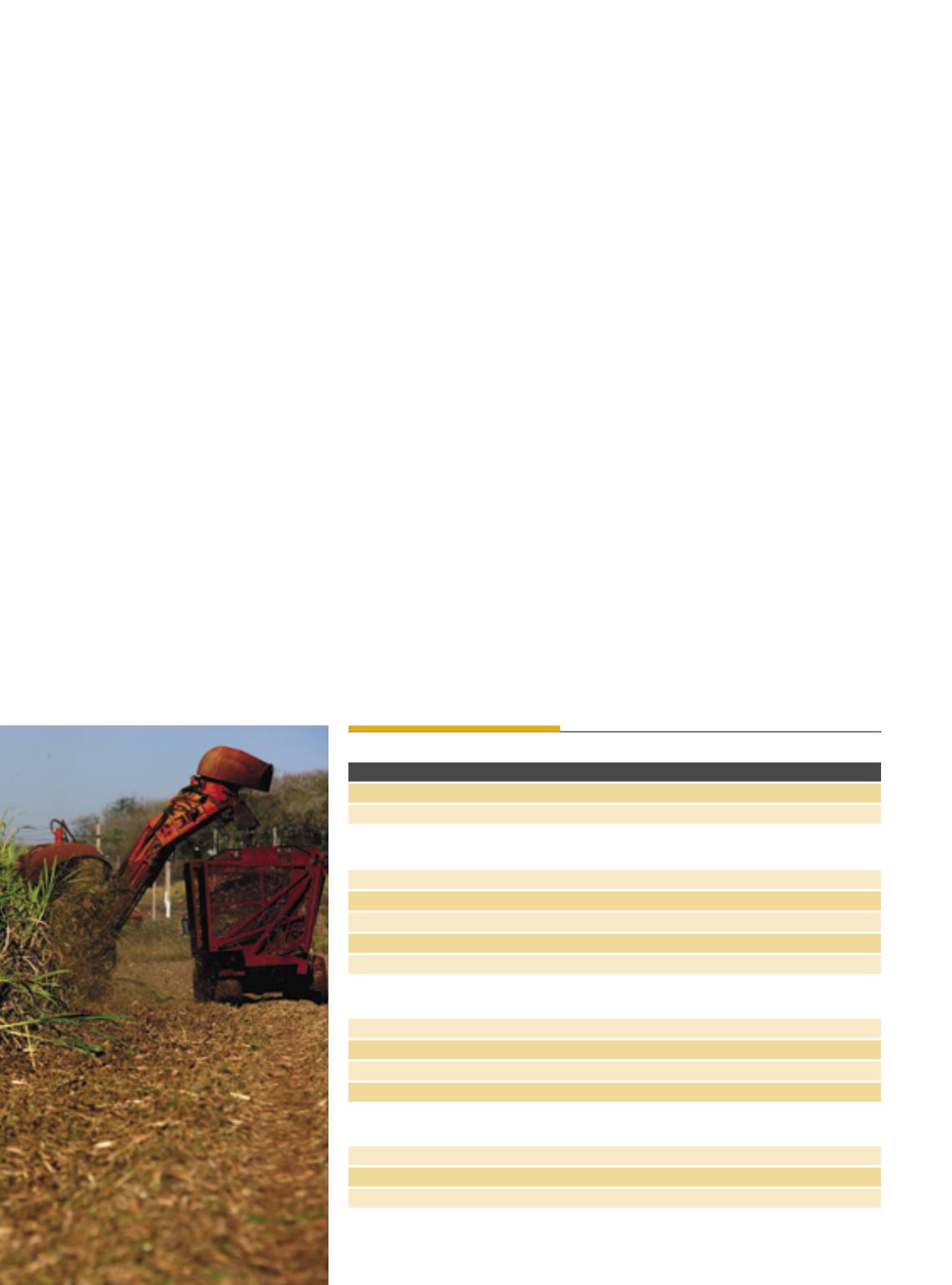

A

fter harvesting the biggest sug-

arcane area in the 2016/17

growing season, Brazil, leading

world producer, experiences a

3.4 percent drop in the 2017/18

crop year, which will equally have a propor-

tional influence on the production of the

crop. However, as far as the supply of sugar

goes, of which the Country is the leading ex-

porter, there shouldbe some increase in the

current season, but somewhat below the

value of the previous year. In themeantime,

another byproduct of sugarcane, ethanol,

though still on a downward trend, showed

some reaction in late 2017.

