l

US$ 19BILLION INTHE SUPPLYCHAIN

CNA, Jointly with the Brazilian Seed and Seedling Trade Association

(Abcsem), in late 2017, came upwith a study that consisted in “Mapping

and Quantifying the Vegetable Supply Chain”, which ascertained a total

financial movement of US$ 19 billion in the segment, based on data re-

leased in 2017 relative to 13 crops (considering the separation of table

and industrial tomatoes). Of this total, US$ 3.21 billion corresponded to

input, machinery and equipment companies, US$ 5.1 billion to produc-

tionandUS$10.5billion to industry,wholesaleand retail sales.

The survey of the sector also ascertained the Domestic Gross Prod-

uct (GDP) of US$ 5.3 billion, taxes of US$ 2 billion and salaries of US$

892.4million. Theproductionof the13 surveyed items in2016 reached

16.7 million tons grown in 537 thousand hectares, while the latest of-

ficial information, relative to 2015, furnished by Embrapa Vegetables,

with data related to 32 products, coming from the IBGE and the Food

and Agriculture Organization of the United Nations (FAO), indicated a

harvested volume of 17.9million tons, in 752 thousand hectares.

Thefinancialmovementstemmingfromthe13products,specifical-

lyintheDistributionCenters(Ceasas)throughouttheCountry,reached

US$ 2 billion. Prices fetched, according to the survey, increased by 80

percent over the past five years, while the volumes soldwent up 5 Per-

cent. As for the foreignmarket, a historical series from2007 to 2016 re-

vealedthatexportsregisteredadropfromUS$47milliontoUS$23mil-

lion, while imports soared about 200 percent, toUS$ 820million. “This

trend shows that there still exist great opportunities in the internation-

al marketplace for Brazilian vegetables”, the study concludes.

a 5-percent drop, including lettuce.

This crop, in principle, would not suffer a

reduction in area in the summer and excep-

tions would include the segments for the po-

tatoand tomato industry,whichwereona ris-

ing trend. Not by chance, the most imported

items in the sector include tomato pulp and

pre-fried potatoes, while some time ago, a

big processing plant of these items started

operating in the Country. In the meantime,

the Brazilian Institute of Geography and Sta-

tistics (IBGE), in its systematic Survey of Agri-

culturalProduction(LSPA,ofNovember2017),

detected an annual growth in the area devot-

edtopotatoes(5%)andevenintheonionarea

(1%), but Cepea officials identified a 7.5-per-

cent drop in this produce, “reflection of the

lowpricesinthesecondhalfof2016andinthe

2016/17growingseason,intheSouth”.

For 2018, according toCepea perspectives

the reduction in planted area would reflect in

betterfinancialresultsforthefarmers,besides

strides in consumption stemming from the

more positive economic scenario, despite a

limitation in the still high unemployment rate

andlowgrowth.Ontheotherhand,theBrazil-

ianConfederationofAgricultureandLivestock

(CNA) considered that the difficulties of 2017

didnot discourage the farmers,whohadeven

celebrated higher profits from management

improvements and new technologies, like

protectedcultivationand ferti-irrigation,while

for 2018 they spotted restrictions in invest-

ments in light of the uncertainties, but supply

stagnation and possible higher consumption

couldsignalbetterprices.

