Stability as an

input

Segment projects 2018without big

growth alterations due to the political

scenario, to the high stocks and illicit trade

S

oybean reigns supreme in the

sales of products for vegetable

surveillance in Brazil. The crop

represents about 55.7%of all fun-

gicide, insecticide and herbicide

sales andother chemical products of the kind

utilizedfortheprotectionofplants.Cornranks

second, with 10.4%, including both summer

andwinter crops, followedby sugarcane,with

9.6%. In spite of the good performance of the

crop in the past years, the pesticide market

continuesstablethroughouttheCountry.

The distance between higher production

volumes and the sales of vegetable protec-

tionchemicalsstemsfromtwomajorreasons,

according to the executive director of the Na-

tional Union of the Vegetable Protection In-

dustry (Sindiveg), Sílvia Fognani. “As a result

of the economic downturn,many farmers de-

cided to lower their stocks. That is to say, they

refrained from buying the product. Another

topic is the illicit trade, which encompasses a

considerable chunk of the trade in the nation-

alterritory,withproductscomingmainlyfrom

Bolivia, ParaguayandUruguay”,shestresses.

For 2018, besides these two factors, Fog-

nani believes that two other elements will

have a say for the development of the sector:

China’s decision to shut down some factories

and the period of elections, facts that always

give rise to uncertainties. “In election years,

normally there ismuch concern about the fu-

ture. It is normal. We’ve got to be prepared.

With regard to China, the question is more

complexandaffectsourmarketstrongly.“,she

comments, insisting on the fact that since the

beginning of the year, hundreds of factories

were shut down in three Chinese provinces,

Hebei, Henan and Shandong. As a result, ac-

cording to Sindiveg officials, the volume and

costsoftheproductsimportedbyBrazilforthe

agricultural pesticide sector will suffer an im-

pact,generatingconsequencesforthefarmers

inthefinalvalueofthesales.

As far as fertilizers go, the performance

is similar. From January to November 2017,

some 32.08 million tons of the product were

brought into Brazil, according to the Nation-

al Fertilizer Association (Anda), up 2.1 percent

from the previous year. With regard to nutri-

ents, thedeliveryof nitrogen fertilizers (N)was

down 3.8% in the first 11 months of the year,

amounting to 3.7 million tons, a reflection of

the supply inadvance for thewinter corncrop

in late 2016, and a drop in supply for wheat

andsummercorncrop.

Phosphate fertilizer (P2O5) sales were up

1.4 percent over the same period, amounting

to 4.76 million tons, mainly destined for soy-

bean and cotton crops. Potassium fertilizers

(K2O) saleswere up 1.8 percent, reversing the

drop registered up to the end of September.

TheStateofMatoGrossoconcentratedthebig-

gest volume of deliveries fromJanuary toNo-

vember 2017, with 6.276million tons (19.5%),

followed by Rio Grande do Sul, with 4.06 mil-

lion (12.7%). São Paulo, with 3.98 million,

rankedasthirdbiggestconsumer(12.4%).

