The strategy of the state and federal governments attempting to reduce the con-

sumption of tobacco products on the basis of a heavy tax burden and in restrictions

on the use of these products, like imposing minimum prices and staging antismok-

ing campaigns, has proved inefficient, and causes harm to the consumers, society,

supply chain and to the public coffers. This conclusion comes froma study conduct-

ed by the Institute of Economic Development and Social Frontiers (Idesf).

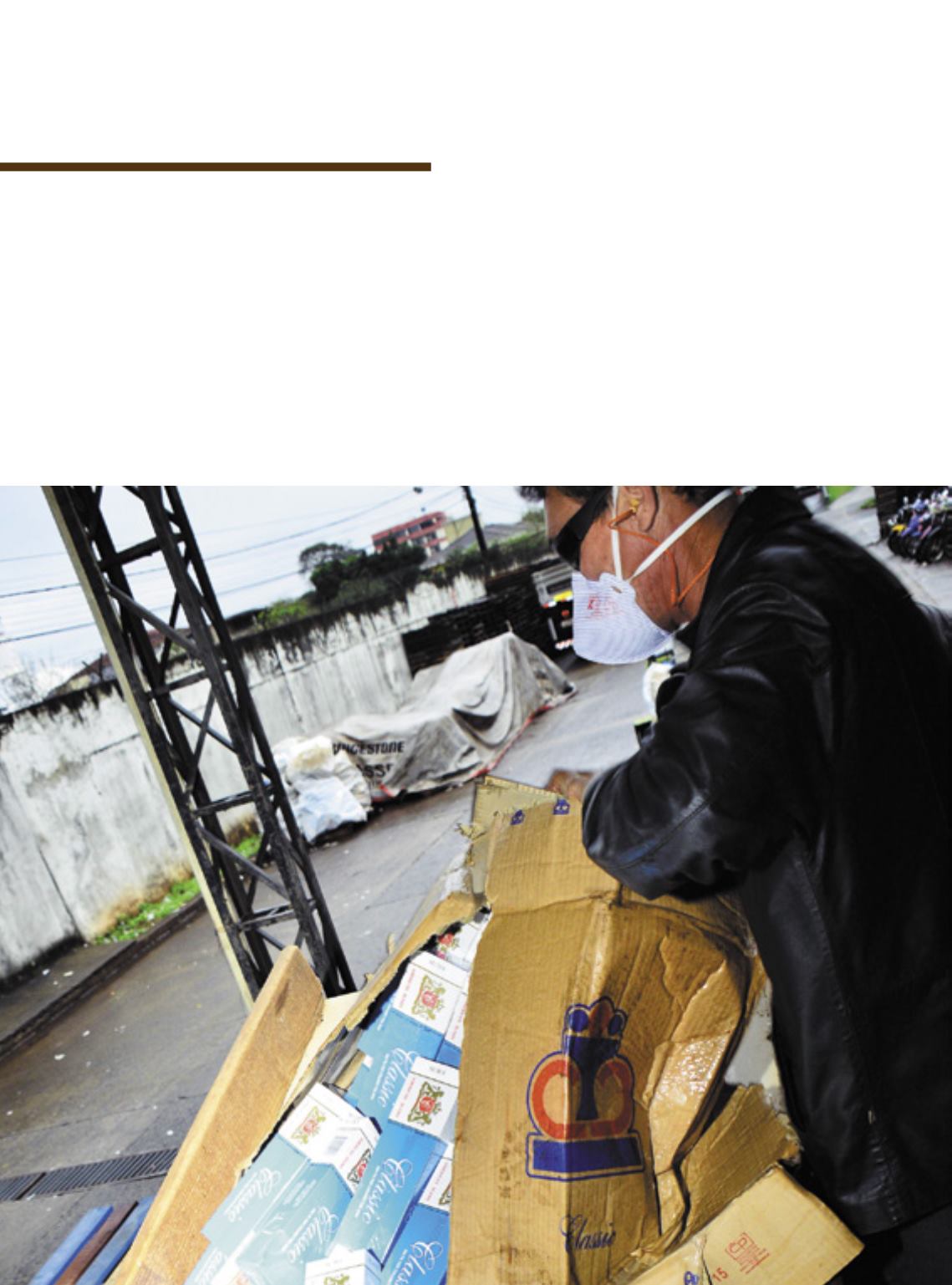

Smoke

curtain

Tax increases on cigarettes broaden the illicit

trade and cause damages to society and

to the governments themselves.