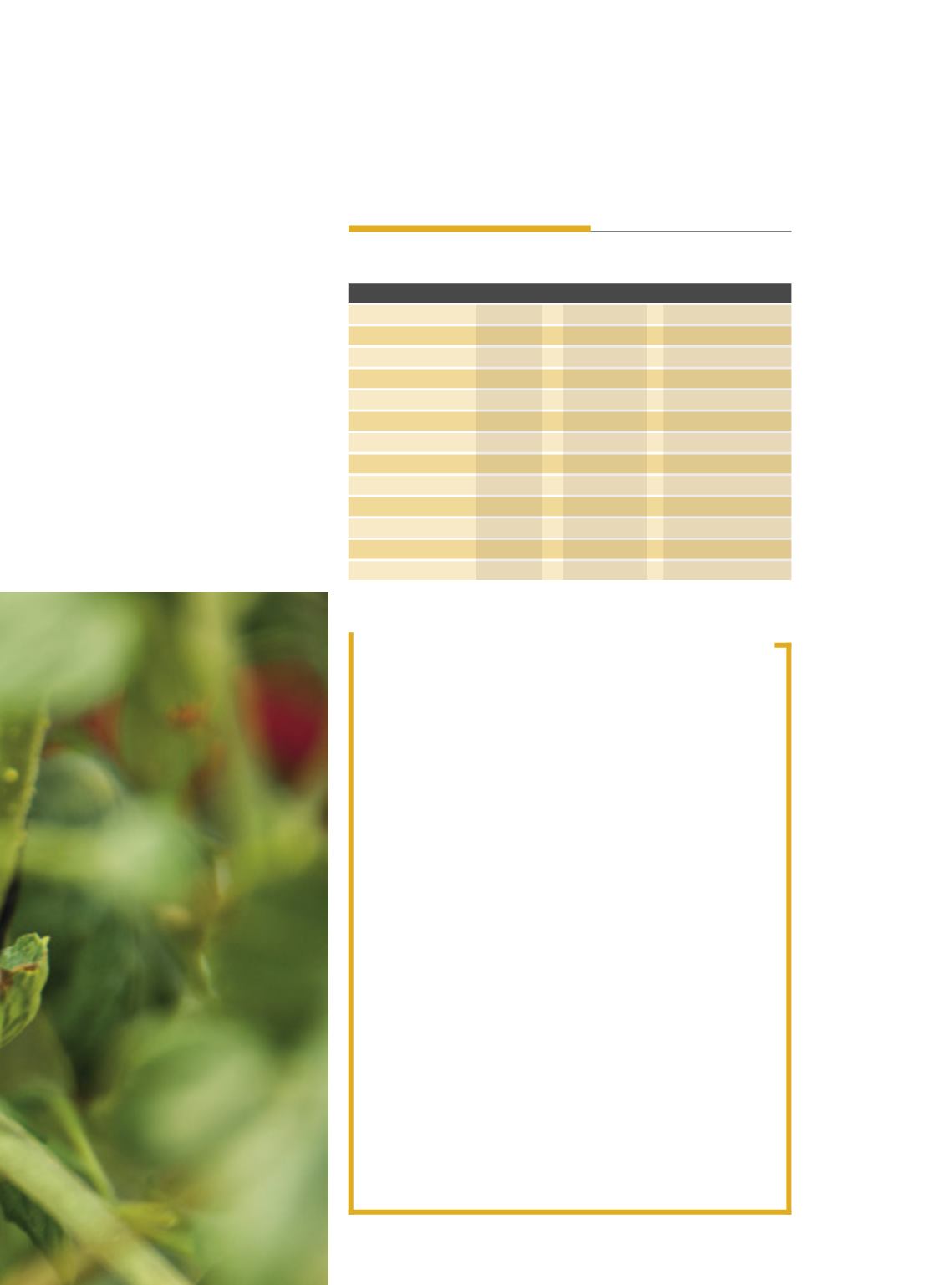

MAPEAMENTODASHORTALIÇAS •

VEGETABLEMAP

Levantamentoda situaçãode 13 culturas em2016

Produtos

Área (ha)

Produção (t) Valor (US$milhões)

Batata

134.243

3.934.288

1.607,63

Tomate demesa

18.814

1.538.070

684,18

Tomate indústria

46.448

3.803.167

196,72

Coentro

73.938

1.109.063

575,88

Cebola

42.458

1.578.554

482,64

Alho

11.334

133.217

390,94

Alface

91.172

1.701.872

384,63

Pimentão

11.188

554.904

201,55

Cenoura

22.254

752.196

175,51

Abóbora cabotiá

42.538

680.613

164,29

Abobrinha

20.904

376.268

103,80

Couve-flor

11.079

329.047

61,46

Beterraba

10.938

218.765

54,82

Fonte:CNA/Abcsem,dezembrode2017.

65