l

OFFSHORE MARKET

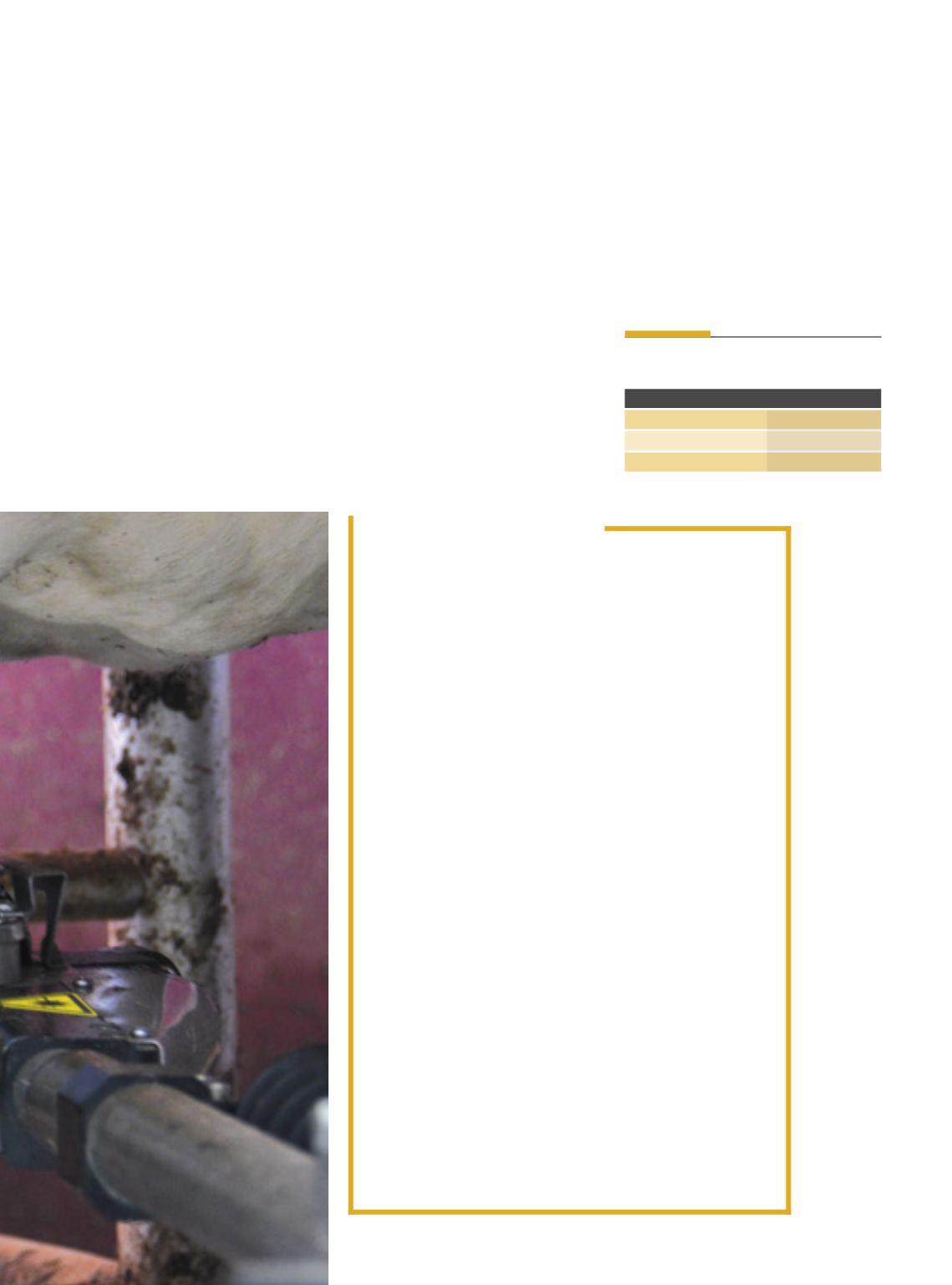

In the sense of trade surveillance, CNA officials emphasized initia-

tives in 2017, besides debates on milk qualitative questions, in light

of regulation changes that will occur in 2018. The Country is interest-

ed in diminishing imports and expanding exports, a fact that has not

yet reached the desired goal. In the year in question, imports were re-

duced (29.5percent in volume and11.1percent in value, up toNovem-

ber, with 157.3 thousand tons and US$ 516.8 million), but shipments

abroad equally dropped (by 28.3% and 33.8%, respectively, to 33.8

thousand tons andUS$ 95.7million), still representing high deficit.