This makes it evident that the argument of

controlling tobacco through tax hikes works like a

smoke curtain for the public agents, diverting at-

tentionfromtheirgreedforcollectingtaxesandthe

negligible results of the initiative. It simply back-

fires, according to conclusions reached by sectoral

entities after ampledebateson the subject.

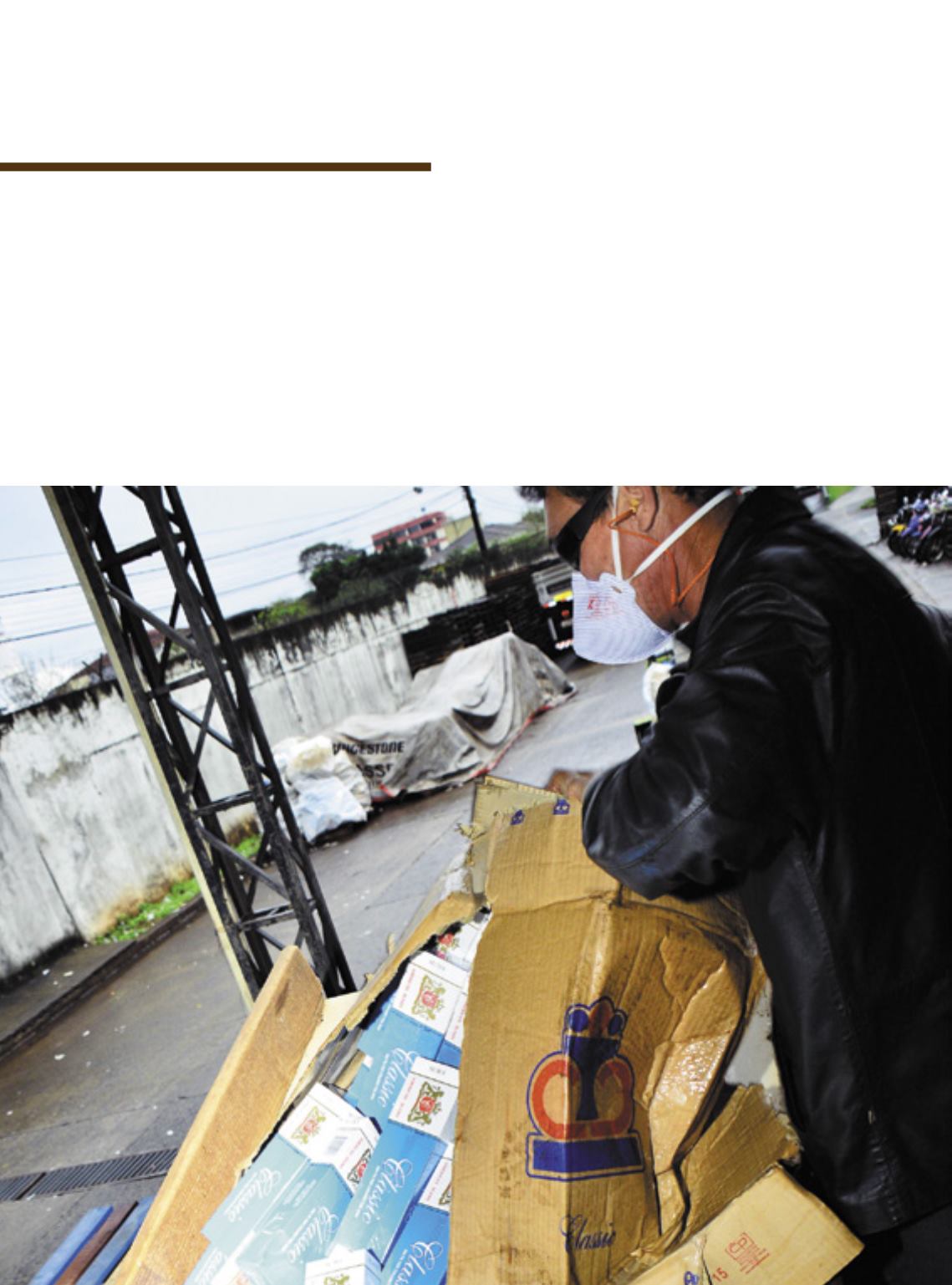

A major conclusion of the study indicates

that tax hikes pave the way for the consumption

of illicit products, especially from Paraguay, di-

rectly replacing the cigarettes legally produced

in Brazil. The difference in taxes and prices of

more than R$ 5 between national and clandes-

tine brands, is the leading factor that convinc-

es consumers to adhere to the illicit product. It

generates a phenomenon that looks like an illu-

sion: the Brazilian government announces a de-

crease in the consumption of cigarettes, but in

fact, it sweeps under the carpet the use of illicit

60