Sparklingwine production comes as

the apple of the supply chain’s eye and is

winningover palates at home and abroad

tion is still low in the national territory,

about two liters per person a year.

According to Dirceu Scottá, president of

the Brazilian Wine Institute (Ibravin), it is

difficult to estimate the amount of sparkling

wines produced in Brazil, as the beverage

comes from a second fermentation of wine

– the companies only declare the amount

of wine that is to be transformed into spar-

kling wine over the year. Nonetheless, with

regard to sales, the numbers indicate that

18.8 million liters were negotiated in 2015.

Compared to 2014, the enologist points to

a sales increase of 11.93%.

On the grounds of the 2015 sales, the

entity shows that, in Rio Grande do Sul

alone, 123 companies trade sparkling

wines. According to Scottá, the Brazilian

BRAZIL

SPARKLING WINES

The Brazilian sparkling wines conquer

new consumers day after day. This is attest-

ed by the soaring sales. In 2015, sales of

sparkling wines amounted to 18.8 million

liters, up nearly 12% from the same peri-

od of the previous year. To raise a toast to

this moment of consolidation of the quali-

ty and image of the beverage, the Brazilian

Wine Institute (Ibravin) launched the Bra-

zil Sparkling brand. The objective is to pro-

mote the product in an exclusive manner,

strengthening even further the identity of

the green-and-yellow sparkling. “We seek

to strengthen the position of the Brazilian

sparkling wines in the domestic scenar-

io, with the identification through a brand

that represents it at consumer level”, ex-

plains enologist Dirceu Scottá.

brands are getting more and more pop-

ular in the domestic market. Of the total

amount of sparkling wines consumed in

Brazil, 80% have national labels. In 2015,

they reached 18.7 million liters”, he says.

The quality and typicality of the beverage

have also won over the global palate. The

category was awarded upwards of 100

medals in international contests in 2015.

“Our sparkling wines boast excellent

comparison between cost and quality. It

is a relatively young product, with a high

quality standard, well accepted at home,

whilst arousing interest in the interna-

tional market for its balance between al-

cohol and natural acidity”, ponders the

Ibravin official. The sector is expecting

consumption to continue on the rise,

with the exception of 2016, where sales

are supposed to drop. “One of our objec-

tives is to reduce the seasonal rhythm of

these sales, something that has been hap-

pening, and return to the growth rhythm

that we had been experiencing before the

increase of the tax burden on Industrial-

ized Products (IPI)”, he justifies.

37

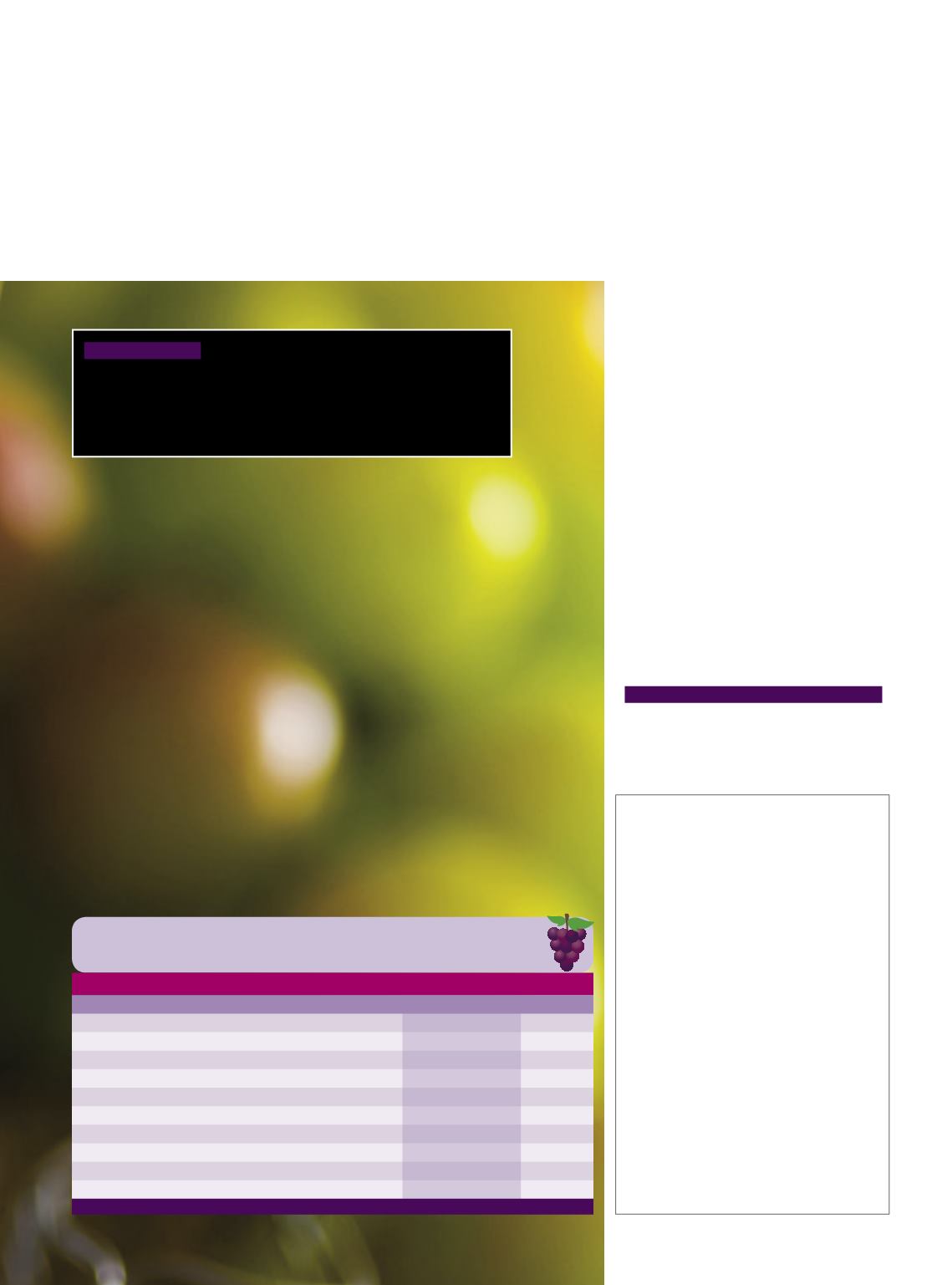

CONSUMO EM ALTA

Consumption on the rise

Comercialização de espumantes gaúchos (milhões de litros)

Fonte:

Ibravin

Ano

Espumantes

Moscateis

Total

2006

6,3

1,3

7,7

2007

7,0

1,6

8,6

2008

7,6

1,9

9,5

2009

8,7

2,5

11,2

2010

9,6

2,9

12,6

2011

10,2

3,0

13,2

2012

11,2

3,5

14,7

2013

12,1

3,7

15,8

2014

12,5

4,3

16,8

2015

13,8

5,0

18,8