These numbers were released by the Na-

tional Food Supply Agency (Conab), of the

Ministry of Agriculture, Livestock and Food

Supply (Mapa), in its third sugarcane crop sur-

vey of the productive 2017/18 period (from

Smaller but

sweeter

crop

Sugarcanemilling inBrazil, biggest global producer,

should experience a reduction in the 2017/18

growing season, but destination for sugar is on the rise

April toMarch). Oneof the reasonsblamed for

thesmallerplantedareaisthefactthat“many

farmersquitplantingsugarcanebecausetheir

fields were located far away from the produc-

tion units, particularly where mechanization

isunviable”.Otherreasonsincludecompanies

thathavefiledforbankruptcy,sugarpricefluc-

tuations and previous seasons adversely af-

fectedbybadweatherconditions.

In the current season, now reaching its fi-

nal stage, climate conditions were considered

satisfactory up to early December 2017 in the

main sugarcane producing region (Center-

South),while thecrop in theNorthandNorth-

east was making a good recovery. This paved

the way for a slight increase in productivity,

around 0.2 percent, but still a long way from

the levels at the endof thepast decade. In the

evaluationof thegovernment agency, theage

ofthesugarcanefieldsmighthaveasayinthis

process,astheyhavenotbeenrenewedasex-

pectedinthepastseasons.

In the end, productionwould be reduced

by 3.3 percent , mainly due to the smaller

area harvested in the main sugarcane pro-

ducing states (São Paulo, Goiás and Minas

Gerais), according to a survey conducted by

Conab officials. Anyway, it registered a 12.8

percent increase in planted area, giving rise

to future perspectives. Still about the har-

vest in the biggest producing region, Center-

South, the Brazilian Sugarcane Industry As-

sociation (Unica), in December, confirmed

the2.33percentreductionintheworksofthe

mills, fromfirst April to first December 2017.

