ProfitabilityoftheBrazilian2016/17

soybeancropdropped,withsmaller

pricesfetchedbythekernel,andthenew

seasonislikelytokeepsimilarpatterns

MOREANDLESS

Still regardingprofitabilityevaluation, analyst LeonardoAmazonas, fromtheNational

FoodSupplyAgency (Conab), commented inhispaper “Perspectives for Agriculture”,

inSeptember 2017, that “despite the slightly lower variable costsof the2017 season,

compared to2016, prices fetchedby the farmers in2017areequally slightly lower

than in2016, onaverage”, considering the influence fromexcessiveoffer. Therefore,

heascertained that “theaverageprofitabilityof thevariable cost isdown45.88%”.

However, hemaintained that soybeancontinues as the cropwith thehighest returnand

liquidity,which is enough reason for the farmers toexpand their plantedareas again.

“

Unfortunately, in the 2016/17

growing season there was a drop

in profitability. Despite the bigger

total volume, with the Country hit-

ting a record high, the final average

result derived by the farmers was smaller,

because, while production costs rose from

5% to 15%, depending on the region, pric-

es fetched by soybean decreased consid-

erably”. This is the evaluation by professor

Argemiro Luís Brum, of the Northwest Re-

gional University of the State of Rio Grande

do Sul (Unijuí) and chief analyst at the In-

ternational Center for Economic Analysis

and Agronomic Market Studies (Ceema),

linked to the institution.

