to the organ since 2001 rela-

tive to Espírito Santo, thus ensuring positive

results to the producers, as ascertained, in

spite of soaring production costs.

In the first half of 2016, says Rodri-

go Martins, from Brapex, papaya prices

reached all-time records. According to his

information, the Papaya in Espírito Santo

and South Bahia went so far as to fetch a

farmgate price of R$ 6 per kilogram, whilst

the Formosa fetched R$ 4 per kilogram in

the field. These high prices jeopardized

exports and were a factor in the small-

er volumes shipped abroad over the year

(down 4.67%), and, of course, they are

also responsible for the smaller produc-

tion volumes in the orchards.

As of the second half of 2016, according

to the same source, prices began to drop:

the price of the Formosa papaya began to

recede and stabilized at an average of R$

1 per kilogram, until late November, when

it plummeted to R$ 0.30 to R$ 0.40 per ki-

logram, remaining as such until late Janu-

ary 2017. According to him, the same thing

occurred with the Papaya, which registered

very high production volumes as of Sep-

tember, leading to “absurdly low prices” to

an average of R$ 0.30/kg/farmgat