With regard to the main sugarcane by-

products, the estimates from the two sourc-

es were positive for the production of sugar

in the season, in linewithwhat happened in

the previous season. “The price of the prod-

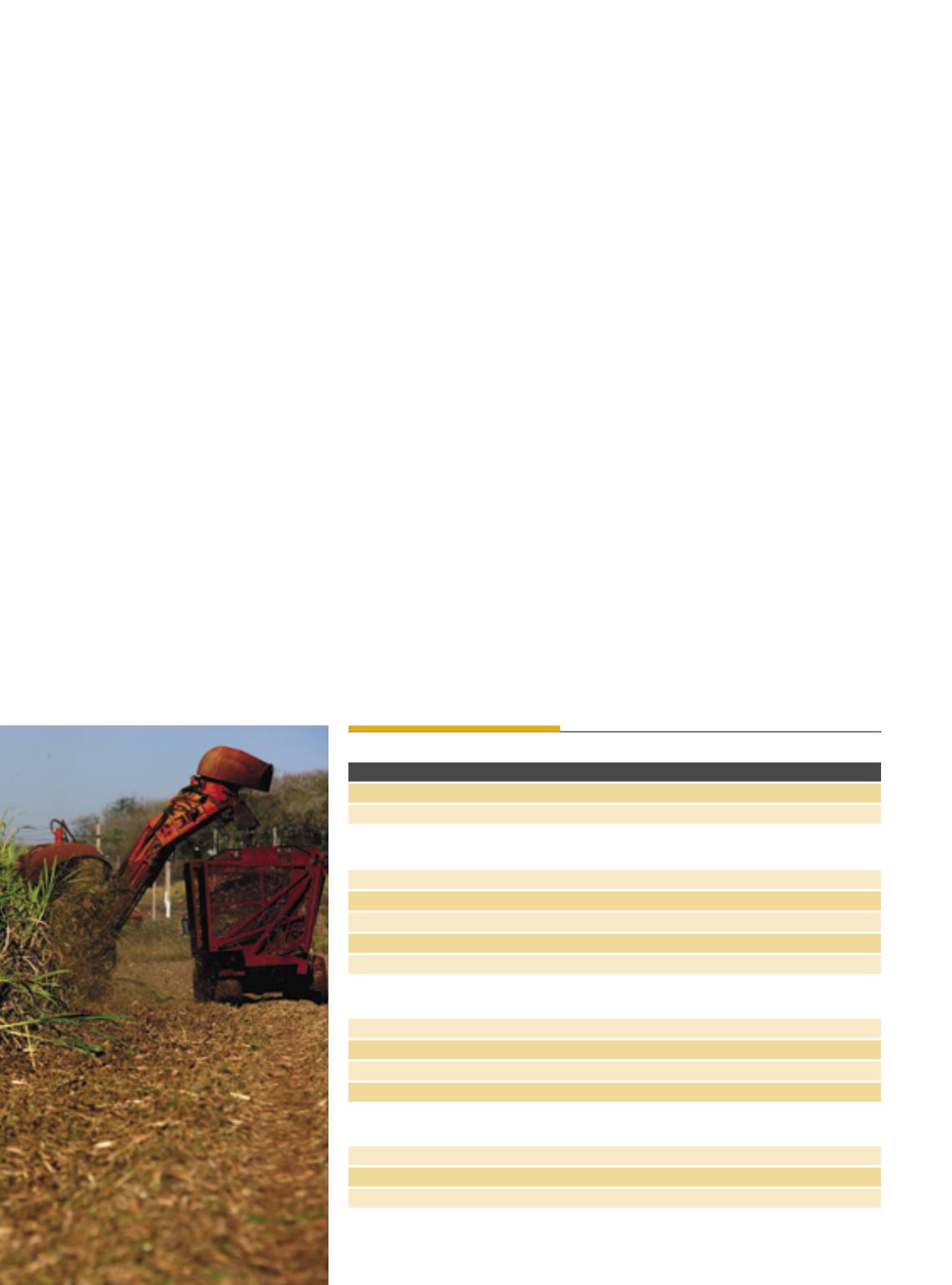

OPAÍSDACANA-DE-AÇÚCAR •

SUGARCANE COUNTRY

Safras

Área (mil ha) Produtividade (kg/ha)

Produção (mil t)

2016/17

9.049,2

72.623

657.184,0

2017/18

8.738,6

72.734

635.595,7

Estados (Safra 2017/18 com%de variaçãoemrelaçãoà 2016/17)

SãoPaulo

4.553,6 (-4,6)

76.204 (-1,7)

346.999,9 (-6,2)

Goiás

919,3 (-4,5)

76.184 (+8,4)

70.036,3 (+3,6)

Minas Gerais

818,1 (-4,1)

79.006 (+5,9)

64.634,6 (+1,5)

MatoGrosso Sul

665,4 (+7,5)

74.835 (-7,9)

49.794,3 (-1,0)

Paraná

597,3 (-3,3)

63.518 (-7,1)

37.938,8 (-10,1)

Aproduçãodeaçúcarbrasileiro (emmil toneladas)

Safras

2016/17

2017/18

%

País

38.691,1

39.461,4

+2,0

Centro-Sul

35.584,5

36.436,5

+2,4

Norte-Nordeste

3.106,6

3.024,8

-2,6

Aproduçãode etanoldecana (emmil litros)

Total

27.807.523,0

27.047.512,4

-2,7

Hidratado

16.734.678,0

15.871.598,4

-5,2

Anidro

11.072.845,0

11.175.914,0

+0,9

Fonte:Conab,estimativadedezembrode2017.

Sílvio Ávila

36