The researcher and market analyst re-

fers to examples in Rio Grande do Sul,

Paraná and Mato Grosso with reduction of

26.46% and 32.47% on average prices from

the crop in question and the previous one,

taking as reference themonthof June every

year. He comments that, “the soaring aver-

age productivity was not enough to avoid

the strong decrease inprofitability fromone

year to the next”. In the case of Rio Grande

do Sul, he cites calculations by the Agricul-

ture Federation of the State (Farsul) that the

average profit margin in Rio Grande do Sul

(gross income minus total cost) of soybean

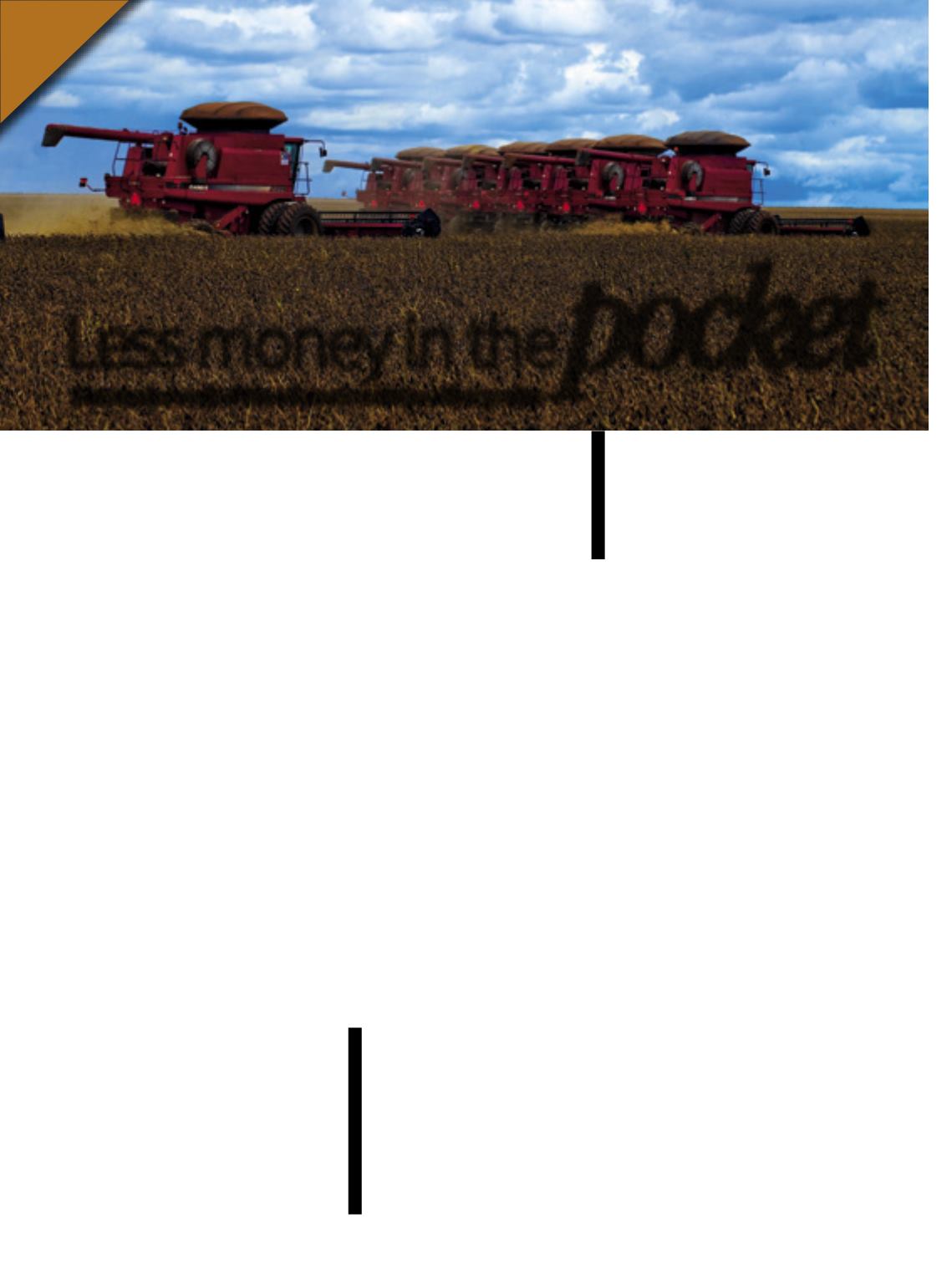

Lessmoney in the

pocket

Economic result of the oilseed outstrips other grains

ing less on inputs), a fact that could jeopar-

dize the productive potential”.

Within this context, the professor re-

calls that, “the gains derived in the 2015/16

growing season, during the 2016 trading pe-

riod, were somewhat out of tune with real-

ity, stemming from artificially raised prices.

In 2017, they came back to reasonable lev-

els, a fact that is likely to have a repeat in

2018, except if the exchange rate skyrock-

ets, something unlikely for the time being”.

He adds that, “despite soybean’s econom-

ic drawbacks, the other three major crops

(corn, rice and wheat), experienced even a

worse behavior in the 2015/16 and 2016/17

crop years, if the average is taken into ac-

count”. Nonetheless, he makes it clear that

the advice “to avoid specializing in only one

crop” still holds”, with the existence of offi-

cial credit lines, at low interest rates, com-

pared to market interest rates practiced in

Brazil. Therefore, he understands that soy-

bean continues a viable crop in rice lands

and it will not come as a surprise if the crop

increases to the detriment of the cereal in

the 2017/18 growing season.

n

dropped 23% in 2017, compared to 2016.

For the 2017/18 growing season, ac-

cording to Brum, “considering productiv-

ity rates similar to the past season, income

to be achieved should remain within this

season’s patterns. This happens because

no price changes are expected, as the ex-

change rate and the Chicago Merchandise

Exchange are signaling prices similar to the

present levels”, he evaluated in September

2017.Nonetheless,heobserved,“weshould

take into consideration the fact that there is

much soybean stored from the past season

and this should press the market down-

ward should we have another abundant

crop early next year”. As for the costs go, in

his understanding, they might drop slight-

ly, “thanks to the exchange market and,

above all, becausemany farmers will prob-

ably try to establish cheaper fields (spend-

Inor Ag. Assmann

32