Our national sparkling is gaining mo-

mentum in the international marketplace,

but the exports of the beverage, and the

same holds true for the other items of the

Brazilian vitiviniculture chain, are still lit-

tle expressive. From 2014 to 2015, shipments

dropped in quantity and value. A total of 145

million liters were negotiated in 2015, com-

pared to 452 million in the previous year,

down 67.92%. In revenue, there was a drop

of 66.25%, from R$ 929 million to R$ 712 mil-

lion. Countries that purchased the Brazilian

beverage were Paraguay, China, Uruguay,

the United States and the United Kingdom.

On the imports side, there was a reduc-

tion in the arrivals of sparkling wines over

the past two years. According to a report

by Embrapa Grape and Wine, signed by re-

searcher Loiva Maria Ribeiro de Mello, im-

ports amounted to 4.314 million liters in

2014 and 4.105 million liters in 2015. Be-

sides the 4.92% difference in quantity, reve-

nue brought in dropped by 4.08%, following

on the heels of the wine segment. “The na-

tional economic crisis had little influence on

POST WORLD CUP EFFECT

The decrease in exports in 2015, according to Ibravin officials stems from the Post Soccer World Cup effect, held in the Country in 2014.

Choosing the sports event as the motto, a strategy was devised to leverage the wine sales abroad in 2014. “A post-sports event decline in ex-

ports was expected, mainly because the visibility of the products linked to Brazil was supposed to fade away after the global sports event”,

says president Dirceu Scottá. “The same phenomenon occurred in South Africa, the venue of the previous World Cup.” The enologist has

it that from now onward the products have to qualify even further, starting with the raw material and going through the elaboration, pro-

motion and marketing processes of the Brazilian sparkling wines and juices.

In order to achieve the desired results, the expectation is for putting into practice the Vitiviniculture Modernization Program (Modervitis), sug-

gested by the Ibravin and by Embrapa Grape andWine. Scottá regrets the fact that the initiative, signed by the federal government, is still at a fledg-

ling stage. “Through this program, it will be possible to do vineyard reconversion according to the characteristics of every different terroir, with the

aimto increase production, and equip the farmers with technology, encouraging themto stay in the countryside and derive hefty profits fromtheir

production, besides mechanisms that promote farmer loyalty to the industry, and a series of other very important factors”, he comments.

market

the amount of products brought in fromoth-

er countries, but had reflections upon aver-

age import prices”, she notes. “Imports most

likely consisted of products not highly valued

in the international market.”

The analyst emphasizes that, just like

what happens with the wines, the average

price paid for imports was higher than the

price fetched by our exports. “On average,

the Country paid US$ 7.93 and US$ 8.01 per

liter, but fetched US$ 4.66 and US$ 4.91 per

liter in the international market, in 2014 and

2015, respectively”, she clarifies. In the do-

mestic market, despite the economic crisis

and the deficient performance of the Brazil-

ian economy, sales of sparkling wines contin-

ue on the rise, and were up 16.64% in 2015.

Sales of muscatel sparkling wines were up

22.48% and sales of fine sparklings experi-

enced an increase of 14.51%.

In light of the unstable scenario in the en-

tire vitiviniculture supply chain, the Brazil-

ian Wine Institute (Ibravin) spots the great

challenge for 2016: strengthening the sector

– especially in view of the chance for weak-

er results in 2016, compared to 2015. “The

size of the crop was down 57% whilst the

tax burden got heavier, a fact that has made

our work very difficult, and some companies

had to shut down “, clarifies entity president

Dirceu Scottá. “With the Taxes over Indus-

trialized Products (IPI) at 10%, the percent-

age of taxes over a bottle exceeds 60%. In the

short and long run, our objective consists in

reducing the tax burden and demonstrate

that this could be decisive for the sector.”

