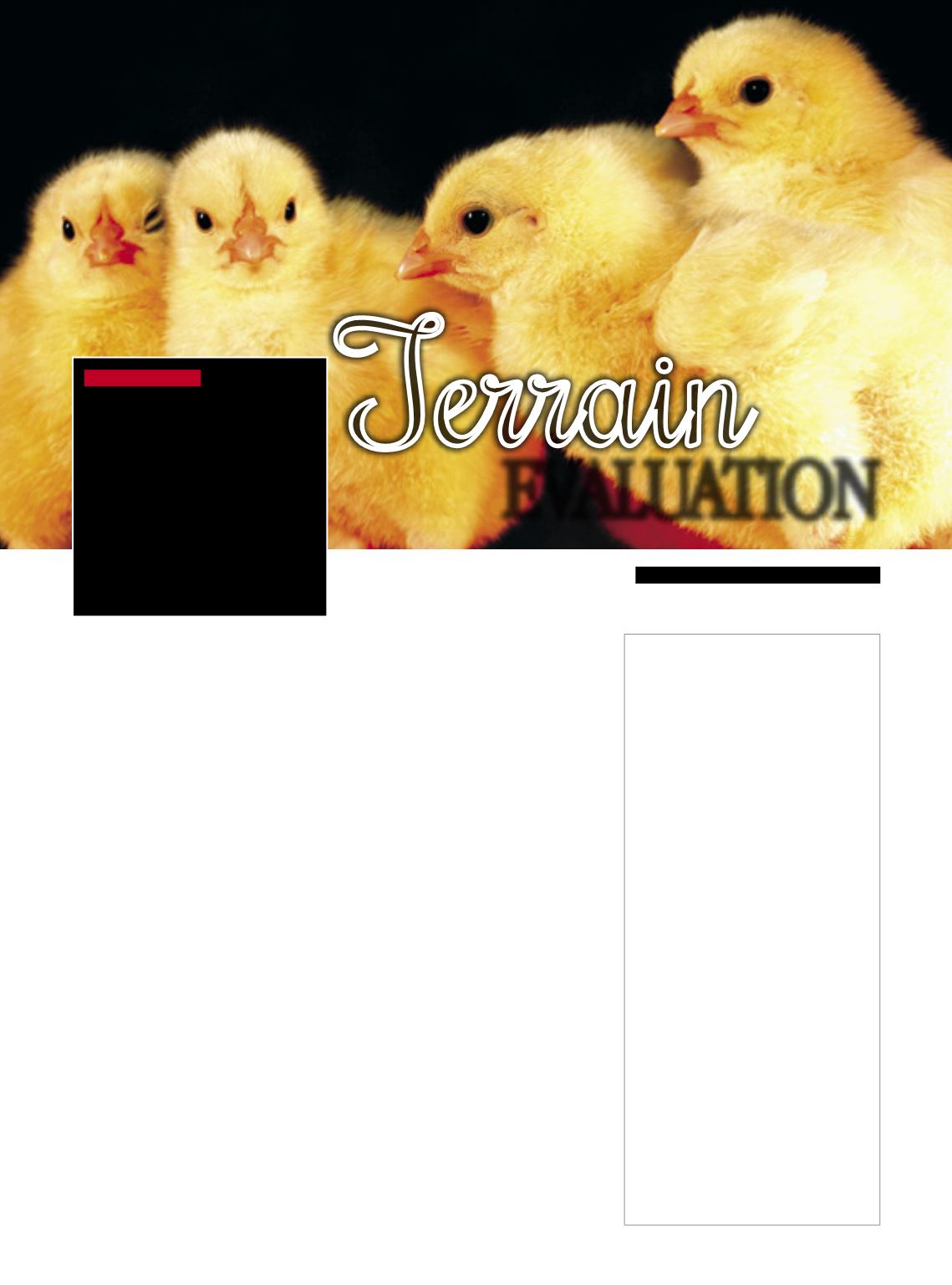

Youngmeat chicken

confinementwas

forced to redefine

its course in 2016, and

the blame goes to the

higher production

cost anddrop in

consumption

Terrain

evaluation

After periods marked by stability in the

production scenarios and meat chicken mar-

ket, during which the sector was making bold

strides, 2016 threw cold water on the busi-

nesses. The national unstable economic activi-

ty, whose backdrop was political turbulence, in

the second half of the year cast direct reverbera-

tions on the activity.

Substantial increases to the production

costs, particularly feed costs, basis of the food

supply chain, on account of the high prices of

corn and soybean, as well as the drop in con-

sumption, in light of the fading purchasing

power of the population, had reflections on

young meat chicken confinements, first ther-

mometer pointing to what is in store for the fu-

ture, in a matter of some weeks, with regard to

chicken slaughter. The president of the Brazil-

ianAssociationofMeatChickenBreeders(Apin-

co),JoséFlávioNevesMohallem, saysthat inthe

caseoffeed,thehighercostenduredbythesup-

ply chain ranges at about 20%. “This is what the

producers were not able to pass on to the final

consumers”, he emphasizes. According to him,

as the domesticmarket was signaling recession,

consuming less, if the sector ended up passing

on to the finished product the higher produc-

tion cost stemming from the price of feed, this

wouldmean the inhibition of themarket.

This context of high foodprices of the flocks

and the drop in domestic consumption was

made even worse by the oscillations of the ex-

change rate. With the dollar highly appreciat-

ed, revenue from abroad, in light of the good

numbers related to chicken meat exports over

the first half of 2016, ended up by providing

the companies with the capacity to counterbal-

ance the losses to a certain extent. However, as

the dollar began to recede in value, businesses

with the foreign buyers were affected, especial-

ly in June and July, at the turn of the first to the

secondhalf of the year, when shipments abroad

began to drop.

Mohallem mentions that in a comparison

between the first half of 2016 and 2015, in the

businesses of the sector, there was a 3-percent

increase in production, attesting that the sup-

ply chainwasworkingwithpositive and reliable

projections. However, in September 2016, lat-

est parameter availableuntil theendofOctober,

the two periods, 2015 and 2016, had already

reached a tie. “In the last months in 2016 the

trend points to a drop, with the year coming to

a close, in our projection, with a 5-percent de-

crease”, he notes.

DISARTICULATION

The president of the Apinco, José Flávio

Neves Mohallem, maintains that the dwin-

dling scenario is macro in all Brazilian re-

gions. In the case of chicken confinement,

should there be a reversal in market expec-

tation, the reaction of the sector should

never be instantaneous. “When we have

a number of broodstock chickens in pro-

duction, there is need to keep them for 18

months, and a change in the plans can only

occur after this period”, he explains. Even

at slaughter, when a company’s structure

is in operation, changes in the course im-

ply in immediate costs, particularly when

it comes to readjusting the use of the in-

stalled capacity, whether in equipment or

in labor.

The taskof the segment as awhole, from

the area of the production of meat chickens

to slaughter, it is fine adjustment to demand,

looking attentively to 2017. “The expectation

is still positive”, Mohallem confirms. He re-

calls that the political scenario is no longer

thatturbulent,andthattheforeignclientsare

confident and loyal to Brazil. “Let us now see

how the exchange rate will act over the prof-

itsandmarginsofthesector“,hecomments.

Sílvio Ávila

41