63

In December 2016, the Ministry of

Agriculture, Livestock and Food Supply

(Mapa) announced a new market for

our mangoes. South Korea, one of the

most discerning countries as far as food

sanity and quality go, is themost recent

destination for the national fruit. The

commercial partnershipwith South Ko-

rea will promote exports and, in partic-

ular, benefit the Vale do São Francisco

region, which is the biggest irrigated

fruit producing hub in the Country –

about 85% of the mangoes exported by

Brazil are from this region, which com-

prises Minas Gerais, Bahia, Pernambu-

co, Sergipe and Alagoas.

n

n

n

Expanded frontier

Country ranks as sixth

biggest exporter of mangoes

producers were Bahia, with 279,680 tons:

Pernambuco, with 239,423 tons; and São

Paulo, with 184,042 tons. The Northeast

of Brazil is one of the most traditional

producers of the fruit, with 45,142 hect-

ares harvested on that year, just like the

Southeast, where 17,896 hectares were

harvested. The South contributed with

626 hectares, the Center-West, with 325;

and the North, with 316 hectares.

Lima emphasizes that the projections

for 2017 do not point to any resumption

of growth. “The expectation is for pro-

duction stagnation, or even for a small-

er crop, due to weather conditions. The

main producing areas in Pernambuco

and Bahia could suffer from water short-

ages in their irrigation systems until de

end of the year, which would directly af-

fect productivity”, he explains. Should

the crop in the Northeast drop, the spe-

cialist believes that the domestic market

will be supplied with poor quality man-

goes, and more expensive, once the best

fruits would be destined for exportation.

“The moment requires caution. Only

at mid-year we will know what may oc-

cur in the second half of the year, when

the bulk of the northeastern mango

crop reaches the market”, he says. An-

other apprehension of the farmers, ac-

cording to Lima, are the difficulties in

trading the fruit, whose prices normal-

ly fluctuate a lot in the market. In one

week, farmers could make hefty prof-

its with their production, but a few days

later they have to endure losses stem-

ming from unexpected sales stagnation.

On the other hand, the uninterrupted

orders, even from importing countries,

are commemorated by the sector.

Even though the crop receded a little

over the past two years, Brazil is the sixth

biggest global exporter ofmangoes. Ship-

ments amounted to 156,337 tons in 2015,

representing revenue of US$ 184,342,375

million. In 2016, exports reached 154,211

tons (-1.36%), with businesses reaching

about US$ 179,932,100 million (-2.39%).

“The quality of the Brazilian mangoes,

shipped abroad, is considered very high

in the international marketplace”, Lima

ponders. Now, the leading buyers of the

fruit are the European Union countries

and the United States.

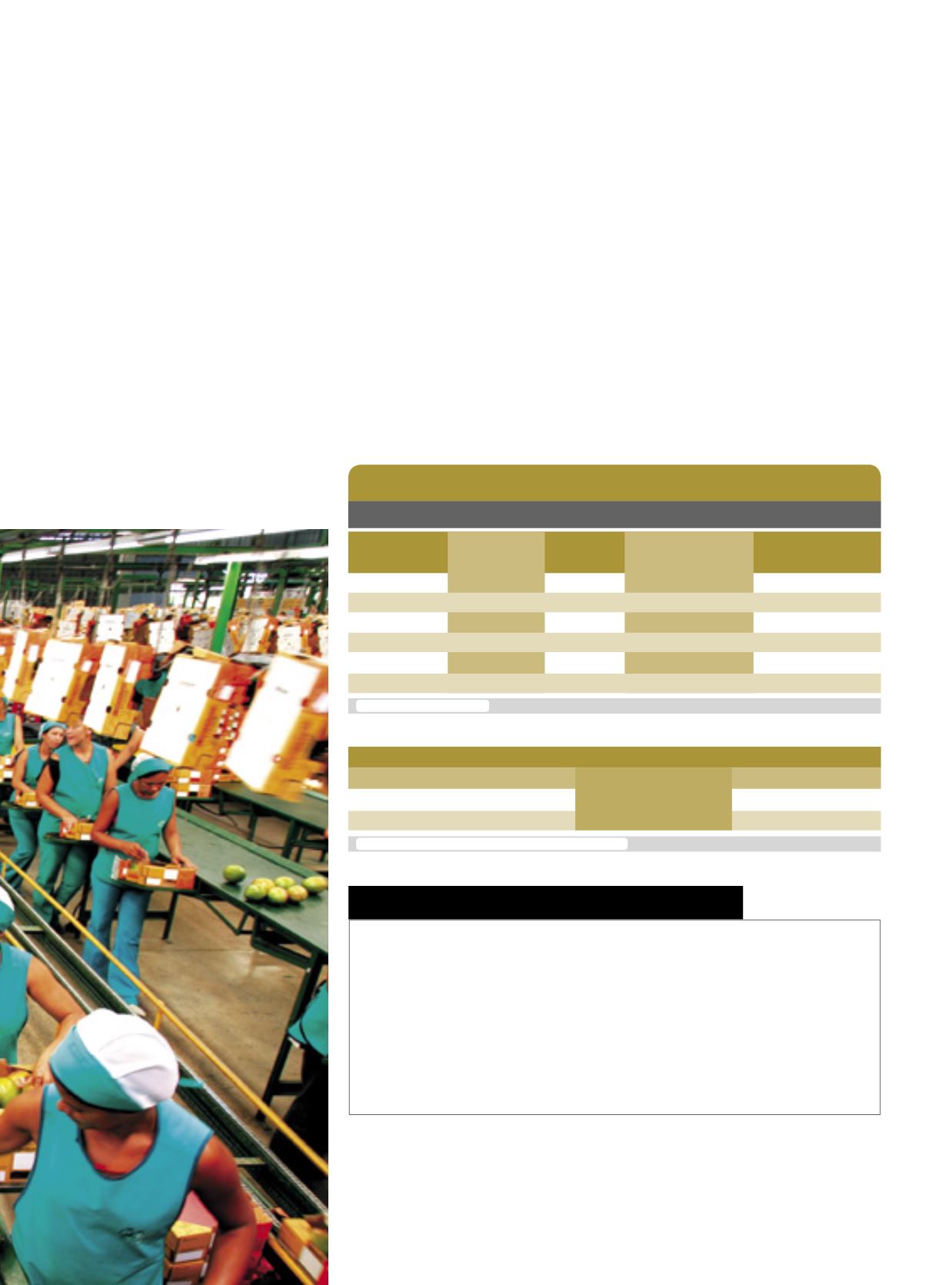

Produção brasileira demangas (2015)

FARTURA

Abundance

Unidade

Áreacolhida Produção Rendimentomédio Valordaprodução

(hectares)

(toneladas) (quilos por hectare)

(mil reais)

Brasil

64.305

976.815

15.190

841.125

Norte

316

2.293

7.256

1.157

Nordeste

45.142

654.493

14.499

529.608

Sudeste

17.896

307.455

17.180

294.012

Sul

626

8.009

12.794

11.063

Centro-Oeste

325

4.565

14.046

5.288

Fonte:SIDRA/IBGE

TIPOEXPORTAÇÃO

Ano

2016

2015

variação

Valor(US$) Peso(Kg) Valor(US$) Peso(Kg) Valor(US$) Peso(Kg)

Mangas 179.932.100 154.211.079 184.342.375 156.337.273

-2,39% -1,36%

Fonte:Agrostat/MapaElaboração:SRI/CNAeAbrafrutas