Fluctuating

41

NO MUNDO

In the world

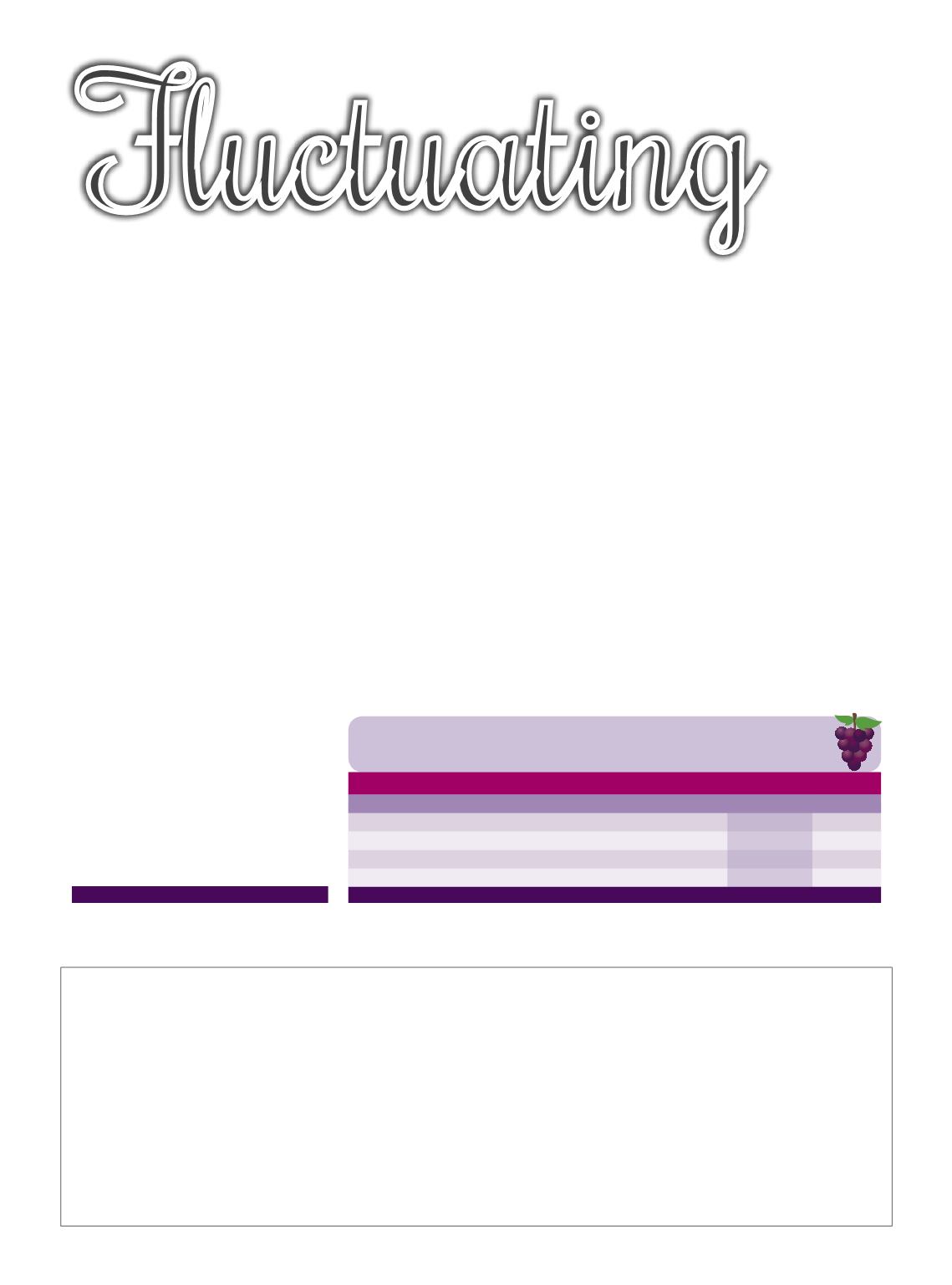

Exportações e importações nacionais – Valores em U$ 1.000,00 (FOB)

Espumantes

2013

2014

2015

Exportações

929

2.109

712

Volume (1.000 litros)

215

452

145

Importações

34.652

34.261

32.862

Volume (1.000 litros)

4.269

4.317

4.105

Fonte:

Embrapa Uva e Vinho