The purpose of expanding the foreign trade of our dairy prod-

ucts is manifested by several public and private organisms linked to

the segment. Upon taking up another term as president of the Rio

GrandedoSul DairyProducts IndustryUnion (Sindilat/RS), inDecem-

ber 2017, Alexandre Guerra, for example, said that the target for the

next three years is to prepare the industries for making exports pos-

sible, achieving 10 percent of the state production with this destina-

tion. He maintained that there are upwards of 30 countries in a posi-

tion to import dairyproducts fromBrazil, “apotential tobe explored”.

On the other hand, hementioned expectations for recovering the do-

mesticmarket, in light of a possible economic recovery.

This same perspective was expressed by CNA officials, to face the

lowprices, while, in themeantime, there is still concern about high-

er production costs, now surfacing, by virtue of the higher value

used in the manufacture of livestock feed. This production cost was

reduced by 2 percent a year, from 2010 to 2017 (in 2016, there were

a total of 19.6million head), whilst productivity went up 4 percent a

year. In the meantime, Cepea sources observed that, in light of the

recent drop in revenue, many farmers quit the activity and others

will refrain from making relevant investments, which could lead to

smaller supplies of the product in 2018.

In 2015 and in 2016, according to the

Brazilian Institute of Geography and Sta-

tistics (IBGE), production was down 1.6%

and 2.8% respectively, and in the past year,

with an improvement in the exchange rela-

tion betweenmilk and input prices, produc-

tion volumes soared again, according to Ce-

pea sources. In November 2017, analysts

Natália Grigol and Lucas Ribeiro, Cepea of-

ficials, , based on higher industry purchases

(3.7% in the first half of the year, according

IBGE surveys relative to production under

inspection, and 7.5 percent until Septem-

ber, according to Cepea rates), counted on

the chance for the year to come to a close

with a 4-percent increase. Therefore, the to-

tal could amount to nearly 35 billion liters.

At the National Food Supply Agency

(Conab), analyst Maria Helena Fagundes,

in turn, foresaw in September that there

would be an increase of 1 percent, leading

toafinalannualamountofaround34billion

liters. She considers that a bigger increase

would be limited by the smaller prices in

force since July, higher stocks and lingering

recovery of the economy, nowaffecting de-

mand. This problem is also highlighted in

an analysis by the Brazilian Confederation

of Agriculture and Livestock (CNA), observ-

ing that consumption has not yet react-

ed, and Cepea technicians, upon inform-

ing that apparent per capita consumption

of dairy products has already dropped 2.2

percent from2013 to 2016.

“Declining demand, stemming from

the falling purchasing power of the Brazil-

ian people in light of the economic down-

turn, has been knocking down the prices

in all the links of the supply chain and jeop-

ardizing the profit margins, at industry and

farmer level”, concluded Natália and Lucas,

fromCepea, in November 2017. That is why

they reinforced the need to encourage con-

sumption and implement measures that

correspond to the importance of the sector,

which brought in R$ 39 billion to the farm-

ers in 2016. Theymentioned an end to pow-

der milk imports from Uruguay, afterwards

reversed, besides the liberation of resourc-

es formilk stocks and the evaluationofmin-

imum price mechanisms, recovery of credit

lines and import quotas fromUruguay.

VIA LÁCTEA •

MILKYWAY

Produçãode leitenoBrasil

Ano

Mil litros

2014

35.174.271

2015

34.609.588

2016

33.624.653

Fonte: IBGE.

61