FOMENTO •

FOSTERING

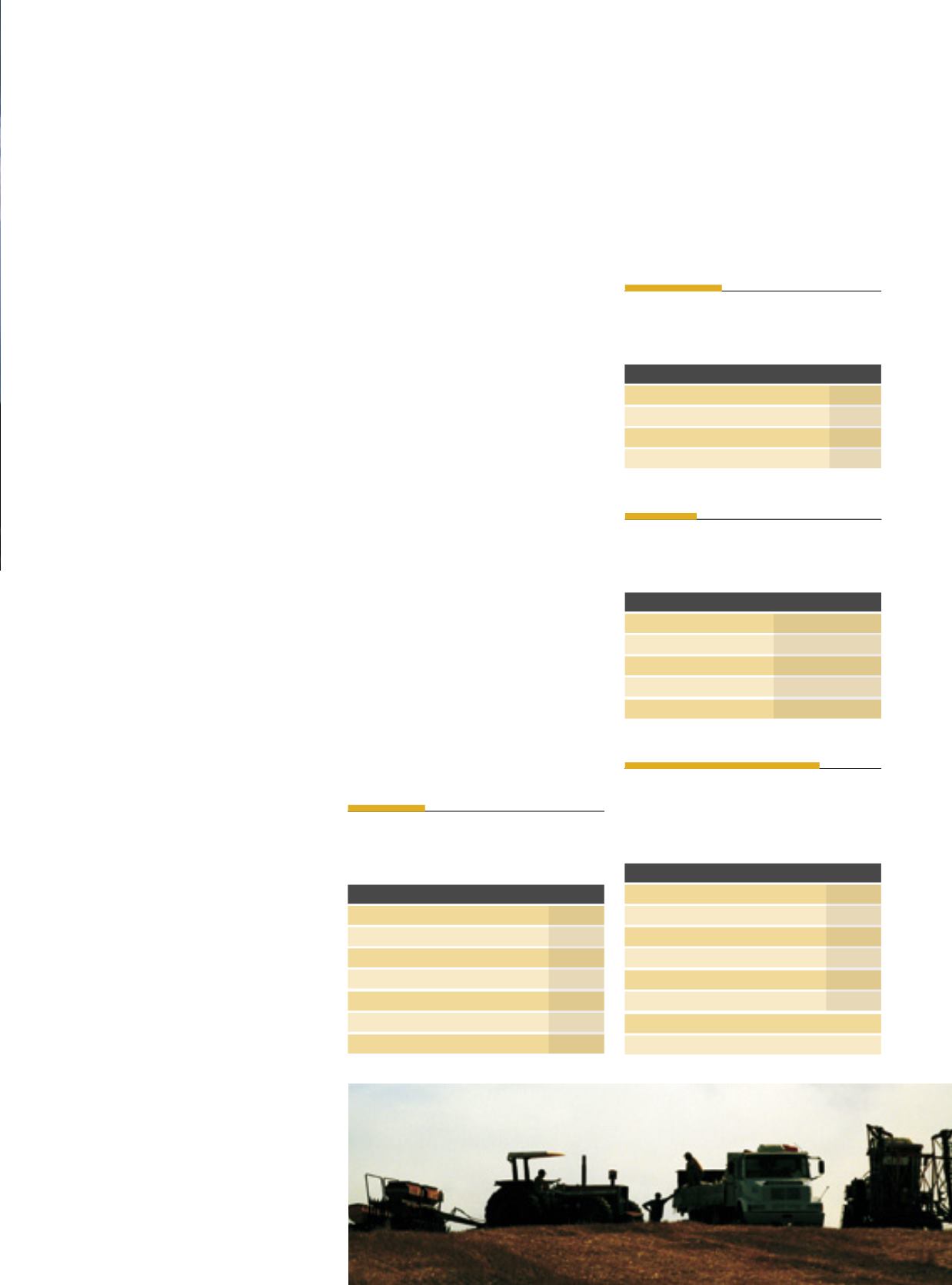

As principais vendas

dedefensivos porcultura:

Cultura

%

Soja

55,7%

Cana-de-açúcar

9,6%

Milho Safrinha

7,3%

Algodão

4,8%

Milho Safra

3,1%

Café

2,5%

Pastagem

2,4%

Fonte:Sindiveg.

OESTADODODEFENSIVO

•

STATE LEADER INPESTICIDES

As principais vendasde

defensivos por Estado

Estado

%

MatoGrosso

20,4%

SãoPaulo

13,9%

Paraná

13,6%

RioGrande do Sul

13,2%

Goiás

9,6%

Minas Gerais

8,3%

MatoGrossodo Sul

6,0%

Bahia

4,6%

Fonte:Sindiveg.

CATEGORIAS •

CATEGORY

As principais vendasde

defensivos porclasse

Defensivo

%

Fungicidas Aplicação Foliar

32,4%

Inseticidas Aplicação Foliar

24,1%

Herbicidas Seletivos

17,1%

Herbicidas Não-Seletivos

15,4%

Fonte:Sindiveg

DE VALOR •

VALUE

Mercadodedefensivos

agrícolasnoBrasil

Ano

Valor (bilhões)

2013

US$ 11,45

2014

US$ 12,25

2015

US$ 9,6

2016

US$ 9,56

2017

US$ 8,8*

*Estimativa - Fonte:Sindiveg.

67